Vietnam is racing to modernize its manufacturing sector, and Vingroup, the country’s chaebol, wants a slice. In just two months, it’s launched two robotics subsidiaries, signaling big ambitions in this high-tech space.

Vingroup has committed 1 trillion Vietnamese dong ($39 million) each to VinMotion and VinRobotics. Launched in January, VinMotion will focus on general-purpose humanoid robots, while VinRobotics, introduced in November, will specialize in industrial robots.

Ownership is tightly held. Vingroup will control 51% of VinMotion, while chairman Pham Nhat Vuong, Vietnam’s richest man, owns 39%. His two sons share the remaining 10% evenly, according to local reports.

Vingroup did not respond to MONIIFY’s queries at the time of publication.

Read more: VinFast’s Indonesian bet: Will it charge ahead or stall?

Vinning timing

The robotics foray is well-timed.

As demand for precision and efficiency in manufacturing grows, Vietnam — bordering China and a rising Southeast Asian manufacturing hub — is capitalizing on companies shifting operations away from China amid the threat of Trump’s tariffs.

In 2023 alone, Vietnam saw 12,000 new robots installed, with $860 million poured into robotics technology by companies, says Ken Research.

To put that into context, revenue in the global industrial robotics market is projected to reach $10.22 billion in 2025.

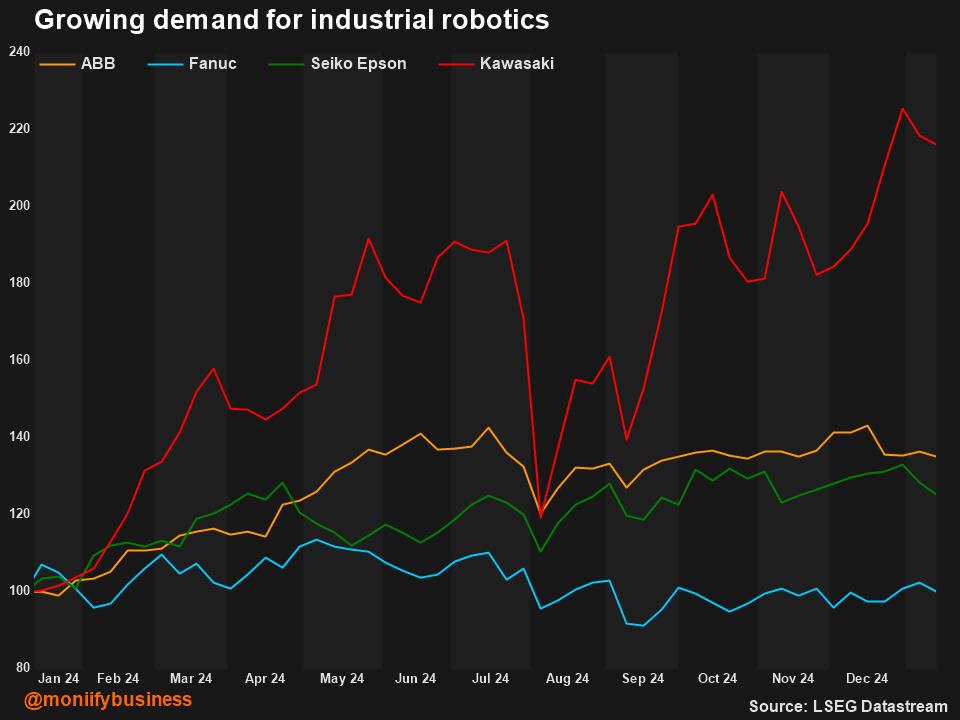

But it’s a crowded field. Global giants like ABB (Sweden-Switzerland), Fanuc, Epson, and Kawasaki (Japan) dominate industrial robotics. While Fanuc has been cautious due to softening demand in China, most of these companies have enjoyed a solid year.

Morningstar, in an analyst note, said that Fanuc’s shares are undervalued and there are “plenty of spaces for robot products to grow in key markets.” Even Nvidia’s Jensen Huang thinks robots are the next big thing too.

Investors looking to bet on the robotics boom can explore ETFs like ROBO Global Robotics and Automation Index ETF, BOTZ Global X Robotics & AI Thematic ETF, or iShares Automation & Robotics ETF — all up over the past year.

Read more: Want to invest in AI startups at a bargain? Head to Southeast Asia

A better strategy

This isn’t Vingroup’s first tech rodeo, and it isn’t just building robots — it’s laying the groundwork for a future where it blends robotics, AI, and EVs into a seamless ecosystem.

Last December, it sold its AI healthcare subsidiary VinBrain to US chip titan Nvidia. But its portfolio also includes:

- VinAI, a generative AI leader behind PhoGPT (Vietnamese language model) and MirrorSense, which adjusts mirrors automatically in VinFast EVs.

- VinBigData, creating voice assistants deeply integrated into Vingroup’s ecosystem.

- VinHitech, pushing other tech innovations.

In October, it also launched a $150 million venture fund targeting startups in AI, semiconductors, and cloud computing.

The group, which began as a food business in Ukraine, is clearly following the playbook of global leaders like Tesla and BYD by fusing robotics, AI, and EV technologies.

It’s an approach that will strengthen its position, says Kengo Kurokawa, CEO of research firm Asia Plus.

Edited by Victor Loh. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com