Forget armies or oil fields –– today, the power to conquer the world lies in stock markets.

The US has mastered this game, creating an economy where the stock market isn’t just a financial tool but a global magnet for wealth. Every year, trillions of dollars flow into US equities, not just from American households but from investors across the planet. And with every dollar, the US tightens its financial grip on the world, while the rest of us foot the bill.

When you invest in the US stock market from India, the Middle East, or anywhere else, you’re doing more than chasing returns. You’re fueling an already well-oiled American machine. Your money drives up US stock valuations, helps American companies grow bigger, and concentrates more wealth into the hands of a select few.

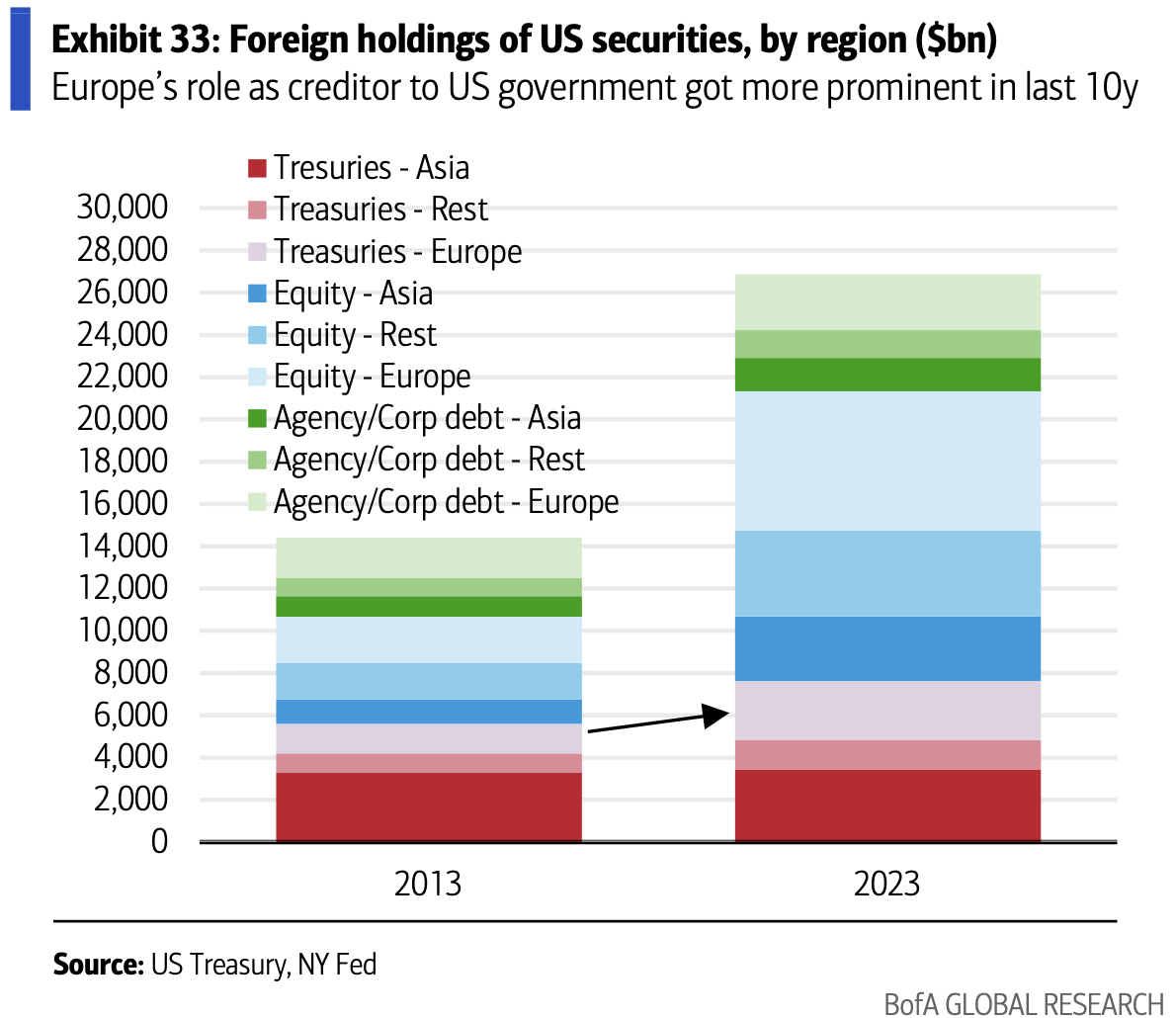

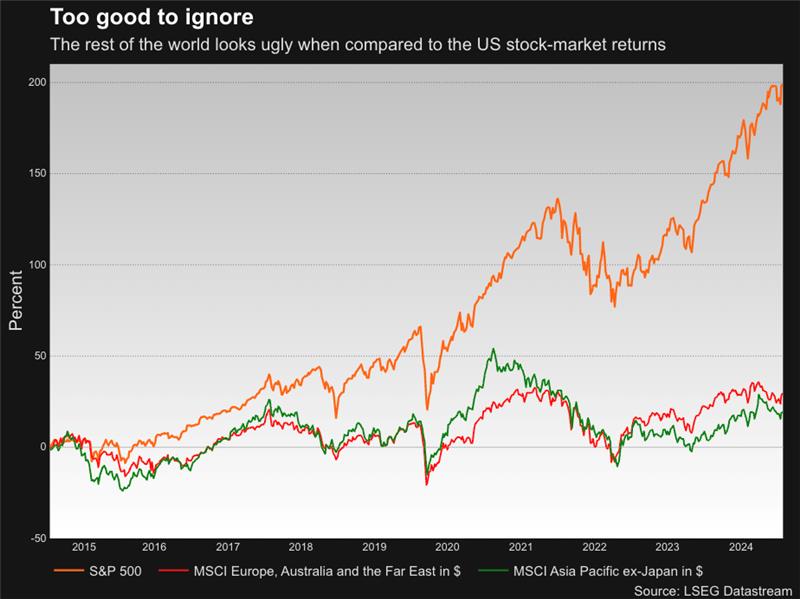

The result? Over the last 10 years, global stock markets added $46 trillion in value. Of that, the US equity market contributed a staggering $36 trillion (78%), while Asia accounted for just 14% and Europe barely scraped 6%, according to LSEG data. (Most of the US gains, of course, can be credited to tech.)

What we’re witnessing is what Bank of America’s Michael Hartnett calls a “virtuous cycle.” Higher equity net worth leads to more wealth, which either supports consumer spending or gets recycled into risk assets. It’s a self-reinforcing catalyst for American exceptionalism.

Meanwhile, your local economy — the one that desperately needs businesses to grow, innovate, and hire — gets left behind. Local companies face higher costs to raise money, which stifles their expansion, while US markets thrive.

And it’s not just individual investors. Governments are in on the action too. Entities like the Swiss National Bank and Norway’s sovereign wealth fund hold significant stakes in US stocks, further cementing America’s dominance.

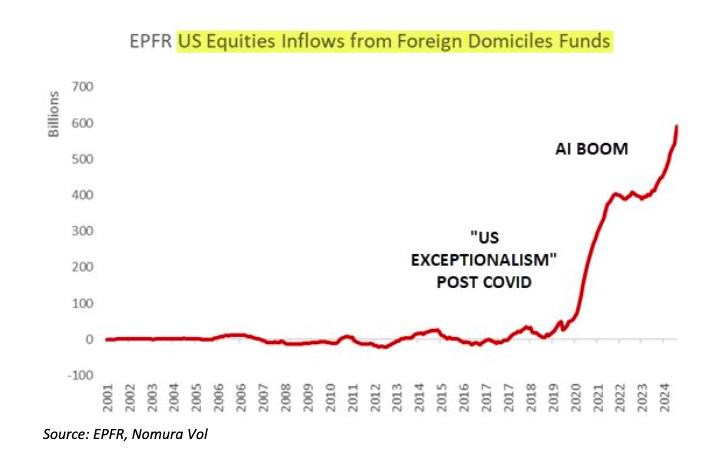

Take a look at this chart from BofA that shows how the world has been piling into US equities.

The US’s net international investment position — the gap between US-owned assets abroad and foreign-owned assets in the US — has dropped to a startling -80% of GDP as of September 30. Most of this is due to the meteoric rise of US stocks and the dollar. Goldman Sachs predicts this number could fall even further to -95% of GDP. Go USA all the way?

All this has global consequences. The dollar’s strength is essentially putting a rocket under commodity prices. Everything from coffee to copper to fuel is becoming more expensive for the rest of the world. Why? Because these commodities are priced in dollars.

For countries like India, which relies on oil imports, or China, which consumes massive amounts of copper, the math just doesn’t work out in their favor.

Political rhetoric in the US isn’t helping. With Trump-era tariff threats resurfacing, things could get even more challenging for global trade.

If all of this hasn’t convinced you, for DeepSeek’s sake look elsewhere. The latest rout is a stark reminder to not chase overvalued tech stocks.

Inflows into US equities after COVID-19 have been unmatched, with almost $600 billion pumped, and the AI boom has been the latest crowd-puller. What happened with Nvidia this week is a stark reminder of the dangers of herd mentality.

Investing in the US market feels safe. It feels smart. It is certainly lucrative. But is it sustainable? By fueling America’s boom, we’re deepening inequality, weakening local economies, and putting all our eggs in one very American basket.

Their secret? 58% of American households own stocks, either through mutual funds or individual shares. But the winds may already be shifting. Today, the wealthiest 10% of US households control nearly 93% of the stock market’s total value. And new listings are slowing as private-equity firms engulf ever more companies.

Still, US stock markets are unmatched on MANY fronts –– long-term returns, liquidity (easy entry and exit), profit growth of listed companies and, most importantly, a political class that cares about the country’s performance.

And let’s not forget the passive investing juggernaut. Two-thirds of every dollar in global indexes inevitably ends up in the US — simply because US stocks make up two-thirds of the global market.

This dominance even affects where companies list. Take British chipmaker ARM Holdings. Despite being headquartered in the UK, it chose to list in the US, where the AI hype is red hot.

Beyond ASML in Europe, finding a legitimate AI play outside the US is like searching for water in a desert. But cross the Atlantic, and there’s an abundance: Nvidia, Palantir, Meta… the list goes on.

So, what’s the alternative?

Maybe, just maybe, the tide will turn. When Indian tech names start making a bigger splash and Chinese companies finally win back investors’ trust, we might see a more balanced world.

But it won’t happen overnight. So, it might be time to start spreading the love 💵 — slowly but surely.

Thyagaraju Adinarayan is Moniify’s head of markets & macro news.