Yup, that BlackRock.

The money manager already controls a good chunk of the financial universe thanks to its ETFs and passive investing empire that’s been steamrolling the competition since the 2008 financial crisis.

And another growth surge might just be round the corner. So, if you’re feeling like you missed out on the last wave, you might want to strap in for this one. 🚀💰

Members only

Forget Big Tech and public markets. How about owning assets that only the ultra-rich usually get their hands on?

BlackRock is cracking open the private markets vault. These are the kinds of investments that happen behind closed doors — deals made directly between buyers and sellers, without all the stock market noise.

This week Bloomberg News reported that BlackRock was nearing a deal to buy HPS Investment Partners, one of the largest players in private credit, as it seeks to become a dominant alternative assets player.

The asset manager has its eyes on indexing private markets. We’re talking about assets like private real estate, shares in companies you might’ve never heard of and exclusive debt investments.

What’s at stake?

- Private markets are already swimming in cash — $11.7 trillion in assets as of 2022. But that’s just the beginning. Analysts at S&P Global Research say that the number could rise nearly 30% to $15 trillion by 2025 and over $18 trillion by 2027.

- And get this: The returns are better. Private equity flexed an average return of 10.5% between 2002 and 2022, outpacing the S&P 500’s 9.8%. That’s why the big money’s pouring in.

With $11.5 trillion under management, BlackRock is already a beast. But the day private markets become as easy to access as ETFs, growth is REALLY going to take off.

Been there, done that

BlackRock has been serving three types of clients: individual investors, institutional investors and anyone pouring cash into its lineup of ETFs across stocks and bonds.

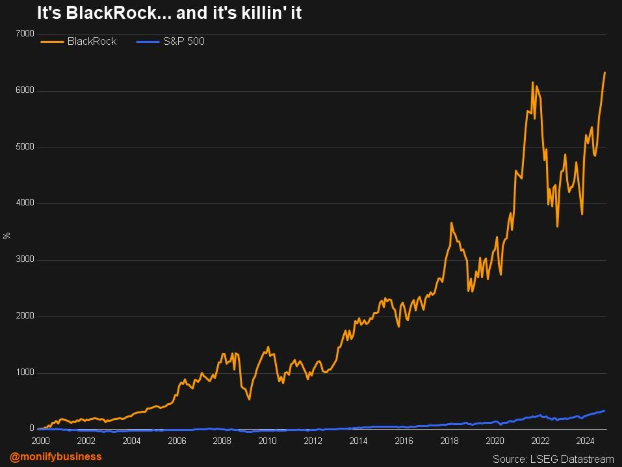

The ETF corner is a big one. It’s no accident BlackRock’s stock blasted off right around 2009, just as ETFs became the new must-have investment products.

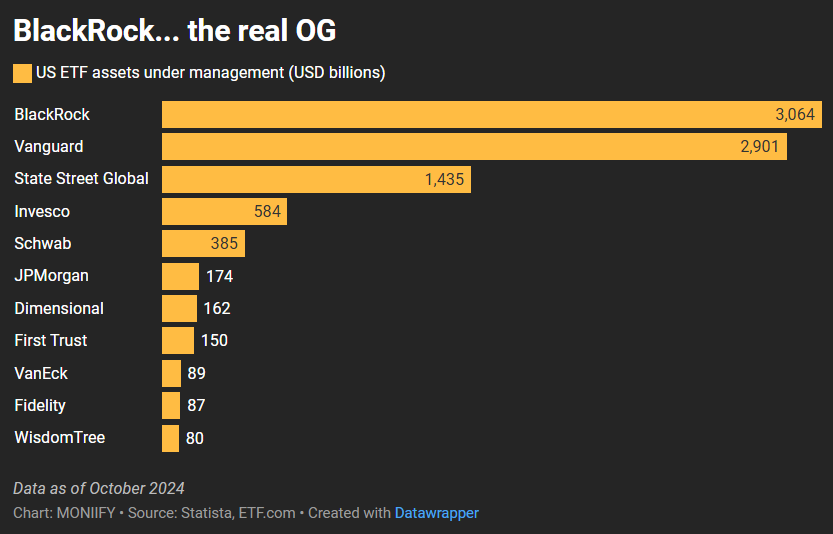

- BlackRock’s the largest issuer of ETFs in the world. Its ETF assets under management are around $4.2 trillion as of September 2024.

- Nearly 40 of its ETFs rank among the top 100 largest by assets. It leads with over 440 ETFs in its lineup, according to VettaFi data.

- BlackRock’s ETFs raked in a cool $186 billion in net inflows last year, with bonds leading the charge. But its biggest ETF moneymaker is still stocks, with a huge $2.5 trillion in assets under management.

But while private markets could usher in the next ETF-like era for BlackRock… this play is actually a MUCH bigger gamble.

Why?

Firstly, it could be harder to attract investors despite the promise of better returns. Private markets are illiquid, which means taking money out is not as easy as it would be in the regular stock market. That’s a big hitch for the kind of individual investors that lapped up BlackRock’s ETFs.

Private markets are also not as transparent. Private companies are… ba dum tish… private. They don’t have to disclose financials, and the rules of the public market don’t apply to them, so you really have to do your due diligence.

When there’s not much information out there, it can be tough to make a call on the quality of an investment. What that amounts to is… more risk. And again, it automatically makes private markets less appealing to small investors who want hassle-free returns.

It’s a roll of the dice, but when it comes from a company like BlackRock, is it worth the gamble? Your call.