An AI bonanza is in full swing in Southeast Asia, and everyone’s trying to strike while the iron’s hot.

It’s WAY cheaper to build and operate in the region compared to North America or Europe, thanks to lower land, labor and energy costs. For example, the electricity prices for business in the US or Germany could be 2-3 times more expensive than Vietnam or Indonesia, according to data provider GlobalPetrolPrices.

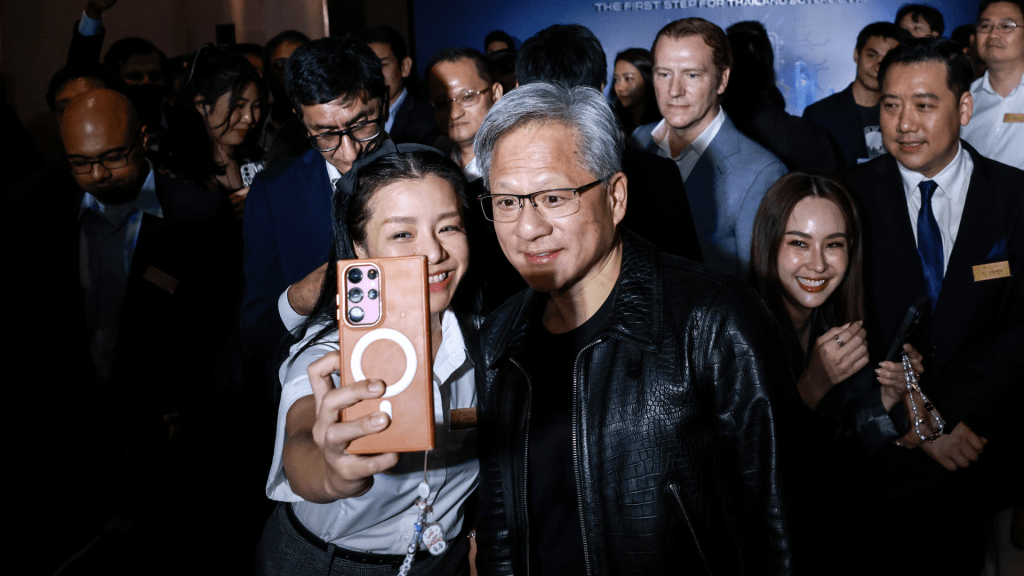

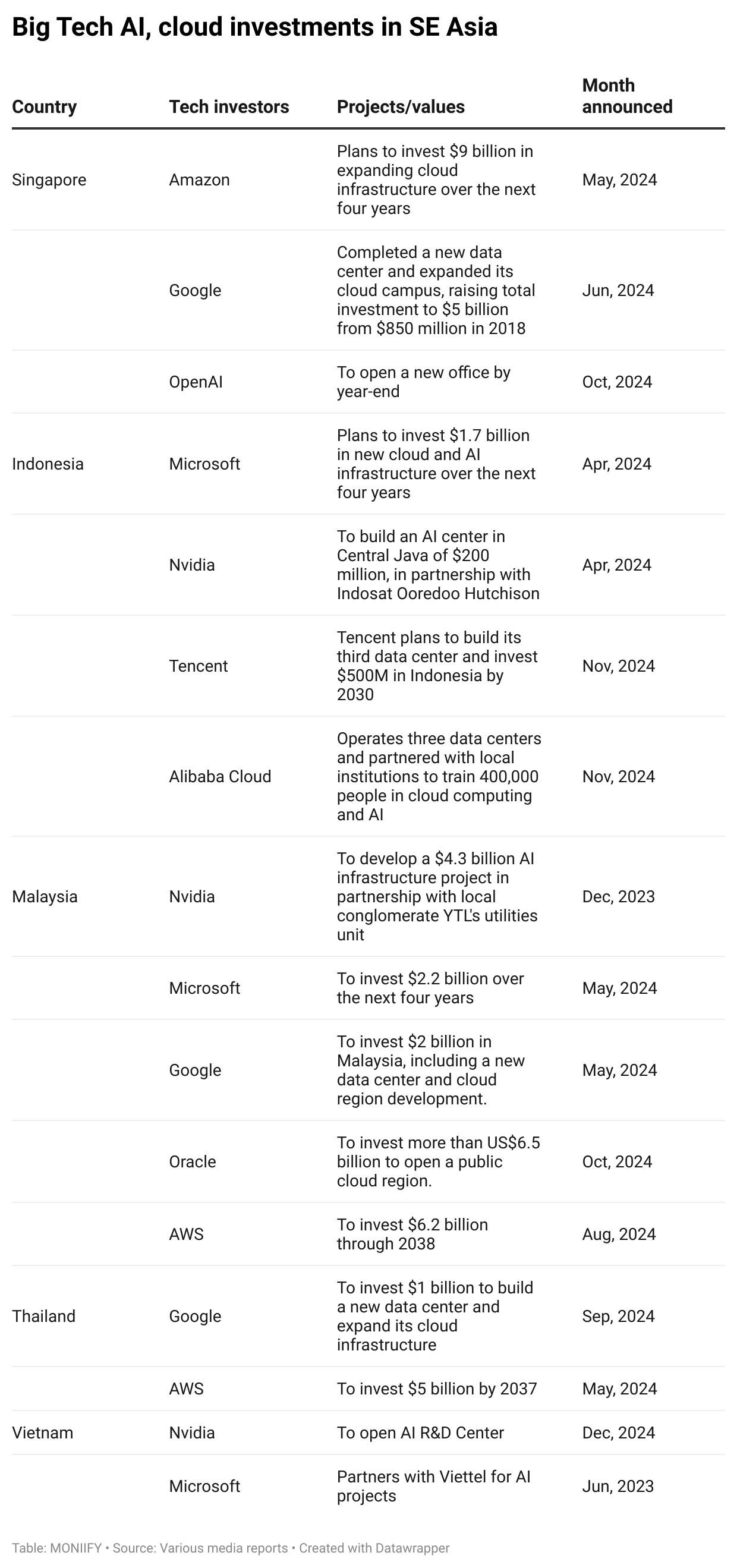

And that’s why the OGs are coming. OpenAI will open an office in Singapore at the end of the year, while Nvidia is set to open a research center in Vietnam. In Malaysia and Indonesia, Microsoft is putting nearly $4 billion into cloud and AI infrastructure.

But it’s not just the Americans coming to the party. Alibaba Cloud is expanding in Indonesia and Thailand, with plans to partner with 100 local businesses by 2025. Tencent Cloud is also making a big push, investing $500 million in Indonesia, with plans to launch a THIRD data center in the country.

Read more: Tell me, ChatGPT: Who’s winning the AI race?

Spillover effect

As more 💰💰💰 flows into AI and cloud tech, the increased competition should translate into cheaper cloud services, better support and faster scaling opportunities for businesses in the region.

“There’s a cloud war brewing, and it’s a blessing for startups,” says Dave Richards from Capria Ventures, adding that more players means better services at competitive prices.

There will also be a positive spillover effect, “boosting AI expertise in these countries,” Roshan Raj, partner at Redseer, tells MONIIFY. Think data science, cybersecurity and engineering, which are seeing wages rise despite a global tech winter.

Companies such as Alibaba Cloud and Microsoft also have ambitions of churning out fresh cloud-computing talent.

Finding opportunities

For these investments by the tech giants to really work, it’s going to require local businesses to identify and scale AI solutions to meet market demands. And that presents opportunities for local investors.

“For investors, it’s all about finding local companies solving real problems,” says Redseer’s Raj.

This means individual investors should look at local companies that are partnering tech giants to drive growth or addressing specific regional needs — think AI-powered healthcare solutions that streamline diagnostics, or smart manufacturing tools that help companies boost efficiency and cut costs.

For example, Singapore’s Grab recently partnered with AWS to enhance its services in mobility, delivery and digital banking to boost efficiency and manage IT costs. And GoTo’s hookup with Alibaba Cloud might shave 20% to 30% off data center costs for the Indonesian tech giant, according to Etta Rusdiana Putra, an analyst at Maybank Sekuritas Indonesia.

These initiatives could help them hit their profit targets. Southeast Asia’s top tech stocks have been on a tear of late. Grab, listed on the Nasdaq, has seen its shares rise by 17.35% over the past month, while GoTo, which is listed in Indonesia, experienced a 21.54% increase.

Read more: Indonesia’s Telkom dials into data center race

Long game

More businesses are collecting MORE data, so there’s a real push for more local data centers to power cloud computing, machine learning and big data analytics.

This could generate long-term demand and growth, and THAT’s why it’s not just Silicon Valley firms and Chinese tech giants doubling down on the region: Middle Eastern firms are joining the party too.

Dubai-based conglomerate Damac Group is putting $3 billion into data centers across Malaysia, Indonesia and Thailand, with its first facility in Bangkok launching in March 2025, powered by Nvidia chips.

But for the party to really get going, governments need to sing the right tune. That means clear, supportive regulations that encourage businesses to experiment with and adopt AI technologies.

Having the right energy resources and the right local talent is also going to be critical, says Redseer’s Raj. Get those fundamentals right, and the party could turn into a rager.