Water is the planet’s lifeblood and we are bleeding it dry.

With demand surging and shortages intensifying under the strain of climate change, managing water is one of humanity’s most urgent challenges. It’s also driving investment in solutions aimed at addressing this global crisis.

Here’s the deal: The UN says global water use has climbed by about 1% every year for the last 40 years, and it’s not slowing down anytime soon. And only 0.5% of the Earth’s water is usable for humans. The rest is salty, frozen, or impossible to access, meaning freshwater demand is off the charts.

It’s a crisis rooted in surging populations and rising living standards, driving a relentless need for investments into solutions such as desalination and purification, recycling and reuse, and storage and management, among others.

So, can you invest?

Sort of. You can’t just buy water, but funds focusing on the above themes are out there.

Christian Zilien from Allianz Global Investors tells MONIIFY that the key is finding funds that treat water as a core investment. Pick funds that “contain companies with a focus on the water supply chain in their investment strategy,” he adds. But these funds can be too narrow in focus, so it’s best to consider them as part of a more diverse portfolio.

Look at mid-cap listed companies — those midsized firms with big growth potential — working on next-gen tech for water filtration and recycling, says Felix Odey at Schroders.

Odey adds that these mid-caps often bring better margins and innovation in areas like purification and conservation compared to big, established players.

Plus, there is a higher chance of them being undervalued compared to the big names, so there’s room for upside, says Zilien.

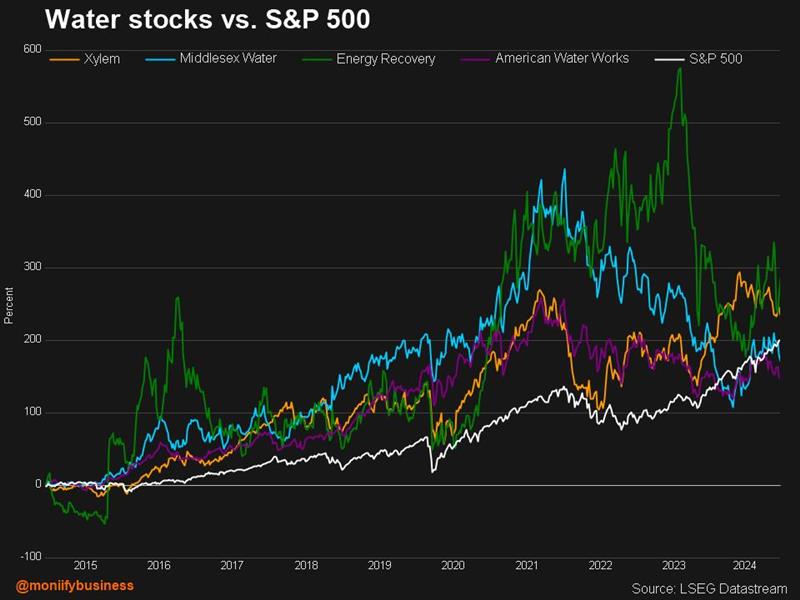

Some water stocks such as Xylem, Middlesex Water Company, Energy Recovery, and American Water Works have outperformed the S&P500 over the long-term.

If stock-picking isn’t your thing, water-focused ETFs offer a less risky way to dip a toe in the sector. They typically track the big names, though they might miss out on the explosive growth of those smaller, scrappier companies, according to Odey from Schroders.

Some of the water ETFs that have outperformed MSCI Water Utilities Index in the past two years include Invesco Water Resources ETF (PHO), First Trust Water ETF (FIW), and Invesco S&P Global Water Index ETF (CGW).

The bigger picture

Look, water is a slow-burn investment. Private companies might not see huge returns overnight, according to Dieter Küffer from Robeco Water Strategy.

The sector may be ahead of the curve in profitability compared to other sustainable investments, but it still requires patience. Think long haul, not short term.

Tighter regulations around water quality will keep the pressure on for clean water solutions, according to Allianz Global’s Zillien. And factors like urbanization, pollution, and aging infrastructure will keep demand strong.

Bottom line: water investments aren’t a get-rich-quick scheme. They’re about addressing a pressing challenge for humanity and so both one of the smartest and most impactful long-term plays around.