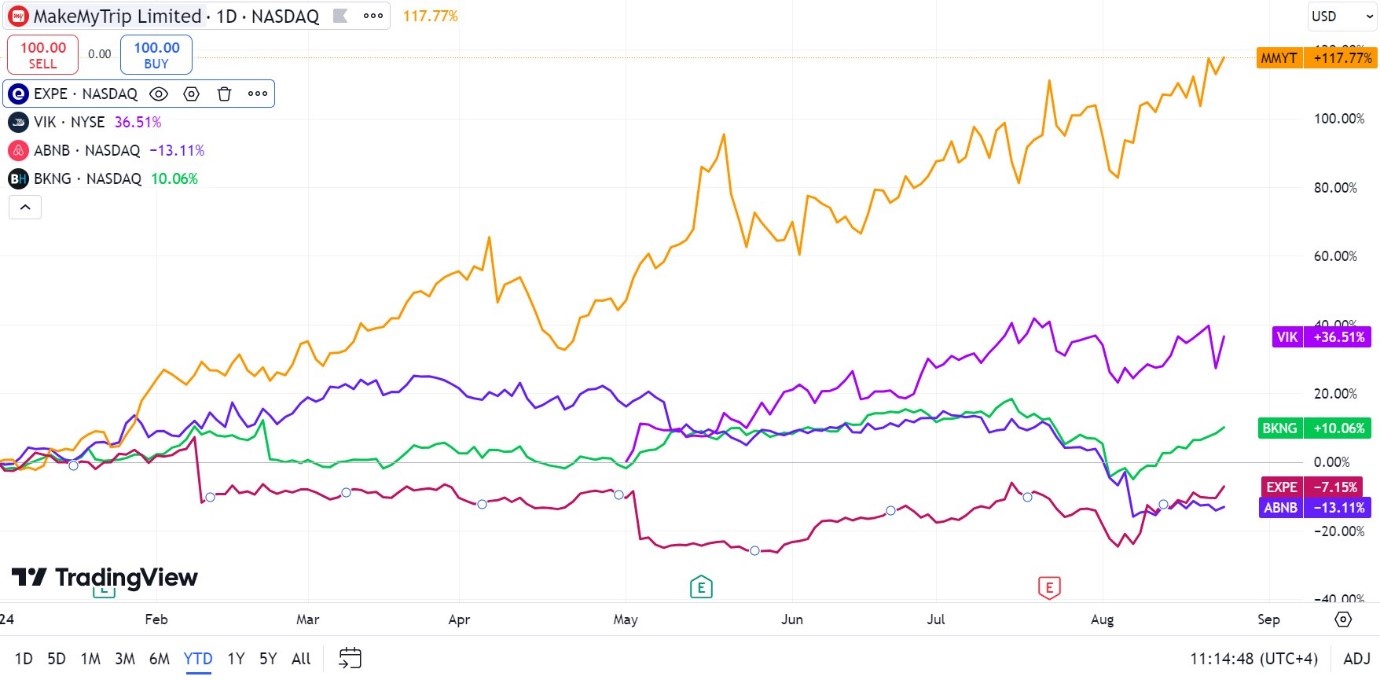

The Nasdaq-listed stock has more than doubled in value this year, with revenue at the online travel aggregator jumping 30% in the quarter ended June 30.

It has outpaced global peers such as Expedia and Booking Holdings.

- The rise of MakeMyTrip shows Indians have been splurging on overseas travel, including to the UAE, Saudi Arabia and the US. They spent nearly $17 billion abroad in 2023-24, a 25% rise from a year ago, according to data from the Reserve Bank of India.

- MakeMyTrip’s earnings have surpassed analysts’ estimates for three straight quarters, with profit growing 14% year on year in the three months through June.

On the fast track

Tourism activity in India, where MakeMyTrip is a well-known name, has been key to the company’s success.

Yet, valuations suggest that the stock may have run too fast, with a price-to-earnings ratio of 59.3 over the past 12 months, compared to 26.9 for Booking, 24.7 for Expedia and 15.9 for online travel company Airbnb.