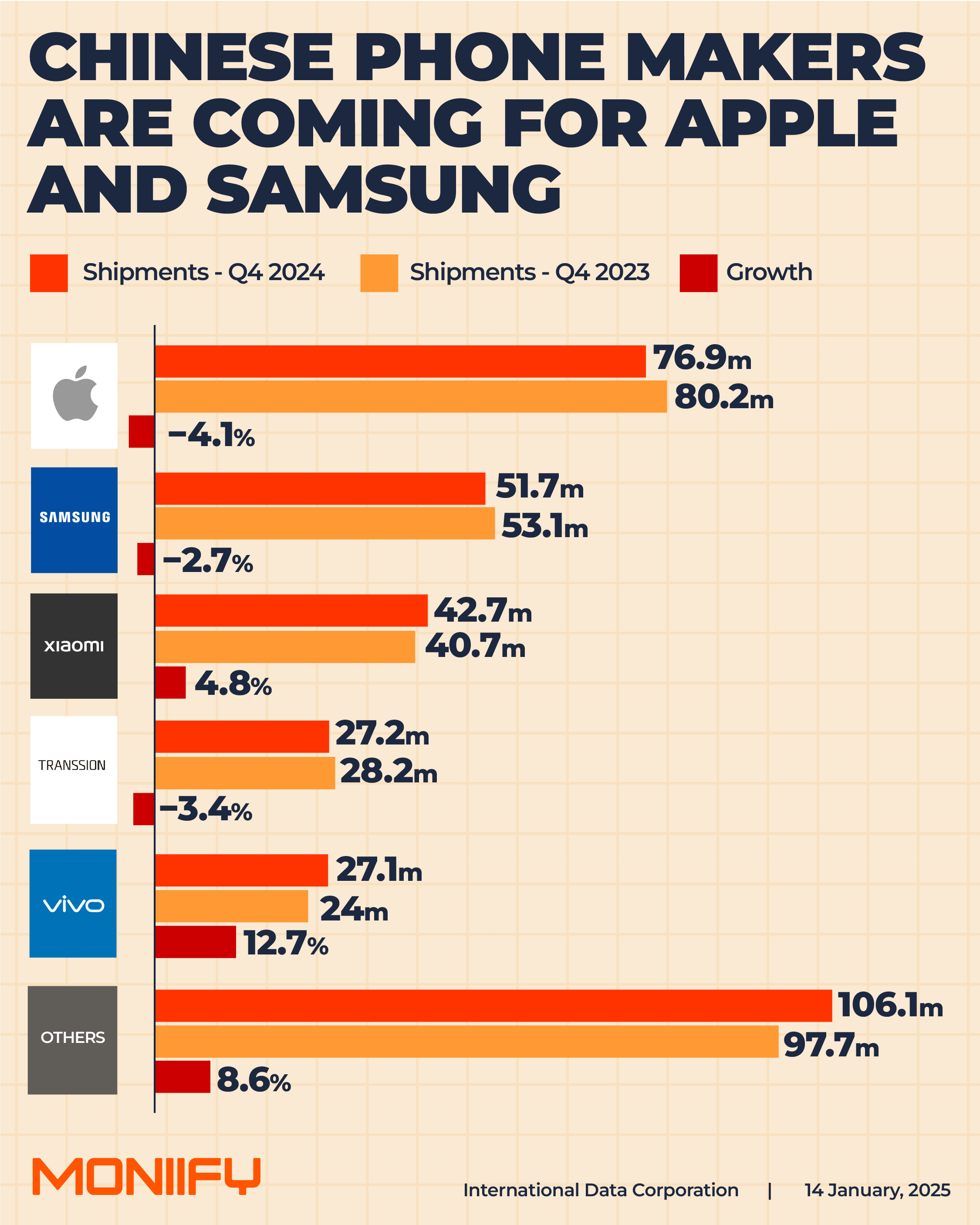

Chinese smartphone makers are giving Apple and Samsung a run for their money, gaining market share at a time when the two OGs are ceding ground.

After two years of declines, global smartphone shipments increased by 6.4% in 2024 to hit 1.1 billion units, according to a report by the International Data Corporation.

But it’s the Chinese brands, with their focus on cheap-but-decent gadgets, that’re helping lift the market.

Cheapo names, think Vivo and Xiaomi, are doing so well they’re now moving beyond their core markets in China and Asia and setting their sights on Europe and Africa, says Francisco Jeronimo, a senior executive at IDC.

Read more: China’s Oppo is teaching Apple and Google a lesson about Indonesia

Narrowing the gap

While Apple and Samsung remained in pole positions – at 1st and 2nd place respectively – Apple’s market share slid 0.9% in 2024. Samsung’s shrank 1.4%.

Xiaomi, which has been on a tear (it even made a successful debut in the EV space last year), grew 15% to maintain its podium position at 3rd place.

Is the tide turning?

Apple is already on the defensive in China, the largest smartphone market in the world. At the start of the year, the Cupertino, California-based tech giant dangled rare discounts on its latest iPhone models in China after rival Huawei cut the prices of its high-end devices.

Apart from Huawei, most Chinese brands are all about giving users the most bang for the buck. Take the flagship phones of Apple, Samsung and Xiaomi. Despite a cheaper price tag, Xiaomi’s phone has a bigger battery capacity, a higher resolution front camera, and bigger RAM. Hard to argue with when inflation’s still a worry.

The last quarter of 2024 was particularly remarkable for Chinese smartphones, IDC’s Jeronimo says.

“They achieved a historic milestone as they shipped the highest combined volume ever in a quarter, representing 56% of the global smartphone shipments,” he says.

The next big thing for smartphone makers? No surprises there – it’s AI, says Anthony Scarsella, IDC’s research director for Client Devices.

Read more: Indonesia’s cool with Apple’s $1 billion investment (sort of)

So how do you MONIIFY this?

Apple stock hasn’t had the best run since the iPhone 16 dropped in early September. It’s a new phone, sure, but one that looks kinda like the 15, 14, 13, 12 AND 11. With demand looking soft, and nothing groundbreaking coming out from Apple’s R&D –– this dwindling smartphone market share is just not helpful.

Especially when the stock’s trading on par with the likes of AI powerhouse Nvidia. Priced at 31 times earnings, it’s pricey too. Rival Samsung isn’t doing any better, its shares fell 27% in the last year.

Does this mean it’s time to jump on Chinese phone manufacturers? Maybe just for now. Or literally for the next six days?

When Donald Trump takes office on Monday and comes after all-things China, especially cheap stuff, it could turn ugly. Some of the big Chinese manufacturers, like Huawei, are private. And Xiaomi shares have already had a BIG run in the last year, with gains of 138%.

Maybe not a great time to buy smartphone stocks all round.

Edited by Victor Loh and Thyagaraju Adinarayan. If you have any tips, ideas or feedback, please get in touch at: talk-to-us@moniify.com