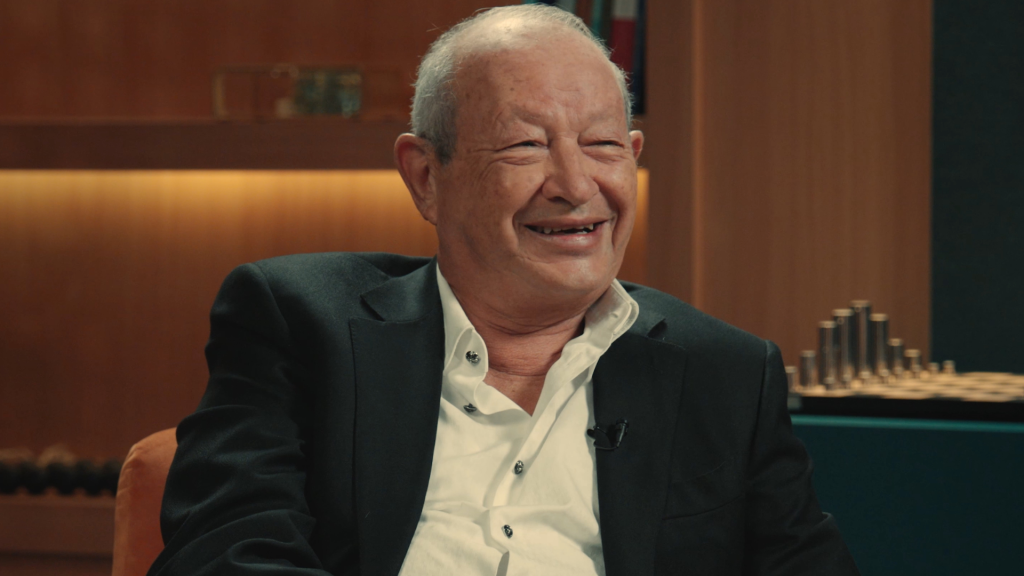

Naguib Sawiris cuts a more colorful figure than you might expect from a 70-year-old billionaire. He likes to DJ in his spare time, likens himself to a race car or a rocket ship, and jokes that he stopped growing up at 30.

“I take my freedom to the maximum,” he says. “I’m more heart than mind. That’s not good in business, I think.”

It’s a change of heart that’s led the Egyptian mogul to his latest big venture. When he sold his majority stake in the broadcaster Euronews in 2021, he swore he was done with the news business for good.

“I said, ‘That’s it with media,’ because it was losing a lot of money every year,” he says. “It’s a very difficult business.”

Turns out, that wasn’t it. Today sees the launch of MONIIFY(👋🏽), a global business news outlet targeting millennial and Gen Z audiences in emerging economies. It’s a major investment in a fickle industry, which he’s experienced first-hand as a money pit. So, what’s Sawiris thinking?

Simply put, he says, he saw a demand from an aspirational new generation of tech-savvy young people across Asia, the Middle East and Africa. They’re hungry for useful information on markets, business and wealth creation, delivered on their own terms. And Sawiris wants to give it to them.

“I get asked by many young people all the time… How do we make it?” he tells Money Moves host Muhammed Mekki, during an hour-long sit-down interview in Dubai. He saw a gap in how traditional business media was reaching this audience: “I don’t think they’re talking to the millennials.”

I thought it was nice to give back, to provide this platform and, maybe by a stroke of luck, we can still make some money.

And if it doesn’t make a buck, he suggests chalking it up as an act of philanthropy. “This way I’m protected from failure,” he laughs.

Failure’s not something you’d readily associate with Sawiris. The eldest of three sons, he was born into a wealthy family that built a fortune in construction. Sawiris joined the family business in 1979, driving investments into railways, information technology, and a hugely profitable push into telecom, launching Egypt’s first mobile phone network before expanding into 28 countries.

Today, he’s Egypt’s second-richest person–eclipsed only by his youngest brother, Nassef–with a net worth of $3.8 billion, according to Forbes. He’s known for his risk appetite, going where few others want to go.

Here are three takeaways from the conversation:

- Go where the others aren’t. Sawiris is known for operating in difficult frontier markets like Algeria, Iraq and Yemen. While these ventures came with undeniable challenges and didn’t always work out, they could also present undeniable opportunities.

- Have an edge. Be an expert in an area where few others are. A caveat: being smart is nothing if it’s not backed up with a fierce work ethic.

- Never make a decision in anger. Bit of a touchy subject. Forgetting that rule once cost Sawiris €450 million. (Ouch.)

- Muhammed Mekki: So, you’re back in the media game with MONIIFY. Where do you see it fitting in the media landscape?

Naguib Sawiris: We looked at Bloomberg, at CNBC, and what do you see there? The budget is in billions. And they have… everything covered. But I call them traditional media still. I don’t think they’re talking to the young generation coming up.

We came up with MONIIFY, focused on the upcoming youth that wants to make money and talk about all the elements of success. MONIIFY is going to focus on emerging markets. Emerging markets don’t [get the attention] that they deserve, because everybody thinks they’re risky.

But, you know, there’s so much money to be made in emerging markets. It’s also our roots, where we come from.

- You graduated in Switzerland, but returned to Egypt, when you could have gone anywhere else really. What’s your career advice for young people from emerging economies who might be studying in Europe or the US?

Study in the west, get the best out of there, but come back home and make a difference. There is a positive bonus if you come back; you will have less competition.

When you are in the States, how many people graduate from MIT or Harvard? You are into a very tough [market]. But how many of these people are in Egypt or India? You have more odds to be successful.

- Tell us about the time you lost €450 million, more or less overnight.

I had this telecom company that was working in all of the Middle East and North Africa and had an Italian operation. In Greece too.

In the telecom world, there was one company … Vivendi. I looked at Vivendi’s telecom arm, and they were present in Morocco and in France. I found that, OK, if I do a merger with this company, we will have France, Italy and Greece, all the Mediterranean. And I would add Morocco to my North Africa. It’s a perfect match from a geographical point of view, also from a cultural point of view, which is important.

I go to Vivendi, I meet the chairman, he loves the idea. And he refers me to the CEO. The CEO, of course, will lose his job, because I was probably the new CEO if the merger took place.

So, he was very tense, very defensive. He made a comment, which was aggravating to me. He said: no merger. But we can give you 10% of the combined entity and the rest in cash.

- How did you respond?

I told him I didn’t come here to sell my company. And if I want 10% of your company, there’s nothing you can do to prevent me. Tomorrow morning I’ll own 10%.

It was a very bad meeting, and the guy, he was thinking [about] the job he’s going to lose.

I go out and say, “OK, I’m going to teach this guy a lesson.” I bought the 10% in anger. I took a margin loan to buy the 10%.

And then the crash happened. Margin loan of €450 [million], bye-bye. It teaches you: keep your ego in the cupboard when you’re taking decisions. Don’t take a decision when you’re angry.

- You’re known for taking a hardline stance against corruption, despite it being widespread in some of the markets you’ve operated in. How important is reputation in business?

It’s the A to Z, you know. I mean, if you don’t have a [good] reputation, who’s going to work with you?

I think you have to choose in life between going to bed at night and sleeping comfortably and feeling good about yourself, or yielding to extortion or blackmail or corruption. In the end, what you want to leave is a clean legacy.

- Tell us about your first deal.

My first deals started even when I was ten, 11, 12. I was playing marbles… and I was very good at it. I was always winning, and I was selling these marbles to other kids. This was my first business.

When I was 16, I wanted to be one of the richest people in the world. And it was not about the money. You know, I am a Christian coming from a minority in Egypt, the Coptic minority.

And wanting to make a difference in the world would have been difficult, because the [Egyptian system] doesn’t really allow Christians to climb into the political scene.

I thought that money is power. So, I’m going to make a lot of money. And one of my dreams, actually, when I was still in school, was to have a private army go to the Berlin Wall and break it down and free all the East Germans.

For me, money was not a tool to buy a nice car or a nice house, but it was like I could do a lot of good with it, you know?

- Let’s imagine you’re established in your first job and you’ve pulled together your first $10,000 of investable money. How do you spend it?

Artificial intelligence. Maybe it’s three years, two years late, but it’s never [too] late. What people don’t understand is that we have not yet seen the maximum of artificial intelligence.

It’s like a snowball, that’s going to get bigger and bigger. Because we haven’t come to the utmost application of artificial intelligence. It’s a sure bet.