Want a piece of the action offered by Indonesia with its population of 280 million?

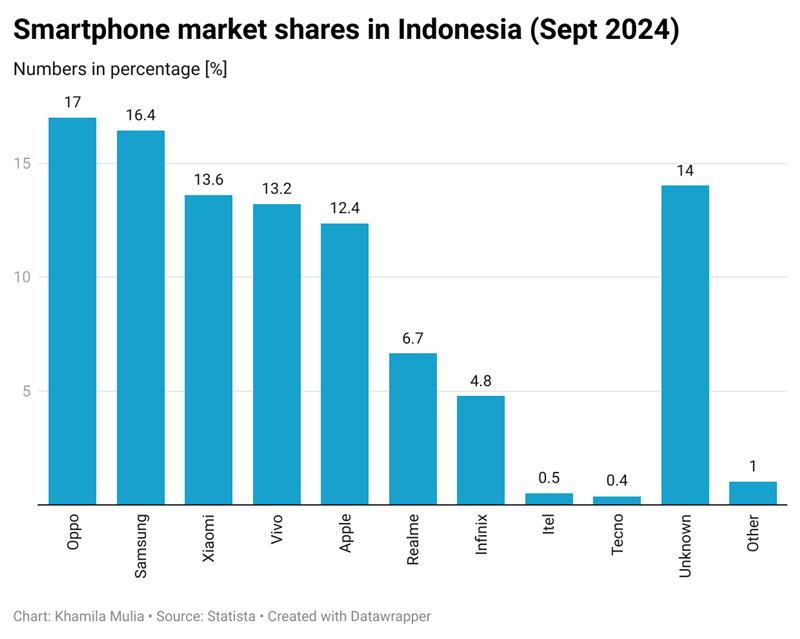

Well, you may want to be more like Chinese smartphone maker Oppo (and less like Apple and Google.)

Oppo’s doubling down on sourcing from local suppliers at its Indonesian factory, earning brownie points at a time when even a $100 million check can’t get Apple a foot in the door.

Apple’s iPhone 16 got slapped with a sales ban in November after it failed to meet Jakarta’s requirement for smartphone makers to manufacture 35% of their components locally. Google’s Pixel phones suffered the same fate a week later.

Apple came back last week with an offer to invest $100 million in a new accessories and components plant to unblock the ban. Only to be turned down on Monday by the Indonesian government.

The justification? It’s just not good enough when Apple’s already spending more in Vietnam and Thailand, which taken together are still a smaller market than Indonesia. Apple also has an investment commitment of $10 million outstanding that should have been spent before 2023. That didn’t help their case, Indonesia’s Industry Minister Agus Gumiwang Kartasasmita said at a press conference.

Jakarta’s flex is part of a broader move to localize or “onshore” production that typically happens in China.

But while Apple and Google are locked out of one of Asia’s biggest markets, the Chinese companies are going with the flow and hoovering up the business. Chinese Android brands like Oppo, Xiaomi and Vivo as well as South Korea’s Samsung are making it work by using more local components to offer affordable entry-level phones that appeal to the country’s young, tech-savvy population.

Read more: Fraud and Failure: Indonesia’s P2P sector takes another hit

Go local or go home

While Apple doesn’t disclose its iPhone sales by country, Agus says it sold around 2.5 million units in the country in 2023 – the most in Southeast Asia – for $1.9 billion in sales.

Smartphones are Apple’s primary source for revenue -> any decline in iPhone sales would have a direct impact on its total revenue….

Something to think about for investors in Big Tech.

Indonesia’s playbook isn’t entirely new. Other countries in Asia are also trying to boost domestic manufacturing, particularly in the electronics sector, though maybe not in such a heavy-handed fashion.

Apple’s suppliers in India like Foxconn and Wistron have taken advantage of government subsidies such as the Production Linked Incentive Scheme to expand production. And Vietnam has dangled tax incentives and attractive land-use policies to entice investments in domestic manufacturing.

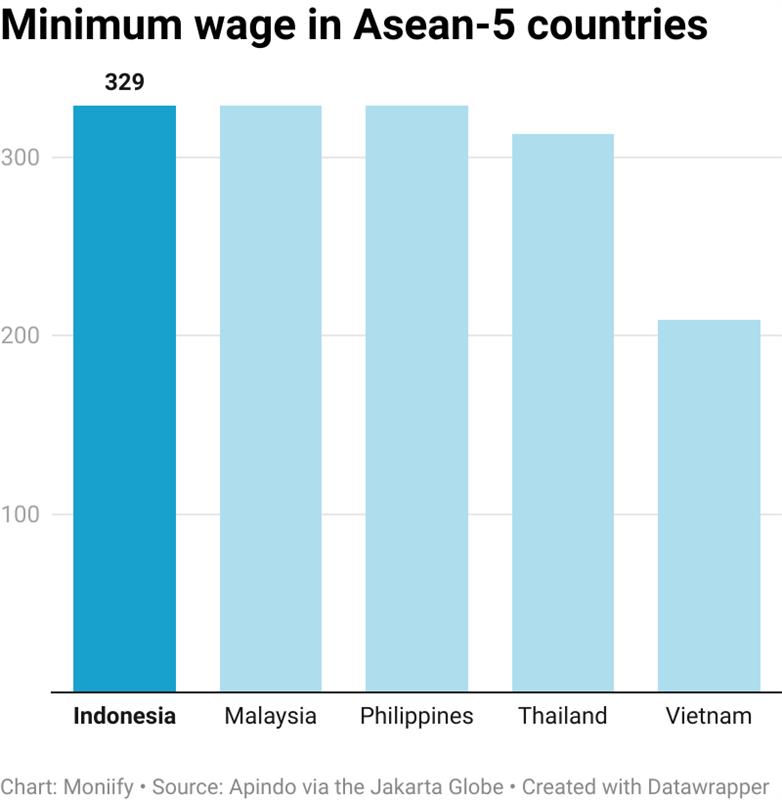

Indonesia also has a few initiatives to encourage domestic production, including fiscal incentives and special economic zones… but labor costs are higher.

Success here requires adapting to each market’s unique challenges, as proven by Chinese brands thriving through localization, says Le Xuan Chiew, an analyst at Canalys.

Show me the numbers

Oppo entered Indonesia in 2013 and established a manufacturing facility as far back as 2015. At its Tangerang factory just outside Jakarta, it’s rocking a 37% local component rate, with parts like batteries, packaging and USB cables being sourced from homegrown suppliers.

Oppo also dominates Southeast Asia, with 5.1 million units shipped and a 21% market share as of the third quarter of 2024, according to market research firm Canalys.

Other smartphone makers like Samsung, Transsion (which owns brands such as Itel, Tecno and Infinix) and Xiaomi have production lines or partnerships with local manufacturers.

Read more: Business owners keep getting sucker punched in Indonesia

So what’s the play?

Indonesia wants to see Big Tech help build “strong local supplier ecosystems” to boost its electronics industry, Jeffrey Bahar, COO of Yamada Consulting & Spire, told MONIIFY, citing the automotive sector as an example.

This trend, he said, means potential growth in sectors like tech manufacturing, local suppliers and the infrastructure that supports them.

Nasdaq-listed Flex, one of the biggest companies involved in the assembly and production for major smartphone brands, has a domestic presence in Indonesia. Its shares are up 79.6% for the year to date.

Fabrinet, which has an Indonesian facility involved in the manufacture of smartphone-related components, is up 24.5% in the same period on the NYSE.