ASML, the Dutch overlord of the semiconductor empire, delivered a bloody blow on Tuesday that sent nearly every single chip stock bleeding into the red.

Yet, just 24 hours later, AI bulls (think: Nvidia fans) came stampeding back into the market!

These aren’t your typical blindly buy-the-dip types either. They’re chasing the AI theme with a laser focus for a good reason even after that disastrous oops-we-didn’t-mean-to-leak-it ASML report.

TSMC swooped in a day later, practically patting these dip buyers on the back, saying, “You’re good.”

The real takeaway from TSMC and ASML’s drama? Spending on data centers, aka the AI engine, is running hotter than ever. Everywhere else? Meh, not so much.

AI hardware is the golden goose, and the hype isn’t fading. If anything, it’s just getting frothier. 😉

AI > Everything else

- TSMC has raised its profit forecast as customers are lapping up chips the Taiwanese giant makes for Nvidia.

- ASML, the bellwether for the whole chip world, got sucker-punched. It clocked only half the business analysts expected last quarter, blaming poor uptake in the automotive, mobile and PC markets. Its down nearly 20% since reporting.

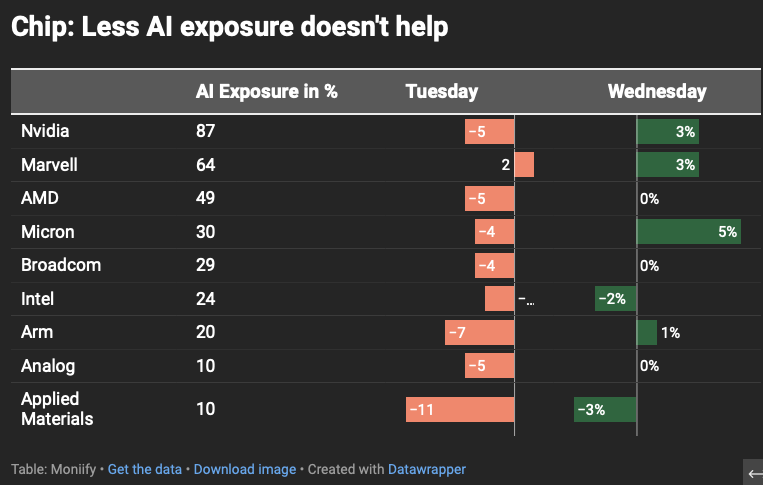

If you squint at the carnage, you’ll notice something interesting: the stocks that barely flinched or bounced back are the ones deep in the data center game. Think Nvidia or Marvell Technologies. The others? Take a look at this chart:

Cloud computing giants like Amazon, Microsoft and Google, along with AI-heavy hitters like Meta and X, are doubling down on data center capacity like there’s no tomorrow.

Forget any talk of a slowdown. They all want Nvidia’s shiny new Blackwells but are racking up whatever is available next. Nvidia was up another 3% on Thursday.

The big question

Yeah, there’s been a little pop in the smartphone and PC markets – thanks to new AI features – but they’re still far from getting their groove back. Smartphone shipments have hit the brakes, with growth slipping to 4% in July-September, down from 9% in the previous three months.

ARM and Qualcomm, both key players in smartphone chips, are probably gearing up for a bumpy road ahead. PC chipmaker Intel and memory producer Micron? Not looking much better either. Automotive chips are in for a rough ride, too. Companies like Analog Devices, Applied Materials, and Qualcomm are all feeling the pinch as major carmakers, including Volkswagen and Toyota, slash their annual production targets.

Do you keep riding the AI wave, betting on its relentless growth? Or do you hold your fire and wait for a bottom to pick up bruised and battered chip stocks still clinging to the mobile and auto markets?

It’s a real fork in the road for investors, and a clear divergence is on the horizon. Stick with the shiny AI dream or play the waiting game for the players stuck in the slow lane. Choose wisely.