Tech layoffs may have slowed in Southeast Asia this year, but there’s no reason to cheer for job seekers just yet.

At least 25 VC-backed tech startups in Southeast Asia laid off staff this year, affecting around 2,000 employees in the region, according to trackers like Layoffs.fyi and Tech in Asia. However, the true figure is likely to be higher as many companies did not fully disclose the impact.

While this is down from 2023 – when nearly 40 tech firms laid off over 3,500 workers – tech wages in the region have stayed depressed in 2024, Ethan Ang, CEO of recruitment marketplace Nodeflair told MONIIFY.

“We’re unsure how long this salary decline will last, but we’re seeing more candidates are open to negotiating lower pay,” Ang said.

Why should I care?

While wages picked up slightly in 2024, the pace remains slow, according to data from NodeFlair.

If you’re a business owner, this could be a golden opportunity to hire experienced talent at a fraction of the cost – when wages are still depressed – to level the playing field against the big players. This is especially important when founders are under fire to hit profit targets and rein in costs.

“Big tech companies are no longer overhiring and their salaries are not as inflated as before,” said Nucky Widjaya, CEO of fintech startup EasyCash.

And the balance of power has shifted. Employers now have a greater say in setting job and performance expectations, says Christian Suwarna, co-founder of health tech startup Diri Care.

Re-skill to make a killing

For job seekers, and even undergraduates, it means understanding the skillsets that are in demand.

For example, while there is a general decline in tech salaries, wages for AI and data science-related roles have actually bucked the trend, registering a 10% increase year-over-year, says Nodeflair.

Crypto companies are still hiring aggressively and willing to pay top dollar for talent, while big multinationals are pivoting to incorporate AI into their R&D and operations, Ang noted.

More employers are also looking for deeper expertise – so that skills boot camp won’t fly anymore. Instead, invest in a four-year degree which could help you stand out in the competitive job market.

Show me the numbers

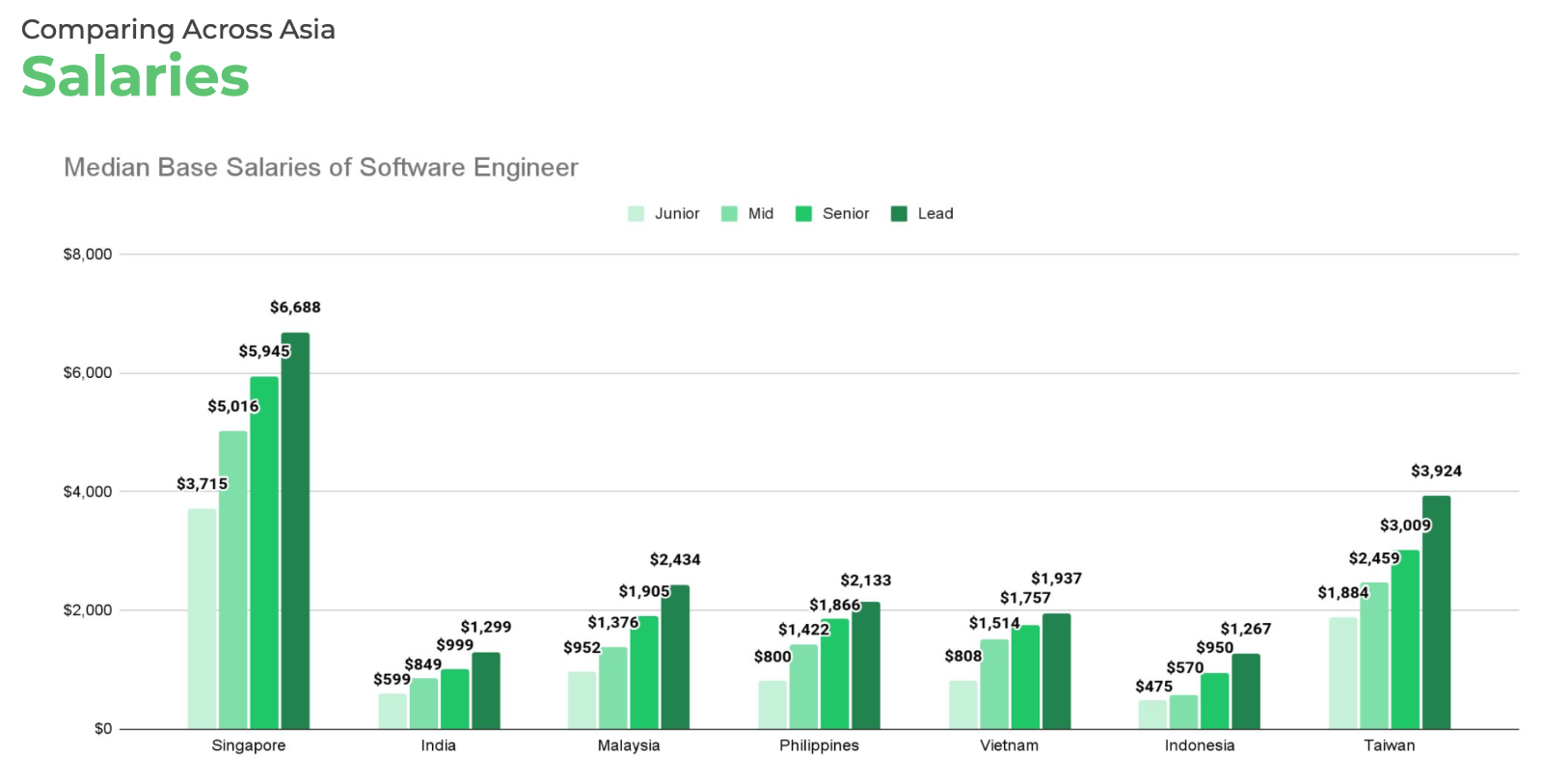

In Indonesia, for instance, the average monthly salary for a mid-level software engineer pay has dropped 22% year-over-year to 9 million rupiah ($570). It’s now the lowest among Southeast Asia’s big five—Singapore, Indonesia, Malaysia, the Philippines, and Vietnam.

And there’s no shortage of tech workers in the job market. From 2022 to July 2024, more than 13,000 tech jobs in Southeast Asia have been axed, according to Tech in Asia’s layoff tracker.

This unforgiving new landscape has even boiled over into the rare sight of street protests by disgruntled tech workers in recent months.

In Jakarta last week, laid off employees of Softbank-banked startup Alodokter staged a protest, claiming their severance pay fell below the legal entitlement. Alodokter’s co-founder Suci Arumsari claimed otherwise in a statement to MONIIFY, and added that the startup was open to further discussions with the affected employees.

The protest was backed by the Indonesian labor union FSPMI. Kardinal, a union official, said earlier attempts to negotiate with the Indonesian health tech startup, which raised $5.2 million in February 2024, had failed to yield results.

And the chill of the tech winter is still lingering widely across tropical Southeast Asia:

- In Vietnam, disgruntled employees of a software subsidiary owned by logistics technology company Ninja Van staged a protest in September over salary delays, which was eventually settled.

- Indonesian construction tech startup Gravel liquidated its entire team in November.

- Web3 gaming unicorn Sky Mavis slashed 21% of its workforce late last month.

- And the big boys are feeling the pressure too — ByteDance axed 500 jobs in Malaysia in October, while Lazada chopped 30% of its regional staff at the start of the year.

So what happens next?

From a funding perspective, there’s no clear sign that the storm has passed yet. Southeast Asia’s tech scene has only bagged $2.3 billion in funding in the first nine months of 2024, marking a 59% decline from the same period last year, according to data intelligence platform Tracxn.

However, Donald Trump’s ascent to the White House in 2025 has given cause for optimism in deal making.

Will less regulation + lower corporate taxes + less regulation = more $$$ sloshing around globally? Two surveys of US executives released after the US presidential election show renewed confidence in the economic and hiring outlook in 2025, which could buoy investment confidence in the region.

For Southeast Asia’s tech workforce, any change in the weather can’t come soon enough.