Indonesia’s been playing hard to get — and Apple has finally got the message.

Its $1 billion investment fee offer was “welcomed” by Indonesia, but an iPhone sales ban won’t be lifted just yet.

Why? Apple’s $1 billion proposal was still short on details of how it would produce smartphone components in Indonesia, which means it has to resubmit its proposal. The investment amount must only be for capital expenditure such as land, technology or machinery, and excludes export values and wages.

Only then will Indonesia grant Apple a certification to sell its products in the country, says Agus Gumiwang Kartasasmita, the minister of industry. A counterproposal was sent to Apple and “the ball is in their court.” He was speaking at a media briefing on 8 January.

Indonesia imposed a ban on iPhone 16 sales on 28 October last year — a month after its global launch on 20 September — when Apple failed to meet local investment regulations. Since then, marketplace apps have been flooded with iPhone 16 units purchased overseas, retailing for as much as $1,200 above the market price of $799.

Read more: #HotStox: No Trump bump for Apple

With the largest population in Southeast Asia, Indonesia is one of the most important markets for smartphone manufacturers. While Apple doesn’t share country-specific iPhone sales, it recorded sales of $3.4 billion in 2024, according to Indonesia’s Ministry of Industry.

The big picture

While Indonesia is egging Apple to build a new manufacturing plant that will make components for iPhones, it is already opening an AirTag production plant on Batam Island, which is just an hour away from Singapore by ferry.

However, Indonesia’s Ministry of Industry considers AirTags, which is a device used to keep track of personal items, as an accessory and not an essential component in iPhone production, and therefore is not considered part of Apple’s certification process.

Apple’s billion-dollar investment, when it happens, could potentially supercharge Indonesia’s tech manufacturing sector, says Roshan Raj, partner at Redseer.

“It’s not just about building factories, it’s about creating a skilled workforce and strengthening supply chains, similar to what we’ve seen in China and Vietnam,” Raj tells MONIIFY. The hope is that building manufacturing plants in Indonesia will spark a surge in demand for local production and materials, fueling growth in tech manufacturing, local suppliers and the infrastructure that supports them.

Read more: Apple hasn’t done this since Jobs and the iPhone

For Apple, this also means boosting its competitive edge against Chinese phone makers Oppo, Vivo and Xiaomi, as well as South Korean chaebol Samsung. They all already have production lines or partnerships with Indonesian manufacturers.

But for Indonesia, the $1 billion is MORE than that. It’s hoping Apple’s move could act as a magnet for other global tech players.

“These investments will entice other technology companies to invest in Indonesia and drive technological developments across the country,” Raj says.

And for individual investors, that creates potential opportunities in terms of local businesses partnering with tech behemoths.

Read more: China’s Oppo is teaching Apple and Google a lesson about Indonesia

What’s the play?

Apple relies on hundreds of suppliers, mostly based in China, with others in Vietnam, Thailand, Singapore and Malaysia.

But in Indonesia, Apple’s sole supplier is Taiwan-listed Yageo Corporation, which produces components like chip resistors and capacitors. The company’s based in Batam, but it’s unclear yet whether it will be behind the new AirTags facility. Yageo’s shares had climbed by nearly 7% at the end of last year.

Meanwhile, Foxconn, one of Apple’s key suppliers, has long been a top foreign investor in Indonesia. In 2022, it sealed an $8 billion deal to develop the country’s EV ecosystem, partnering with local powerhouses like Indika Energy and Indonesia Battery Corporation.

Foxconn, which trades as Hon Hai in Taiwan, has had an exceptional 2024, with shares soaring 72%.

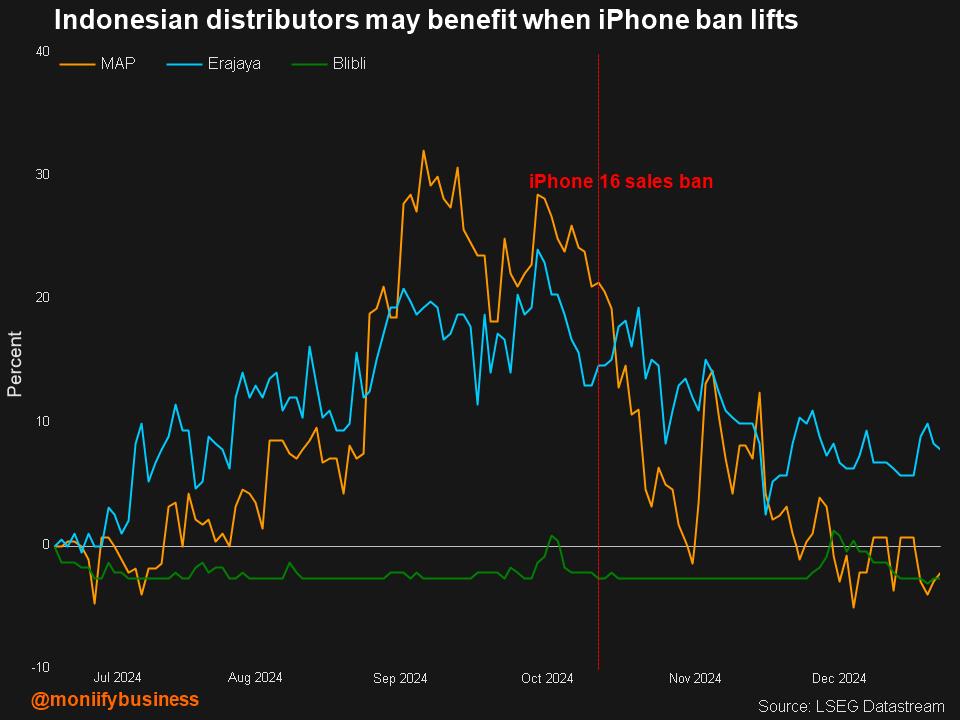

And there are local distributors that may gain from iPhone sales in the country.

Apple doesn’t operate an official store in Indonesia, so the government sales ban is hitting authorized resellers and distributors hard. These include listed lifestyle retailer MAP Group, Erajaya Swasembada and Global Danapati Niaga (which is part of the listed e-commerce company Blibli).

Before the release of the iPhone 16, Erajaya had stockpiled Apple products worth an eye-popping $1.2 billion from Singapore-based Apple South Asia between January and September 2024, a nearly 12% increase year on year. That amounted to about 40% of Erajaya’s sales.

In the past six months, these companies have shown mixed results. Shares of MAP Group and Blibli have each dropped by around 2% to 3%, while Erajaya’s shares have risen by around 7%.

Read more: Indonesia business owners get sucker punched

What’s next?

Apple’s AirTag production plant in Batam may produce up to 65% of the world’s AirTags, Indonesia’s Minister of Investment Rosan Roeslani claims. If true, that would boost Indonesia’s role in the global tech manufacturing scene.

The new plant is expected to take advantage of Batam’s free-trade perks — no luxury taxes, VAT or import duties.

Apple also has a $10 million outstanding investment commitment, with which it has promised to build its fourth Apple Developer Academy in Bali. However, the Indonesian government wants an R&D center and technology transfers to be part of the deal, and may impose penalties if Apple fails to invest that amount.

Lawmaker Saleh Partaonan Daulay told reporters in December that Apple’s investments needed to have a tangible impact on the Indonesian economy. He expects it to create jobs and contribute to national economic growth.

While Apple’s investments may be a win for Indonesia, analysts warn that it’s a bad look. The country’s tech and manufacturing ecosystems still lag Vietnam’s, which contributes up to more than 50% of Apple’s supply chain.

Read more: This Indonesian startup raised $14 million a year ago. It’s now in trouble: MONIIFY Scoop

Indonesia must upgrade its workforce to attract global tech giants while ensuring that its domestic suppliers are able to meet international standards, Nailul Huda, director of digital economy at the Digital Center of Economic and Law Studies, tells MONIIFY.

Without these improvements — and with heavy-handed protectionism — it risks driving away big investors.

Whether the ongoing back and forth between Indonesia and the US tech giant plays out that way remains to be seen — but so far, all the ingredients are there.

Edited by Azar Zaidi, Tim Hume and Victor Loh. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com