The recent controversy at Temasek-backed Singapore Post, aka SingPost, made headlines for all the wrong reasons for the postal service provider.

And what’s worse? It isn’t the company’s first rodeo. The scandal is its THIRD major drama in the past twenty years — a history of troubles that’s taken a toll on the Singapore exchange-listed company, according to Mak Yuen Teen, a professor of accounting at the National University of Singapore’s Business School.

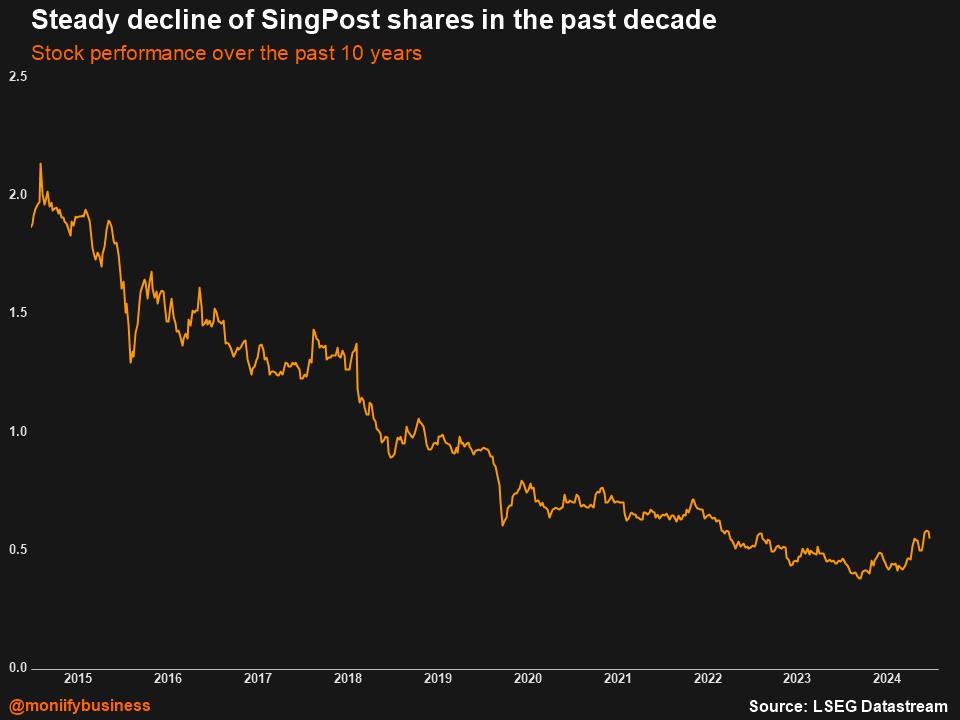

The company’s share prices were now a quarter of what they were only 10 years ago, said Mak.

In the latest controversy, SingPost, one of three licensed postal service operators in the country, fired its Group CEO Vincent Phang, Group CFO Vincent Yik and CEO of the company’s international business unit, Li Yu, on Saturday after they allegedly mismanaged a whistleblower investigation.

Phang and Yik said they intend to “vigorously contest” their termination.

When asked about any potential appeal by the sacked executives, SingPost told MONIIFY that it is confident of its legal position and declined to provide any further comment “in light of possible litigation.”

Clarion call

Mak said that stricter governance could have enabled SingPost to deal with its business challenges better. He said the case served as a clarion call for entrepreneurs to focus on governance, as well as profitability — not as a “nice-to-have,” but an essential.

“Governance, if properly understood, is also an enabler of long-term business success,” he said.

Read more: Singapore’s got deep pockets for deep tech

Good corporate governance is also an indicator for investors to safeguard their investments — while promoting ethical business practices and contributing to the overall health and success of a company.

Before the SingPost debacle, there were plenty of other troubling examples of poor corporate governance in the region.

In Indonesia — the largest economy in the region — the country’s national airline, Garuda, was slapped with fines after irregularities were found in its 2018 annual report.

The icing on the cake? Its former CEO Ari Askhara was fired after he was caught smuggling a Harley Davidson on a brand new Airbus. Its $5 million profit on paper that year was later updated to show a $175 million net loss.

Earlier this month, aquaculture unicorn eFishery, which is backed by Temasek, Softbank and Peak XV, suspended its co-founders Gibran Huzaifah and Chrisna Aditya after financial irregularities were uncovered.

Nathaniel Mangunsong, managing partner at Jakarta-based Adrem Law Firm, says that “the bigger the company, the more blind spots faced by management and founders.”

“They need tools to enhance the company’s visibility through standard operating procedures, policies, or software that could help,” he added.

Read more: This Indonesian startup raised $14 million a year ago. It’s now in trouble: MONIIFY Scoop

The right DNA

Mak said that while running a startup isn’t the same as a big company, “there are common principles and entrepreneurs should start by ensuring the right DNA.”

For example, a company’s management should not be involved in any investigation conducted in-house, be it a report by a whistleblower or an official complaint. Instead, an independent board should be convened to ensure that the investigations are impartial.

SingPost’s filing to SGX on Sunday had no mention if the executive powers of its management were curtailed during investigations into the whistleblower report — which in turn prompted Singapore’s Securities Investors Association to press for more answers.

The company has had no shortage of tough lessons in its recent history — whether it’s learning from them remains to be seen.

Edited by Victor Loh and Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com