What if the US markets rally is just getting started?

Since Donald Trump’s big comeback, the S&P 500’s already jumped 5%, sitting pretty at 5,973 overnight. Now that election jitters are out of the way, the bears are back in hibernation, and Wall Street’s loving it: decent economic growth, falling interest rates and AI waiting in the wings to help everyone cut costs.

Oh, and the cherry on top? Potential Trump tax cuts.

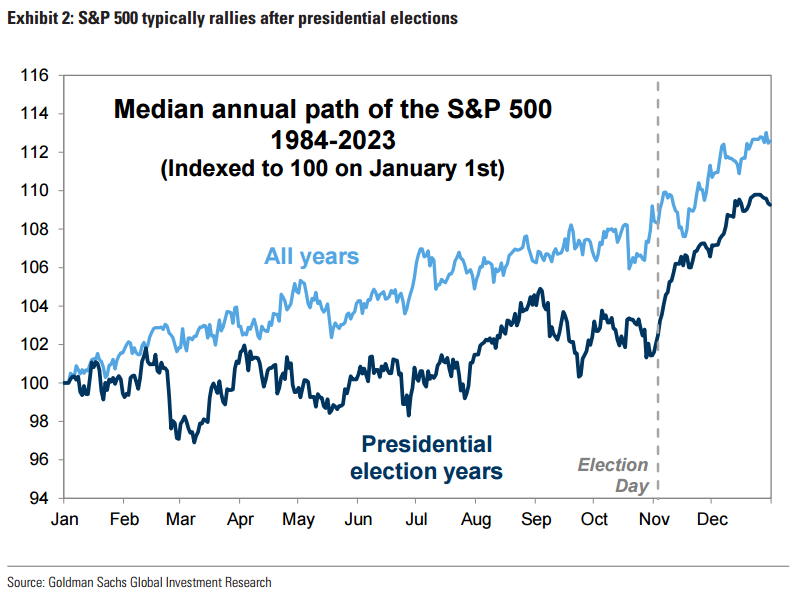

Wall Street’s big boys are sticking to their bullish guns with many predicting the S&P will cruise past 6,000. History is on their side too – the S&P has averaged a 4% bump between Election Day and year-end in previous years. That’s more than enough to crack the mark.

Inflation? That’s a tomorrow problem. Ballooning debt? Trump’s got Elon Musk, the “great cost-cutter,” on standby.

Next stop?

- Goldman Sachs is feeling bullish with a 12-month target of 6,300 points for the S&P 500 – that’s a 5.5% climb from where we’re at now.

- The fundamentals? Rock solid. Earnings are forecasted to jump 11% in 2025 and another 7% in 2026, giving the market a sturdy backbone. Trump’s tax cuts could push those numbers even higher.

Before voting day, investors had one foot out the door, with market exposure hovering just above the 12-month average, according to Goldman data. But with the election dust settling, don’t be surprised if they come roaring back, ready to pump the S&P 500 to new heights.

Here’s a bonus: M&A and IPO action is set for a revival. With Washington expected to roll out a more business-friendly stance, the regulatory roadblocks that have tripped up deals in recent years could start clearing under the new administration.

Melt-up

It is not just about Trump. The “roaring 20s” idea has been brewing for years, fueled by tech-driven productivity gains. But Trump’s win, and a likely Republican takeover of Congress, adds serious fuel to this fire.

Yardeni Research sees this setup as a green light for good times ahead, maybe even into the “30s.” It’s putting a 50% chance on a roaring 20s scenario, a 20% chance on a 1990s-style market “melt-up,” and a 30% shot at a 1970s-style geopolitical crisis (complete with a US debt drama).

So, while most arrows are pointing up for stocks in the near term, it’s not all smooth sailing ahead. Moniify recently dove into this.

ChatGPT corner