Vietnam’s Vingroup isn’t tiptoeing around Indonesia’s EV market — it’s stomping in, armed with a fleet of 10,000 VinFast electric taxis and 100,000 charging networks. Forget the usual car dealership playbook, the Vietnamese chaebol is going all in.

But Indonesia’s not going to be an easy win. It’s going to be costly to fight, not only with other chaebols like Hyundai, but also Indonesia’s biggest taxi operator Blue Bird and ride-hailing giants Grab and GoJek.

The Jakarta gambit

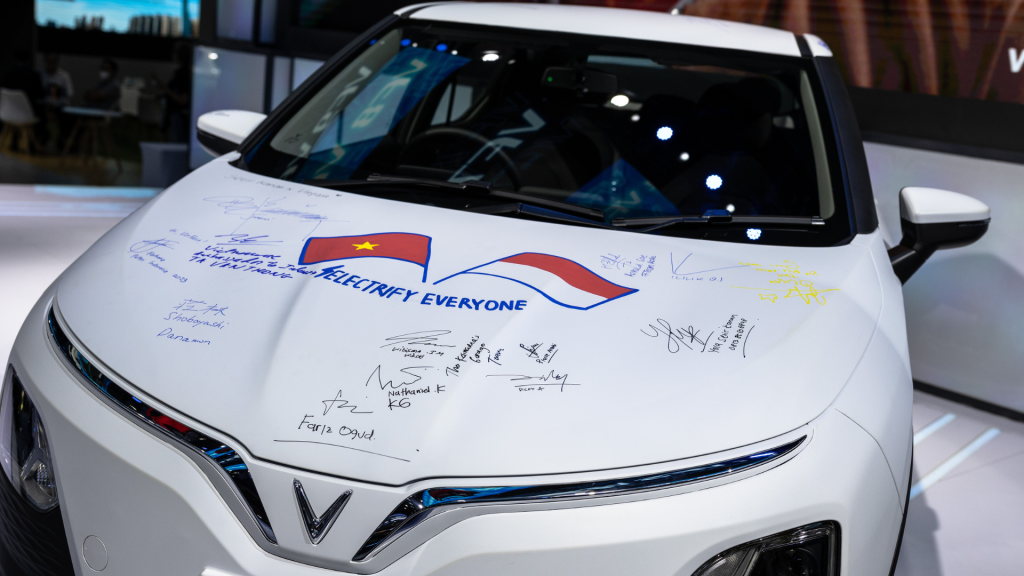

On Wednesday, Green and Smart Mobility (GSM), the ride-hailing unit of Vingroup, officially launched its Xanh SM taxi brand in Jakarta — a 1,000-strong electric fleet, with an eye to expand it to tourist hotspot Bali.

GSM’s global CEO Thanh Nguyen tells MONIIFY that the cars will be all VinFast for now, but they’ll keep an eye on market dynamics.

Jeffrey Bahar, COO of Yamada Consulting & Spire, thinks this is strategic. Xanh SM isn’t looking to compete head-on with the ride-sharing giants, but rather, aiming to build visibility for VinFast through its taxi fleet, he reckons.

This strategy mirrors the company’s approach in Vietnam, where its taxi brand focused on specific regions and premium routes.

But in Indonesia, this might not translate, says Kengo Kurokawa, CEO of research firm Asia Plus Inc.

It is uncertain how many locals would want an EV tied to a taxi brand and it’s likely that the “From Vietnam” label might struggle against dominant Chinese players like BYD, Kurokawa tells MONIIFY.

What the numbers tell us…

VinFast went public on Nasdaq via a SPAC merger in August last year, briefly hitting a valuation of $85 billion — outpacing GM and Ford at the time. But the hype quickly faded.

As of December 18, its shares had plummeted 93% from its August 2023 peak, slashing its market cap to $9.96 billion.

VinFast has managed to narrow losses and increase revenues in the third quarter of 2024 and says that it expects to break even by 2026.

In October this year, VinFast reportedly secured a $1 billion investment from a consortium led by Abu Dhabi’s Emirates Driving Company as part of a push into the Middle East. Vingroup also injected $3.35 billion into VinFast in November.

The funding that VinFast has secured to scale its production and global expansion, combined with an increased sales volume, justifies a buy rating, according to BTIG’s Gregory Lewis.

Speed bumps ahead

However, operational hurdles remain. VinFast delayed its North Carolina factory launch from 2025 to 2028 and is struggling to establish itself in the US.

In the first nine months of 2024, it delivered 44,773 cars — only about 55% of its annual target. However, one-fifth of those sales went to affiliates, according to Reuters. Reports from 2023 showed a similar trend, with 70% of its deliveries tied to its own affiliate, GSM.

Reliance on affiliate sales raises questions about VinFast’s ability to attract mainstream buyers, says Kurokawa.

While VinFast is flexing its way into a big market, it’s one where consumers don’t have a lot of purchasing power. The local EV market is also still in its infancy, with fewer than 140,000 EVs on the road — the majority of them being motorcycles, according to Indonesia’s ministry of energy and mineral resources.

Electric cars remain a niche, and shifting consumer behavior in such an emerging market won’t happen overnight.

VinFast is also a relatively late entrant to the market. Besides Hyundai, there are the Chinese giants in BYD and Wuling, as well as French automaker Citroen.

Maybank analyst Paulina Margareta says in a note that Astra International, which is the Indonesian distributor for brands like Toyota, BMW and Isuzu, is unlikely to be affected by VinFast’s moves due to the nascent market for EVs.

There is also a preference for “larger vehicles such as seven-seaters, and after sales and resale value concerns” in Indonesia, Margareta adds, who has a buy rating on IDX-listed Astra.

It’s the battery!

Perhaps smartly, knowing its limitations, VinFast is doubling down on infrastructure. That’s a win-win, whichever way you slice it.

Just earlier in the month, V-Green, a separate company from Vingroup but owned by its founder Pham Nhat Vuong, teamed up with Egypt’s Prime Group to roll out 100,000 charging stations in Indonesia over three years at a cost of $1.2 billion.

A price tag that it is willing to also pay for a spanking-new assembly plant in Indonesia, which broke ground in July 2024 and is expected to start production late next year.

Vingroup’s strategy of building a network of charging stations is taking a leaf out of Tesla’s playbook. This will address concerns about range anxiety and encourage EV sales, Yamada’s Bahar says.

Meanwhile, Kurokawa is of the opinion that for true growth, VinFast must build a strong regional or global presence, as “Vietnam’s market is too small.”

Indonesia might be VinFast’s best shot at outsized growth, but with tough competition and limited brand recognition, capturing that growth in Indonesia or abroad will require significant investment, Kurokawa adds.

Can VinFast outdrive its rivals in Southeast Asia? That remains to be seen. It might not hit a dead end, but it sure needs to strap in for the bumpy ride ahead.