Yep. Someone hit the “send” button at ASML before it was time🤯.

No one saw that coming and within minutes Nvidia – the “godfather” of the chip industry – fell nearly 5%, leading the $420 billion selloff.

Why? Well, that’s because ASML sits at the top of the chipmaking food chain. It goes like this:

- ASML makes the machines that create chips.

- TSMC uses ASML machines to manufacture high-end chips.

- Nvidia (and other tech giants) design and sell the final products that power AI, gaming and more.

I know, I know. Your immediate question is: should I buy the dip in Nvidia shares?

Look at it this way. It’d be too bold to call time on the AI mania. ASML’s miss on order bookings is not a problem with the AI sector – the weakness is coming from memory (storage) and logic (the brain of electronic devices) chip makers, like Samsung, Micron etc.

Wrong reaction?

The strong performance of Al clearly continues, and it “continues to come with quite some upside.”

^^That’s ASML CFO Roger Dassen reassuring Nvidia bulls during an earnings call.🔥JP Morgan traders echoed this sentiment: “The kneejerk reaction to sell Al names seems like the wrong reaction.”

But also, know this: such shocks can kill rallies if things are pricey. Nvidia just overtook Tesla as the most expensive stock among Big Tech. It trades at 62 times forward earnings and 35 times forward sales. Tread carefully.

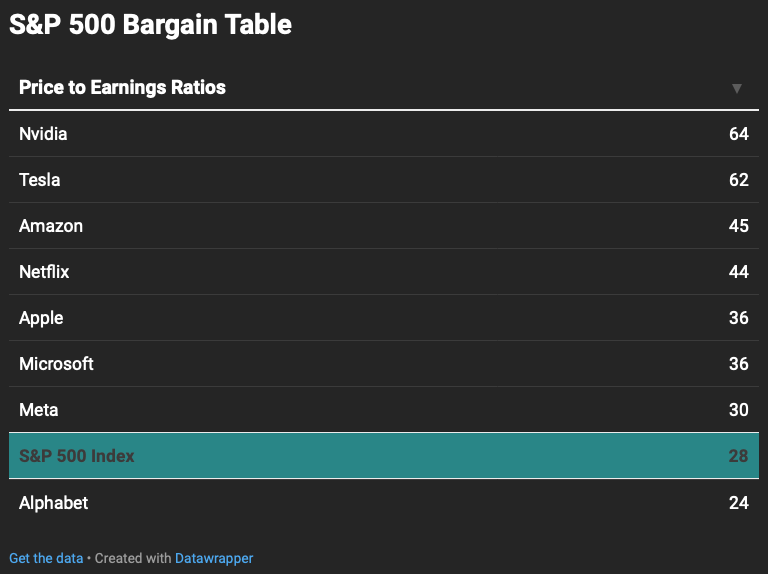

Before you buy any dip, here’s a little guide on how things stand in the Big Tech world according to price-to-earnings ratios i.e. how many years of earnings it will take for the price of the stock to be “worth it.”

- A higher P/E ratio means people are willing to pay more because they think the stock will become more valuable in the future. These stocks tend to fall hard and fast during shocks.

- A lower P/E ratio means a stock is cheaper, but maybe people aren’t as excited about it. These tend to fall less during shocks.

And just before you go, here’s the ChatGPT pick: