Southeast Asia is sweating — and so is its wallet.

A region with a GDP bigger than the UK’s and a climate crisis to match needs $422 billion by 2030 to hit its green goals. But the money isn’t showing up.

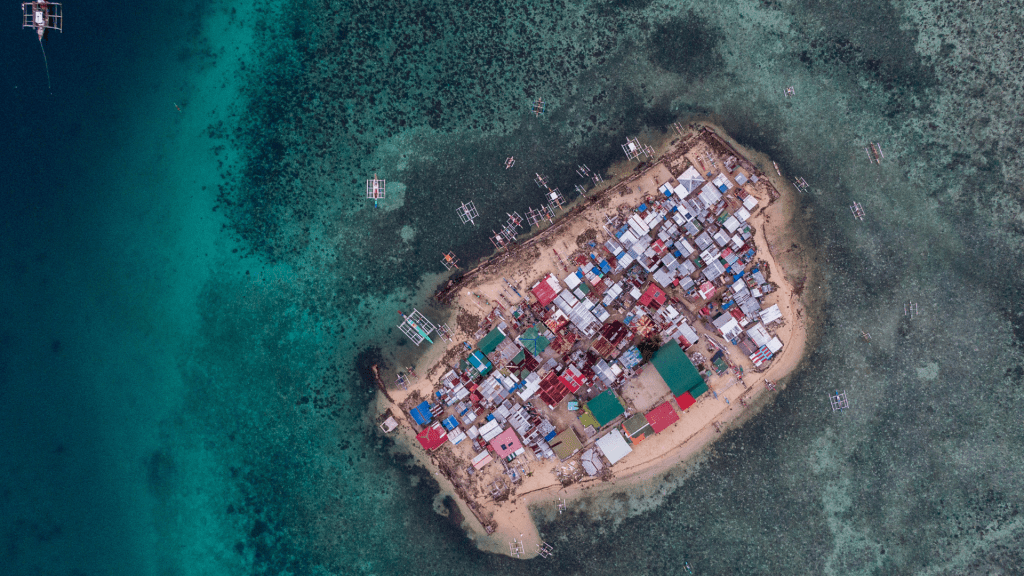

Despite being one of the most climate-vulnerable areas on Earth, private investors aren’t exactly sprinting to fund solar farms or water projects, while fossil-fuel projects are still very lucrative.

Enter blended finance — a buzzword for cobbling together public, private, and philanthropy money to bankroll climate projects that aren’t instant cash cows.

Beyond the buzzword

Sectors that benefit from this approach include energy, agriculture and water, Yin Shao Loong, a climate finance expert with Malaysia’s Khazanah Research Institute, tells MONIIFY.

Take Singapore’s Fast-P initiative, which wants to turn $1 billion of public funding into a $5 billion war chest by luring private investors to tap opportunities in renewable energy projects like storage, EV infrastructure, and water and waste management.

The city-state has committed up to $500 million for climate projects by matching every dollar from other partners. Australia chipped in $50 million this month, and big names like BlackRock, HSBC, and Temasek are circling.

Southeast Asia’s first blended finance fund, SEACEF II, also raised $127 million this year from organizations such as the IFC and Norway’s Norfund, and backed projects like Hijau, an Indonesian solar developer, and Mober, a Philippine logistics firm ditching gas guzzlers for EVs.

Read more: Tap in: Why water is the smart long game

The green play

The pitch to climate entrepreneurs? Cheap loans, longer repayment periods, and a credibility boost from having multilateral and sovereign heavyweights in your corner. But accessing that cash means aligning with specific sectors and outcomes.

Besides Fast-P and SEACEF II, other avenues include the Green Climate Fund, Adaptation Fund, multilateral organizations like the Asian Development Bank, and philanthropic foundations like the Bill & Melinda Gates Foundation and the IKEA Foundation, etc.

But budding green entrepreneurs must also understand that climate projects are largely divided into two outcomes and have different funding sources. Here’s how the climate cash game breaks down:

- Mitigation projects like solar, wind, EVs that offer predictable revenue streams and are investor magnets.

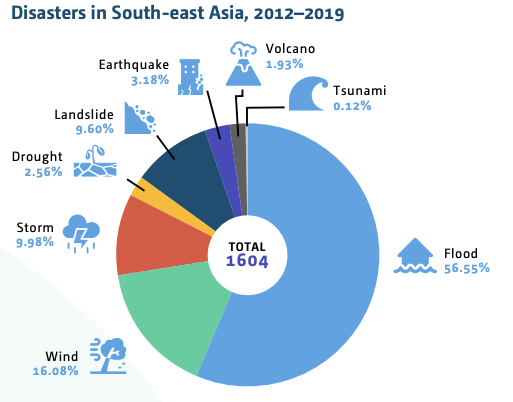

- Adaptation projects like flood defenses, drought-proof crops, which are good for PR but bad for profits. These rely on grants and concessional loans.

Of the $422 billion Southeast Asia needs, 69% is earmarked for mitigation. Adaptation projects? They’re often left picking the scraps.

Many adaptation projects are non-revenue generating, requiring concessional or grant financing, which is in short supply, Khazanah’s Shao Loong says.

Read more: Is investing in Southeast Asia’s durians a thorny play?

The bigger picture

The question isn’t whether the region will pay for climate change — it’s how. The UNFCC estimates that if Asian institutional investors were to reallocate just 5% of their investment to climate projects, that would lead to an additional flow of $8 billion to $10 billion a year.

But blended finance isn’t the cure-all that will solve this climate financing gap. Experts like Sharon Seah from the ISEAS-Yusof Ishak Institute point out that it can jack up sovereign debt, making some governments question if it’s worth the trouble.

Still, Seah suggests that Asian governments could supercharge initiatives like Fast-P instead of spinning up new ideas. Sometimes, scaling what already works beats trying to reinvent the wheel.

Southeast Asia is caught between a climate crisis and a funding drought. But with solar returns hitting 9%, as Khazana’s Shao Loong says, and EV projects gaining traction, there’s opportunity hiding in the chaos.

Edited by Ankush Chibber and Victor Loh. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com