Tired of chasing sky-high tech stocks with P/E ratios that could give you altitude sickness? Meet Alibaba — the Chinese tech giant.

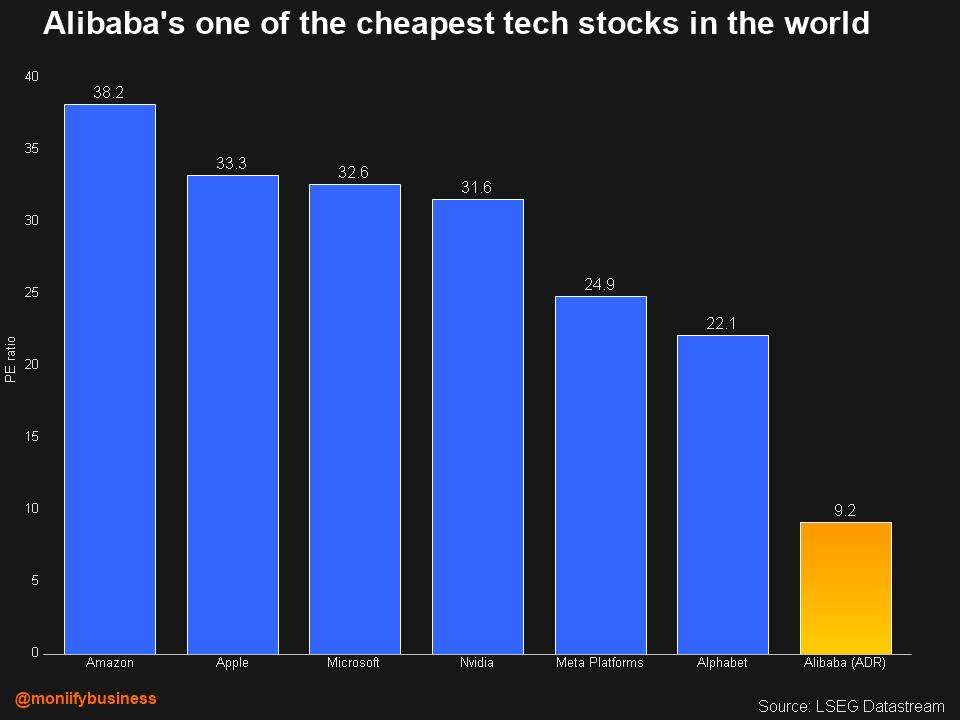

It’s practically begging to be noticed with a forward P/E of just 9x, cheaper than all the Magnificent Seven stocks, and even its peers in China. Yes, it is cheaper than Nvidia (31x), Amazon (38x), or Tesla (an eye-watering 141x).

And then there’s Alibaba’s Scrooge McDuck-level cash stash — a key measure of financial strength that stands at $55.4 billion, or about 27% of its $205 billion market cap.

Compare that to Wall Street’s heavyweights: Nvidia’s got 1.2%, Apple has 1.7% and even the best of the bunch, Meta, maxes out at just 4.5%.

The only criticism from some quarters over those $$$ in the chest? They’re not spending enough on R&D, which could bite them down the line.

Read more: Alibaba’s a massive bargain right now

Numbers check out

Alibaba is one of China’s biggest tech giants, and if the world’s second-largest economy can pull itself out of the woods, this stock could be a major winner.

It’s up 16% for the year and its fundamentals look strong. Profits are expected to grow in double digits (10% or more) over the next two years, with revenue growth projected at 8% over the same period.

Amazon — Alibaba’s closest comparison with its e-commerce and cloud services — may look shinier, but at 40x earnings, you’d be paying through the nose.

Alibaba stock had a solid run between July and early October after China rolled out new stimulus measures to boost its economy. But like clockwork (which has been the case with China’s drip-feed strategy), the gains slipped when the buzz wore off.

Now, with more stimulus coming — with an aim to hit a record 4% budget deficit for 2025 — China might finally be serious about a turnaround.

“China is saving parts of the stimulus bazooka until they see the outcome of Donald Trump’s tariffs,” Michael Sandberg, an equity derivatives sales trader at United First Partners, tells MONIIFY.

With the concentration of Mag 7 and overshooting US markets, $BABA might be the ultimate contrarian play, he says.

Loved by all!

Other analysts agree: 48 of 48 covering $BABA say “buy” or “hold.” Consensus says the stock could climb 45% in the next 12 months — more upside than any other tech darling you could think about investing in.

So yeah… $BABA is stupid cheap, fundamentally solid, and maybe the most overlooked tech play out there.

But it has one giant shadow looming overhead: Trump, TIME’s Person of the Year. His tariff threats are back, and no one wants to be holding a Chinese stock when that hammer comes down.

Fun fact: Michael Burry (the guy from The Big Short who called the 2008 crash) made Alibaba one of his top picks this year, but hedged his bets with put options. Smart money loves the upside, but isn’t blind to the risks.