Maybe it’s time to take off the rose-tinted glasses, says a report co-authored by Kevin Aluwi.

Aluwi should know. He co-founded Gojek, one of Southeast Asia’s best-known unicorns, and is now a venture partner at Lightspeed, one of Silicon Valley’s largest investment firms… So he’s made all the mistakes that come with believing the hype.

In a report on the startup environment in Southeast Asia, though, Lightspeed looks at the cold, hard numbers. And it’s not pretty. Though a respectable $72 billion was ploughed into the region’s startups over the last five years, they’ve underperformed when compared to peers in China and India.

Funding invested in Chinese and Indian startups generated far more value – 2.4x and 1.6x, respectively – compared to just 1.3x in Southeast Asia.

Why should I care?

So if you’re starting a company in Southeast Asia today, you might want to temper your expectations on returns.

Most Southeast Asian companies that have listed (think GoTo, Grab, Bukalapak, and Blibli) have since lost a lot of value.

(Only SEA Limited’s market cap has risen, soaring 920% to date. But it went public much earlier than the others and it listed on the NYSE rather than Asian exchanges.)

Southeast Asia is also just not growing as fast as other emerging markets. Its economy grew 4.8% a year on average from 2000-2023, trailing far behind China’s 8.4% and India’s 6.1%.

Its tech startups raised $2.3 billion in the first nine months of this year, less than the $5.7 billion raised in the same period in 2023 and $11.6 billion in 2022, Tracxn says. That’s no longer a blip; it’s a pattern.

And a cautionary tale for budding entrepreneurs….

Aluwi said in a recent post on LinkedIn that believing the hype over the past decade about Indonesia and Southeast Asia led him to make “many wrong decisions” while building Gojek.

He merged Gojek with e-commerce giant Tokopedia to form GoTo amid much fanfare in 2021. The next year, GoTo raised $1.1 billion in an IPO, making it the third-largest listing in Asia and fifth-largest globally in 2022.

It’s been downhill ever since. GoTo’s shares are down 85% since its listing. Earlier this year, it said it was closing its business in Vietnam.

Right sizing your strategy

To make big money in Southeast Asia, you really have to really understand who your customers are, Lightspeed says.

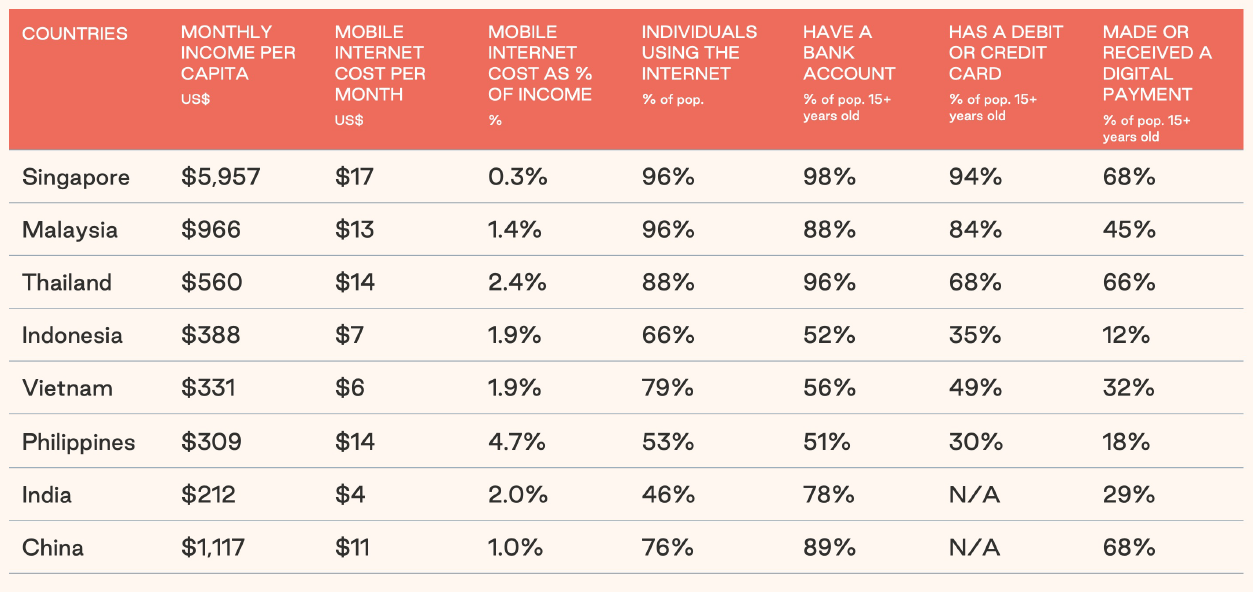

For starters, the spending power of the region’s middle class isn’t as big as China’s and India’s. And because the region is so fragmented, there are lots of local differences that can be hard to navigate. Income inequalities are gaping, both between and within countries.

That means you have to pitch your product super-carefully because, say you aim to build a new product targeted at median-income people, if you don’t do your research right you could easily be missing out on 90% of the population.

Addressability and cost of acquiring customers in SEA, India, and China (Lightspeed’s report)

Still got some rizz?

None of this makes Southeast Asia a write-off, of course. The region is home to 44 unicorns, which have built high-quality talent and founder ecosystems. And there’s so much room for growth in online users, which could translate into big opportunities for businesses that are pitched right.

“We are most definitely still excited about the future of Southeast Asian consumer tech,” Lightspeed says.