When there’s a funding drought, you may end up praying for some divine intervention… or angel investors.

Across Southeast Asia, institutional investors and venture capital firms have been hesitant about putting their money into startups due to tightening monetary policy and a shift that prioritizes profit over growth.

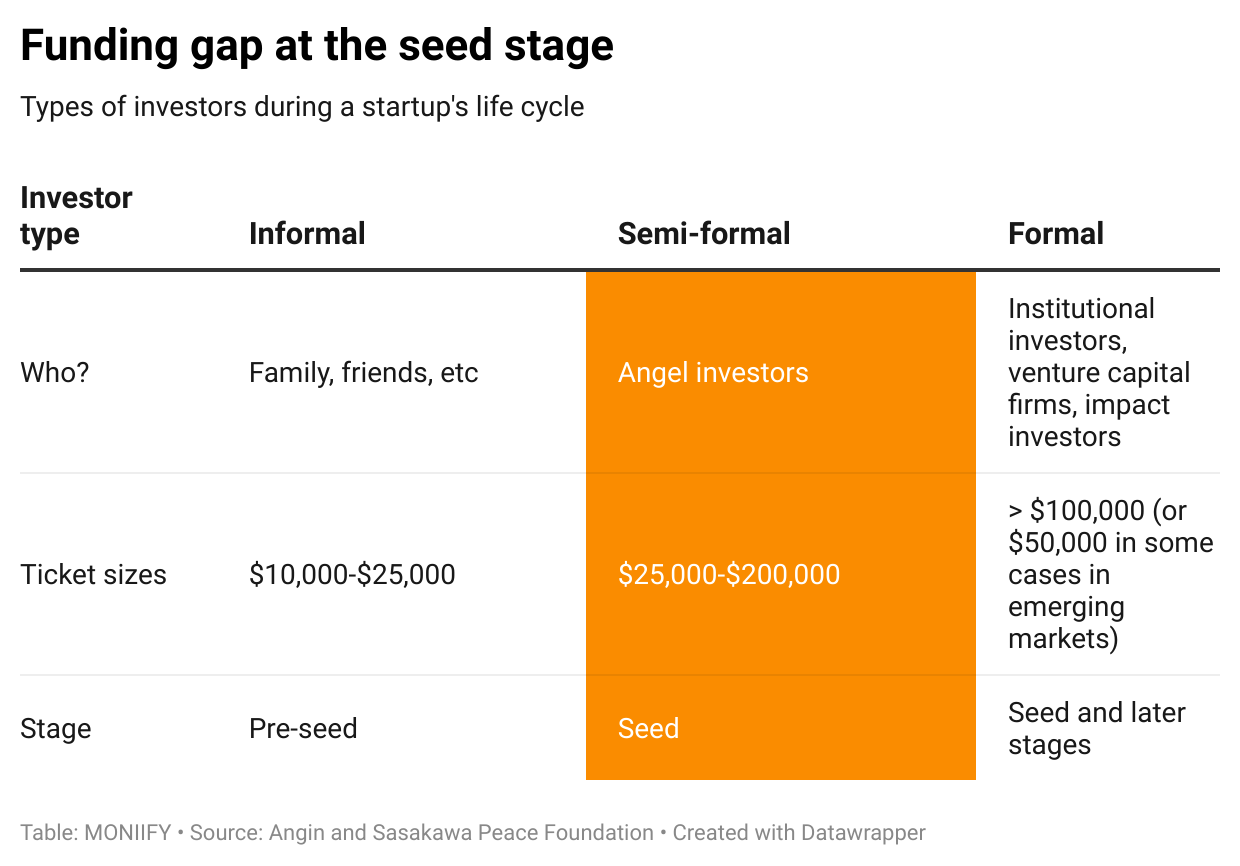

Enter angel investors, who usually step in to fill financing gaps in the early days of a startup when there aren’t any products or outcomes to show just yet.

The increased risk of failure during a startup’s early days means that most investors are even more wary of parting with their $$$, according to a report by Angel Investment Network Indonesia, or Angin, and Sasakawa Peace Foundation.

Read more: Fatter checks for Indian startups in 2025?

For instance, up until the first half of 2024, private funding reached $3 billion in Southeast Asia, according to a report by Google, Temasek and Bain & Company. In 2023, it stood at $8 billion, $22 billion in 2022, and $27 billion in 2021.

While the firepower provided by angel investors may not pack the same punch as VCs, these sums are usually bigger than the informal loans secured from entrepreneurs’ families or friends. Plus, these investors can be an actual godsend, bringing value beyond capital through their expertise and networks.

Angel investors may be individuals, or a network that recruits potential members such as C-suite executives, celebrities, influencers, and entrepreneurs looking for financial gains or to share their expertise.

Angel investing in Southeast Asia remains promising despite challenges, says Nelson Ng, founder of angel investment community Good Karma Club, which provides private credit to early-stage startups.

Some angel networks also offer opportunities for people to invest as low as $1,000, making startup investing more accessible than ever before, says Ng. His typical ticket size is around $10,000-$20,000 per deal.

Read more: No Tyme to lose for Southeast Asia’s new fintech unicorn

High risk, crazy returns

At a time when Bitcoin, gold, and the S&P 500 are at record highs, investing in startups may seem absurd, but some people see beyond quick gains.

Think Mike Markkula, one of the OG angel investors in Apple, and Sun co-founder Andy Bechtolsheim, who wrote a $100,000 check for Google in 1998.

Ideosource — one of Indonesia’s oldest VCs — made a $200,000 bet on smart fish feeder startup eFishery back in 2015. While the cofounders of eFishery are currently embroiled in fraud allegations, the startup had previously managed to secure several funding rounds and became a unicorn in 2023. According to local media reports, Ideosource made as much as 75X returns from its initial investment.

Many startups resort to self-funding, also known as bootstrapping, says Nailul Huda, digital economy director at Center of Economic and Law Studies.

Read more: Why Southeast Asia’s fintechs are making moves in the Middle East

If they manage to get through the bootstrapping phase, the next round of funding will be easier for them, Huda tells MONIIFY, noting that startups are forced to survive and make money with limited funding during this phase.

But bootstrapping doesn’t pack a punch for a startup to expand, so help from angel investors is much welcomed by entrepreneurs.

Approach with caution

Despite the lure of promising returns, seasoned investors warn that angel investing can be extremely risky — and your money can be wiped out in an instant even if you think you know the founders well.

“Are you willing to lose this money?” says David Soukhasing, managing director of Angin. Because, “the truth is, angel investment is risky, even as debt.”

He usually asks prospective angel investors about their risk appetite, and won’t recommend it for those who only have savings to tap on.

Read more: A tech winter? Not in tropical Indonesia, says VC firm East Ventures

Always consider your risks, “especially when it comes to high-risk, high-reward vehicles like startups,” says Elisabeth Kurniawan, an angel investor and startup advisor.

“It’s important to prepare for the possibility that the business might fail.”

Fandy Cendrajaya, founding partner of Kopital Ventures, says angel investing is a very difficult asset class because an angel likely needs to invest in multiple companies to be diversified enough to have a chance of recouping invested capital and profiting.

Cendrajaya, himself an angel investor once, considers it an “illiquid asset” with an “uncertain” holding period. However, angel investments could be attractive for those with early access to information and deep roots in the industry that they are investing in, he says.

However, having a small stake in a company will not guarantee an angel investor has updated information about the company and its plans. This will become an important aspect when an angel investor thinks about exiting.

As a company grows and investors get diluted, it is very unlikely that an angel is able to do pro rata, or double down to maintain his or her stake in the company, Cendrajaya says. “This will eventually lead to more difficult exit opportunities and lack of value-add in the long term.”

Read more: Can blended finance fix Southeast Asia’s climate financing gap?

The basics

While angel investments may not offer the daily liquidity of stocks or cryptocurrencies, they offer a chance to support startups you believe in, and to enter the world of innovation and entrepreneurship.

“If the goal is purely monetary rewards, the stock market would be more efficient,” says Good Karma Club’s Ng.

But if you do want to explore angel investing, Ng offers some suggestions for newbies:

- To get started, consider investing in a friend or family member’s business, as angel investing is built on trust.

- You can also join an investment fund or VC firm to learn how to evaluate deals.

- Another option is joining an angel investment club or community to gain exposure and connect with like-minded investors.

- And of course, always research the company thoroughly, and remember to diversify your investments — especially in early-stage startups, where risks are higher.

While joining an angel investing community is easy — there are several new ones such as Bangkok-based A2D Ventures, the Malaysian Business Angel Network, Bali Investment Club, Good Karma Club, and older ones such as the Business Angel Network of Southeast Asia and Angel Investment Network Indonesia — approach wih caution. The last thing you want is to be a “fallen angel”.

Edited by Victor Loh and Azar Zaidi. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com