Forget the skyscrapers and shopping malls — Dubai is now a clubhouse for the rich and powerful, and Africa’s elite want in.

The latest member? Nigerian Aliko Dangote, Africa’s wealthiest man, who just set up a family office in the city.

Worth $13 billion, Dangote isn’t just stashing cash — he’s plotting business expansion and linking up with players beyond his usual industrial empire along with daughter Halima. Not business, but business 2.0.

The Dangote family, which declined to comment on its move, is part of a growing club of wealthy African families, such as those behind conglomerates like Group SNS, who are saying goodbye to Africa for Dubai.

Economic challenges and currency instability in Africa are driving a significant migration of wealth to more stable regions, with Dubai standing out as a preferred landing spot.

Rajesh Mahadevan of Deutsche Bank tells MONIIFY that many of the bank’s African clients are now setting up family offices in the city. And he expects this migration trend to persist well into the future.

The wealth drain

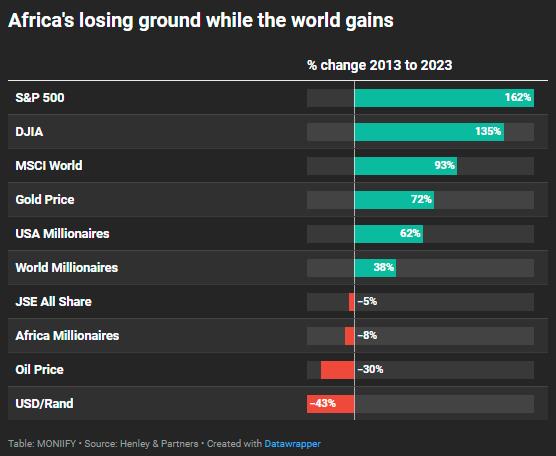

Big money is packing its bags, and Africa’s left holding the receipts. Henley & Partners’ 2024 Africa Wealth Report says currencies in countries like Nigeria and Egypt have plunged by a whopping 75% over the past decade. And guess what? So has the number of millionaires.

Since 2013, 18,700 millionaires have bounced. Of Africa’s 54 billionaires (yes, Elon Musk is one), only 21 are still calling it home. The rest? They’ve found new zip codes — Dubai being the ultimate hotspot.

Blame the currency chaos. Nigeria, Ghana and Zimbabwe have been hit hard by wild exchange rates this year, wiping out the value of wealth held in local currencies.

Take South Africa: The JSE All Share Index jumped 65% in local currency terms over the past decade, but in dollar terms? It’s down 5%.

Why? The rand plummeted from 10.50 a dollar in 2013 to 18.30 a dollar in 2023 — a 43% freefall. Nigeria, Egypt and Angola have fared even worse, losing more than 75% of their currency value against the greenback.

Nigeria-based family office advisor Abiola Adediran keeps it real: “If your wealth is tied to volatile currencies, you’re risking it all. So, families are moving their money, and themselves, somewhere more stable.”

Add sky-high taxes, and it’s no wonder family offices are looking for better deals abroad.

Why Dubai’s the go-to

For the ultra-rich of Africa, Dubai is a strategic haven where money meets opportunity. Forget the cliches about gold-plated Lambos — the city offers something far more valuable: practicality.

Start with golden visas. Dubai hands out long-term residency to those who can bring the cash or the credentials. Plus, no personal income tax. It’s a deal few countries can match.

Then there’s the location. Smack bang in the middle of Africa, Europe and Asia, Dubai isn’t just a hub — it’s the hub.

Whether you’re shipping goods, striking deals or just need to hop between continents, this city puts you at the heart of it all. Plus, it’s next to Abu Dhabi, which is upping its finance game on the back of sovereign heft.

Safety? Check. Convenience? Double-check.

And while it may look like it’s dripping in luxury, it’s not just about the glamour. The city is engineered to attract wealth, with several financial institutions and wealth managers offering options to ensure fortunes don’t just stay — they grow.

These are essential elements for ultra-wealthy families navigating complex needs, Amer Malik from Lombard Odier tells MONIIFY.

What’s at stake?

The exodus from Africa isn’t just continuing, it’s gaining momentum.

Experts foresee even more African millionaires packing their bags for Dubai in 2025, lured by the soaring real estate market and tax-free, investment-friendly environment that the city offers. It’s a fortress of opportunity with financial perks they can’t resist.

But what does that mean for Africa? Trouble. Big trouble. As its wealthiest families seek greener pastures, local economies could be left gasping for air.

When the rich leave, startups lose investors, sectors like tech, infrastructure and manufacturing stall, and progress grinds to a halt. Family offices fuel local growth, Adediran the family office advisor says. When they bail, everyone feels the pinch.

Arthur Minsat from the OECD doesn’t sugarcoat it either: better governance, stronger institutions and a business-friendly environment are non-negotiables if Africa wants to keep its wealth at home. It’s not a quick fix, but it’s waypoints on a roadmap.

Africa’s challenge? Stop the double hemorrhage — of both brains and wallets. The continent must find a way to convince its ultra-rich that their futures lie in Africa, not in the penthouses of the Burj Khalifa.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com