For years, Indonesian tech giant GoTo was bleeding cash from its e-commerce arm, Tokopedia, while ceding market share to fierce rival Shopee.

But TikTok’s $1.8 billion investment into Tokopedia a year ago, in exchange for a 75% controlling stake, has been a gamechanger. Not just for Tokopedia, but for GoTo as well, says its group CEO Patrick Walujo.

“[Shopee] is still bigger than us, but all the fundamental problems that we saw on our e-commerce platform are now fixed,” Walujo said at the recent Indonesia PE-VC Summit 2025 in Jakarta.

So how did the TikTok deal turn things around? For a start, reducing its exposure to cash-burning Tokopedia allowed GoTo to concentrate its firepower on other, more lucrative, segments, such as fintech.

And growing those fintech services within GoTo’s diverse ecosystem – which includes ride-hailing, food delivery, and e-commerce – has meant better prices for customers, while allowing the tech giant to manage risk more effectively.

It’s all handed GoTo a real advantage over rivals, including standalone fintech apps, GoTo’s Walujo reckons.

Read more: How Gojek co-founder Kevin Aluwi would do it today

Fintech is on the up

Fintech’s a hot proposition in Southeast Asia, where many people still lack access to traditional banking institutions.

How hot exactly? Fintech revenues in the region are expected to grow a whopping 32% this year, with digital lending contributing 2/3 of the business, according to a research report by Maybank Investment Banking Group.

And that’s shaping up as a key growth driver for the region’s tech giants – think names like GoTo, Grab, and Shopee’s parent Sea Group.

As for GoTo, investors are clearly liking what they see in its alliance with TikTok, which has brought both financial backing and strategic guidance to the table.

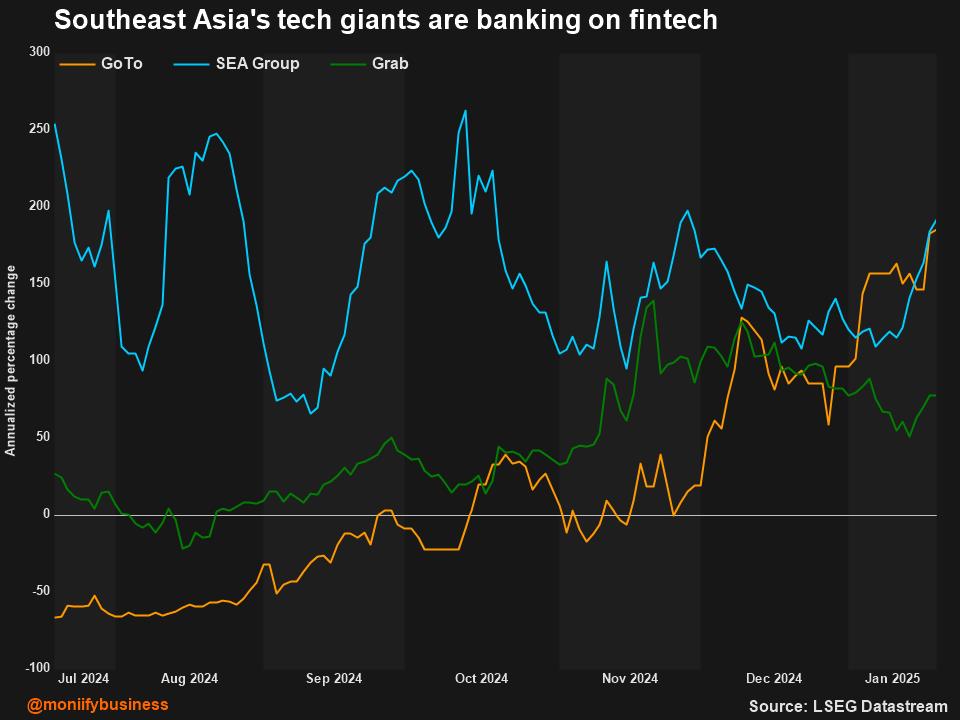

While GoTo’s shares haven’t yet returned to their June 2022 highs, their 60% increase over the past six months shows that investors feel the company’s turned a corner.

Read more: No Tyme to lose for Southeast Asia’s new fintech unicorn

Analysts have picked up on the vibe-shift, too. Malaysia’s largest bank, Maybank, has named GoTo as one of its top picks in the tech sector.

Meanwhile, Jeffrey Bahar, COO of Yamada Consulting & Spire, tells MONIIFY that GoTo is well-positioned to develop its lending services, in particular. Now that its digital payment service is putting up sizeable customer and transaction volumes, the time’s right for the company to focus on lending services while it has a head start, he says.

As for those other big regional tech names? They’re delivering serious returns as well.

Singapore’s Grab, which last year launched a digital bank in Indonesia called Superbank, saw its stock surge 44% in the past year.

Meanwhile Sea Group – the parent company of Tokopedia’s rival Shopee, which also offers an array of fintech services – has seen its stock leap more than 212% over the same period.

How do you MONIIFY this?

So which of these big names is looking the most attractive?

GoTo is more expensive than Sea and Grab. The stock trades at 5.8 times forward sales, a slight premium to Grab and a whopping 75% pricier than Sea, according to LSEG data.

Also: GoTo’s not yet profitable, with analysts expecting it to post a profit in 2026 or 2027. Grab is almost back to black, while Sea has been there since 2023.

When you factor in their projected revenue growth for the next couple of years – +12% and +16.5% for GoTo, +20% and +17% for Grab, and +22% and +16% for Sea – then Sea looks to have a slight edge, followed by Grab. They’re all looking like sound bets, though.

Read more: Indonesian OG Bukalapak signals defeat in turf war with likes of Shopee

What’s next?

Looking ahead, GoTo’s priority will be a laser-focus on profitability in Indonesia and Singapore, following its withdrawal from Vietnam last year, and from Thailand in 2021.

Rather than stretching its resources across markets with intense competition, the firm chose instead to strengthen its core base, allocating most resources to areas that can significantly impact products, customer experience, and overall results, says Walujo.

The company’s shown it has what it takes to successfully rethink its strategy and deliver. If its momentum of the past year is anything to go by, expect more big things to come.

Edited by Victor Loh and Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com