If you didn’t buy Bitcoin at $100 a coin or $1,000 — or even $10K — you might be kicking yourself right now.

The crypto bros will tell you… The ride to $100K was not for paper hands, anyway (remember the 2021 and 2022 crashes?). The diamond hands? They’re the ones raising a toast to this milestone.

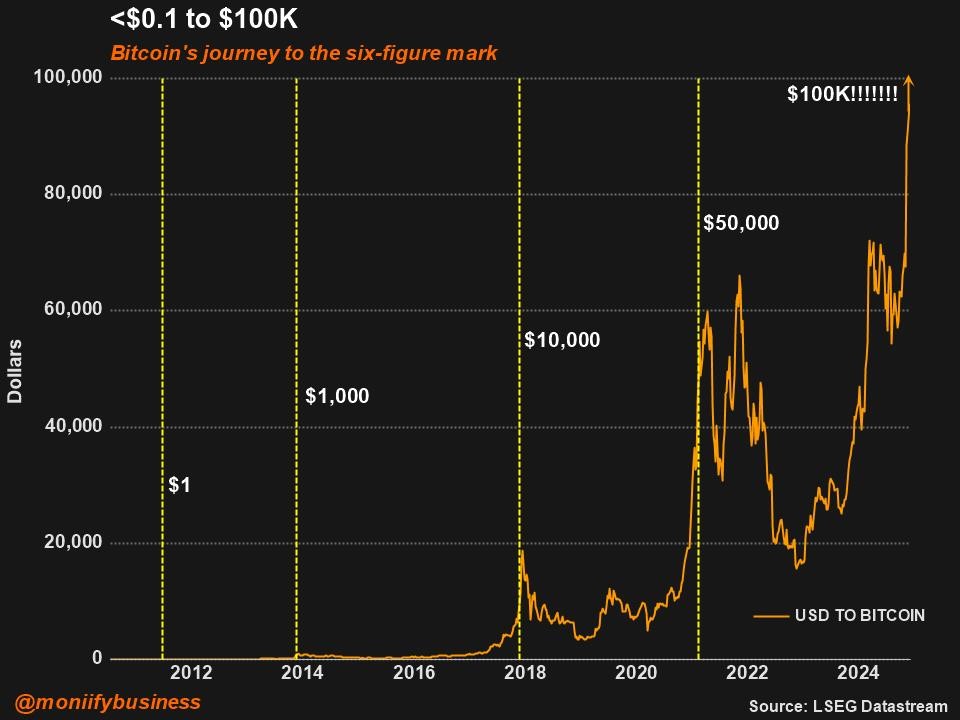

Here’s a snapshot of the wild ride you would’ve been on as a HODLer over the past decade.

Starting from $0

The Bitcoin story begins in October 2008, when its anonymous creator, using the pseudonym Satoshi Nakamoto, posts a message on a cryptography mailing list titled “Bitcoin P2P e-cash paper,” linking to the now-legendary white paper that started it all.

In January 2009, Satoshi introduces the first version of Bitcoin, describing it as “a new electronic cash system that uses a peer-to-peer network to prevent double-spending.”

History is made when Satoshi sends 10 Bitcoins to Hal Finney, a fellow developer and the first person to run the software besides Nakamoto. At the time, these 10 Bitcoins are worth nothing. Today, that’s a cool million dollars.

(Satoshi, if you’re reading this, your holdings of about a million bitcoins are now worth >$100 billion!)

March to $1,000: First test

In 2010, Bitcoin starts entering the real-world scene as exchanges begin to emerge. Bitcoin Market is among the first, introducing a floating exchange rate for the token.

This becomes a game-changer: buyers can now use PayPal to send dollars to a seller, while Bitcoin Market holds the seller’s Bitcoin in escrow until the payment clears. Bitcoin is no longer just a digital experiment — it’s now officially a tradable asset.

The following year, Bitcoin’s price reaches $1. It’s no longer just magic internet money dreamed up by a mysterious figure; it’s worth something.

From here, Bitcoin’s popularity begins to increase. Trading volumes have a breakthrough year in 2013, and the coin hits a full $1,000.

The $10Ks: Pain and reward

An era of cheap money, fueled by central banks slashing interest rates, helps push Bitcoin above $20K by 2020.

By the end of 2021, it has powered through $30K, $40K, $50K and $60K. This is the height of falling interest rates and a Covid-era boom in retail trading, where lots of free time and easy money (stimulus checks) push risk assets, including Bitcoin, up and up.

But it’s not all smooth sailing. In 2021, Bitcoin’s price tanks nearly 50% in less than four months before rebounding to hit $65K by year-end.

The most painful test

In 2022, the crypto world crumbles under the weight of TerraUSD’s implosion and FTX’s collapse, sending Bitcoin down 60% for the year.

Obituaries of Bitcoin are written. Trust vaporizes.

One man is at the center of it all. Sam Bankman-Fried is one of the largest donors to Democratic causes in the 2022 midterm election. America and the world are sitting up and taking notice of crypto and its star exchange.

But he is also the conductor behind FTX’s misuse of customer funds to the tune of nearly $10 billion. When a CoinDesk news report points to that hole, a bank run ensues.

Increasing customer withdrawals push FTX and its sister company Alameda into bankruptcy and leave the crypto world shook. Today, Bankman-Fried is serving a 25-year sentence.

All this chaos unfolds as a war in Europe sends investors rushing to safe havens. At the same time, rising interest rates worldwide make borrowing expensive, and leave less room for risky investments. Bitcoin crashes from $60K to around $15K. Brutal, right?

Bitcoin stages a strong recovery after the US regional banking crisis in early 2023, as shaken confidence in traditional banks pushes some $$$ back into crypto. Chatter about rate cuts fuel a rally in stocks and improved risk sentiment, with Bitcoin climbing alongside.

Trump and $100K

Fast forward to 2024, the SEC approves the first ETF tracking the spot price of Bitcoin, the Fed cuts interest rates for the first time in four years, and Donald Trump’s storming win in the US presidential elections adds extra fuel to Bitcoin’s momentum.

The token trades between $50K and $70K for most of the year but hits $80K and $90K in November on Trump’s promises of supporting digital assets. His pro-crypto pick of Paul Atkins to lead the SEC proves to be the cherry on top, finally propelling Bitcoin to a historic $100K.

See you again at $1 million?