Bitcoin’s party is over, for now. After riding Trump’s post-win high to $108K, the biggest crypto has stalled out at $95K, locked in a deep freeze as the year winds down.

Blame the Federal Reserve for pouring cold water on the fun with warnings that Trump’s policies might stoke inflation.

But don’t call it game over just yet, because Friday’s shaping up to be a make-or-break moment.

All eyes on Friday

Almost $20 billion notional across BTC and ETH options will expire this Friday, Singapore-based QCP Capital says.

Options allow holders the choice to buy or sell a pre-decided amount of an asset or stock at a specified price and date in the future.

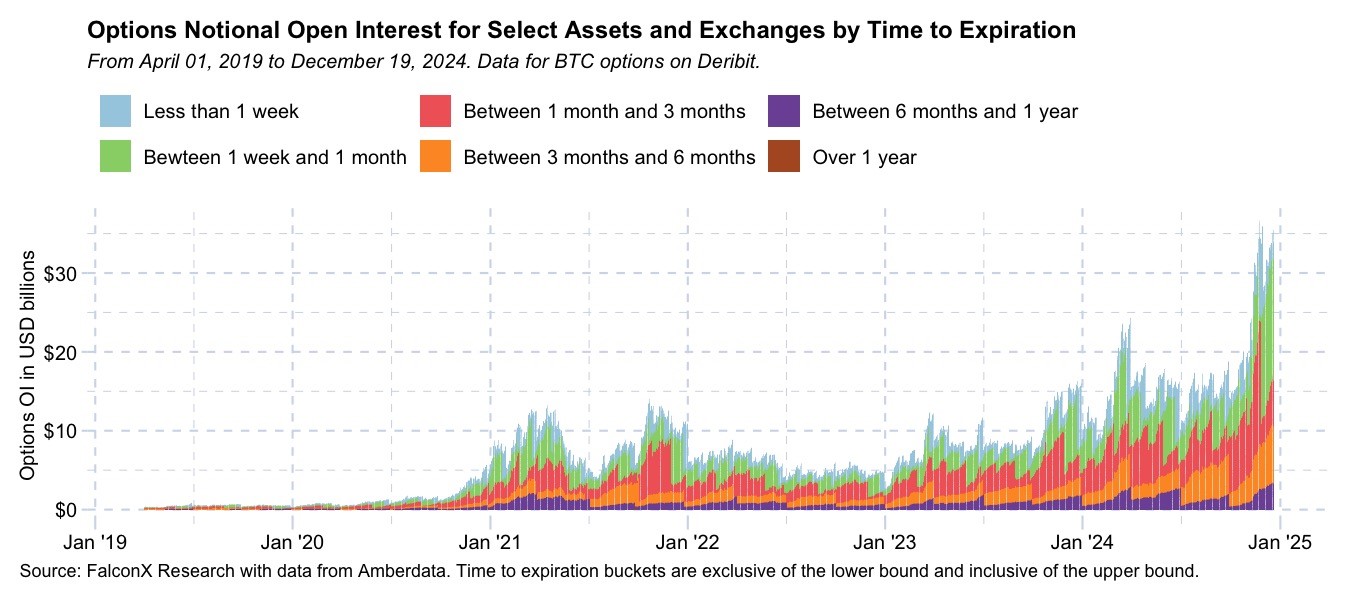

Crypto derivatives platform Deribit dominates that with almost half of the total open interest.

About $14 billion or 44% of the total $32 billion worth of BTC options open interest is set to expire on Friday, Deribit CEO Luuk Strijers tells MONIIFY.

This is a landmark moment for Deribit, wherein over $4 billion notional will expire in the money, likely driving significant trading volumes, Strijers says.

As he puts it, BTC’s once unstoppable rally has hit the brakes, and with the air thick with uncertainty, the fallout of BTC breaking in either direction could snowball fast.

Uncertainty spurring urgency

As traders brace for volatility, the crypto world is piling the pressure on Trump’s new dream team to issue pro-crypto executive orders on his first day in office itself, 20 January, Reuters reported.

Expect at least one, the report said.

As for Bitcoin bulls, they remain optimistic, even if some caution appears to be creeping in. Crypto prime broker FalconX’s David Lawant predicts a bullish start to the first quarter of next year, despite the sentiment turning cautious.

Among institutions, Tokyo-listed Metaplanet increased its Bitcoin holdings to $133 million with a BTC purchase worth $61 million.

Forever bullish MicroStrategy also took its BTC holdings to $42.2 billion, buying an additional $561 million worth of the OG crypto. But this was the least Bitcoin the bull has bought in several weeks.

Michael Saylor, MicroStrategy’s executive chairman, isn’t just hoarding though.

He is actively lobbying, releasing a crypto framework that he says can strengthen the US dollar, “neutralize national debt,” and cement the US as a digital superpower.

For now, though, all eyes are on the weekend. Will BTC thaw out or spiral deeper into the cold? Stay tuned.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com