OpenAI’s ChatGPT had no street cred two years ago.

Today, it’s got more than 300 MILLION weekly users AND is worth over $150 billion, OpenAI CEO Sam Altman recently told a conference.

In the process, it’s also spawned numerous wannabes and has attracted some serious $$$$. In fact, OpenAI’s got enough clout to tell investors where they can or can’t put their money – reportedly, they must invest EXCLUSIVELY with it.

Today, it’s raised an $18 billion war chest and doubled its annualized revenue to $3.4 billion.

But it’s burning cash – fast – to keep its lead. Think expensive hires, training of AI models like text-to-video bot Sora and more.

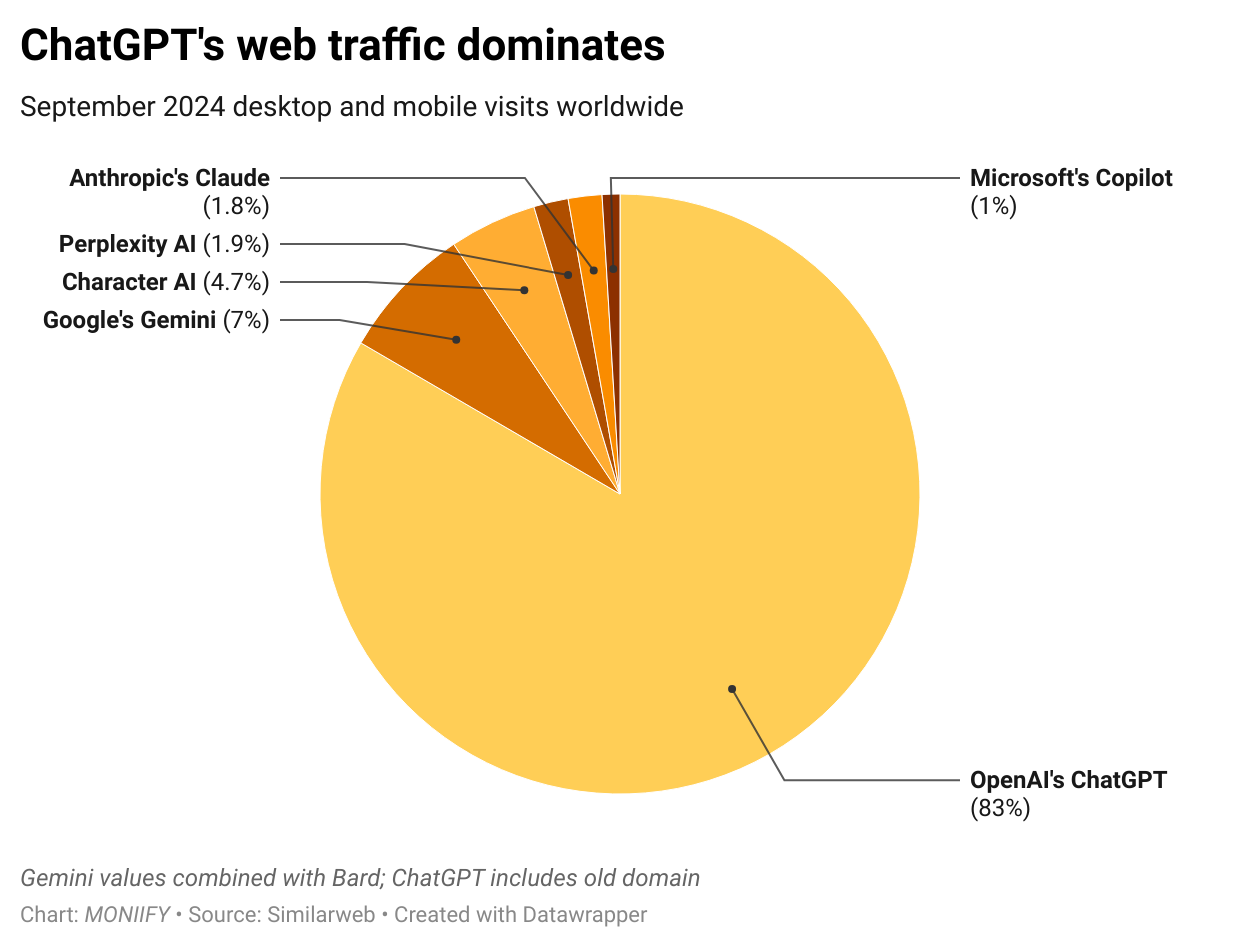

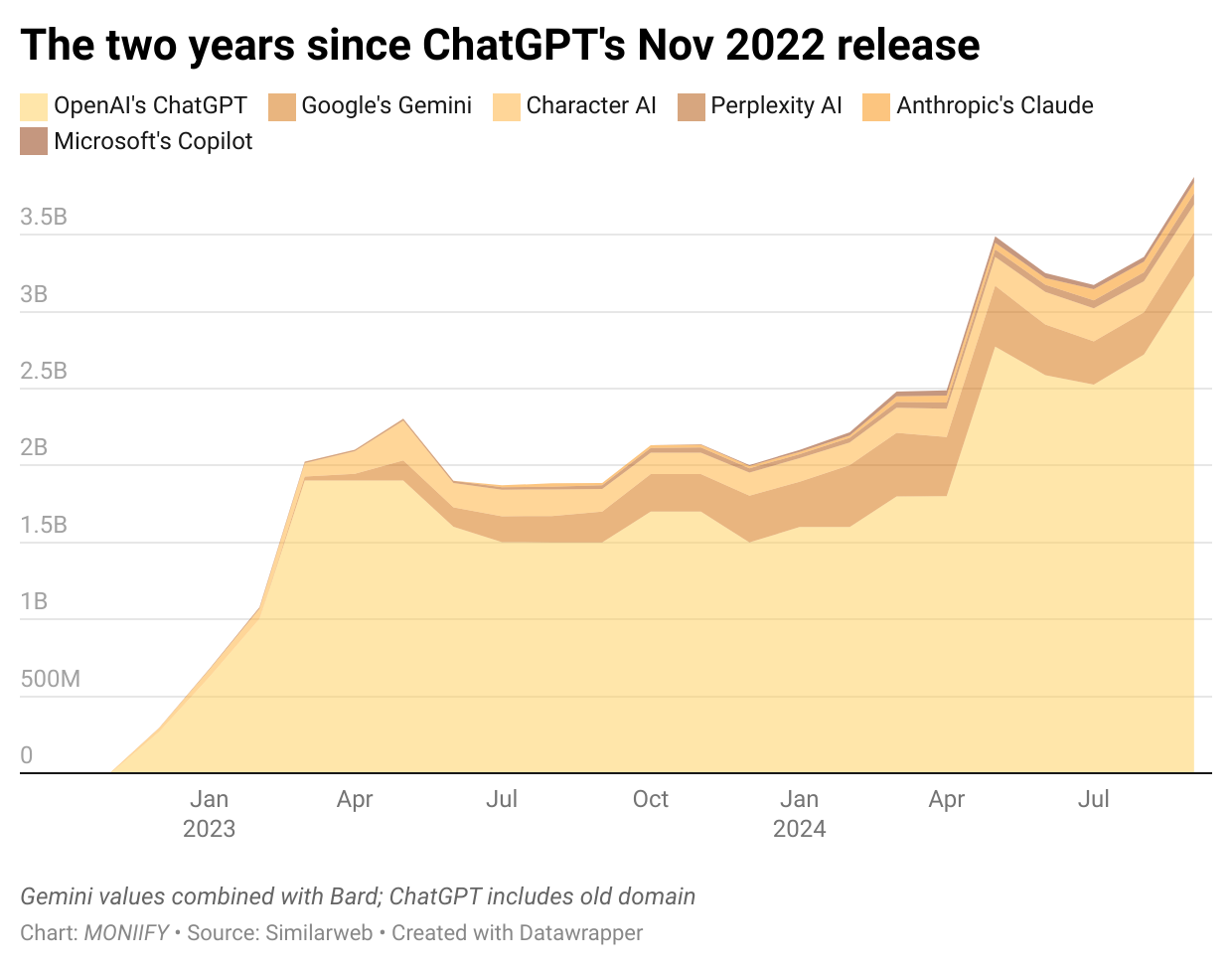

BUT the OG has an overwhelming lead in terms of web traffic on all devices, according to digital data firm Similarweb. As of the end of September, ChatGPT commanded a whopping 83% of traffic among top GenAI chatbots, or 3.2 billion page views.

Beyond ChatGPT’s broad dominance, specialized GenAI platforms are carving out niches, says investment advisor Michael Ashley Schulman of US-based Running Point Capital. Think Midjourney and Nightcafe for image creation, Luma Labs and Runway for video production, AlphaCode for programming and Soundraw for music.

OpenAI doesn’t have an answer to these just yet, but Sora is expected to hit the market soon.

What winter?

If there was a slowdown in the tech sector, AI clearly didn’t get the memo.

More than 8,000 AI and machine learning deals worth $111.3 billion were closed between October 2023 and September this year, according to PitchBook data. That’s $24.3 billion more than the preceding period.

So, it shouldn’t be surprising to hear that ChatGPT’s got competition. It’s ceded some ground to Google’s Gemini (rebranded from Bard), Perplexity AI and Anthropic’s Claude.

Google has plugged Gemini in Search and Android OS, ensuring that it’s at the front of its global user base. Last month, Amazon invested $4 billion in Anthropic, the AI firm started by ex-OpenAI employees, taking its total investment to $8 billion.

Elsewhere, Perplexity – backed by Nvidia as well as Amazon founder Jeff Bezos – has also emerged as a strong alternative to Google Search and doubled its market share this year.

There’s also a dark horse in Character AI, which has eked out a 5% share of traffic.

Elon Musk, who co-founded OpenAI before falling out with Altman, is obsessed with giving it a run for its money through xAI, his new AI firm which recently raised $6 billion.

Apple has integrated ChatGPT in its devices, even as it splurges on its own nascent genAI model, Ajax.

Risky, risky

Investors have grown cautious, though, amid concerns about how fast these AI startups can become profitable. While Microsoft, one of the earliest movers in the AI race, is set to make a cool $10 billion a year from AI, that’s still a mere 4% of its annual sales.

The risk for companies investing in AI is BIG since there’s no immediate ROI, Bob O’Donnell, president and chief analyst at US consultancy TECHnalysis Research, told MONIIFY.

What’s next for the sector? Big Tech companies are turning to “AI agents”, which, instead of just delivering or summarizing information, can accomplish tasks like making sales calls and transactions online.

“2025 will be the year of the AI agent,” says Jamil Valliani, an AI product leader at Atlassian. As these agents grow “richer in interactivity” and start to reach across more than just text and into audio and visual elements, they will bring about “a powerful cultural shift in how humans collaborate with AI.”

(Correction in the sixth paragraph: An earlier version cited Runway as an example for programming. It should be AlphaCode for programming.)