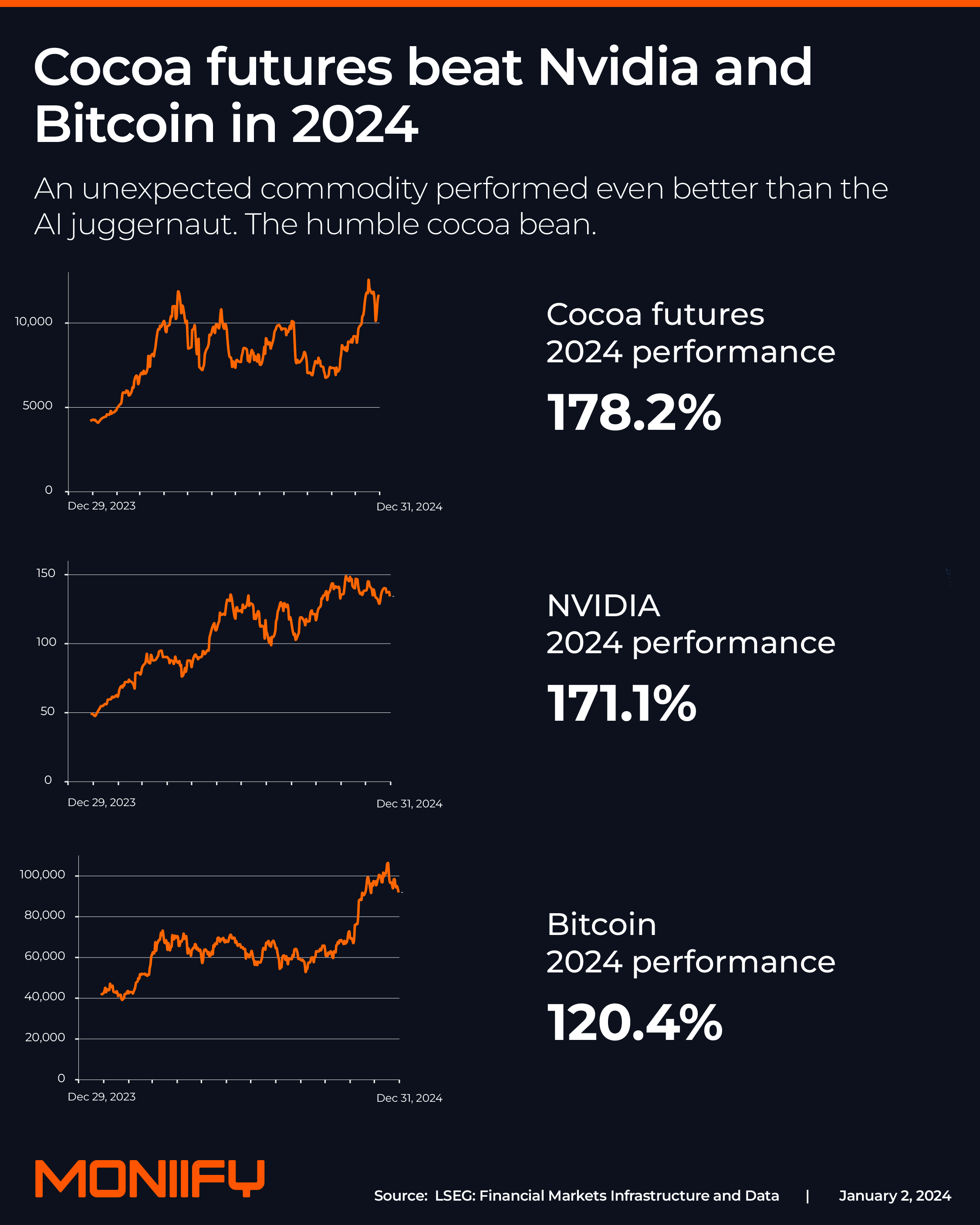

Last year was all about AI hype: ChatGPT this, Claude that, and Nvidia shares flying high.

If you were in the game, you probably thought the smartest move was to ride Nvidia to the moon. And hey, with a 171% gain, it was a rocket ship worth boarding.

But it turns out that one unexpected commodity performed even better than the AI juggernaut: the humble cocoa bean. That’s right – cocoa futures outperformed Nvidia’s gains, skyrocketing 178% on the Chicago ICE exchange last year. That’s enough to leave Bitcoin in its wake too.

The reason? It’s all down to a mix of factors that are clobbering supply. These include climate change-induced erratic weather patterns, crop diseases, and less land available for cocoa plantations in the most important West African growing region.

Read more: Is Nvidia switching to the slow lane?

Bittersweet moment

As a result of all of this, 2024 is forecast to have seen the biggest drop in cocoa beans harvested in at least a decade, according to the International Cocoa Organization.

The reason that cocoa futures, which market players use to hedge or speculate on where prices are heading, have blown through the roof though is this is not some one-off. These same factors have been affecting supply for a few years now.

And there are plenty of doubts about whether there will be any dramatic improvement in the crop’s growing conditions going forward.

In short, the chocolate industry is in a bitter spot.

The impact?

Cocoa prices are surging, but chocolate makers haven’t passed the cost onto consumers yet. JPMorgan warns that double-digit price hikes will hit in 2025. So stock up on your favorite bars now, because they’ll soon cost almost as much as your streaming subscriptions.

All of which means the chocolate makers are having a tough time. Nestlé fell more than 28%, Hershey dropped almost 10%, while Mondelez took an 18% hit in 2024, as the soaring cocoa costs, without a comparable rise in revenue, has spelled bad news.

Read more: Nvidia who? The two stocks that matter more

Some of them face a double blow, with coffee having soared 78%.

Analysts say cocoa and coffee could see even more volatility in 2025. Bank of America says that’s literally “stress testing” the confections industry on multiple levels.

So what’s the impact on your food bill? The US’s FAO Food Price Index hit a 19-month high in November. Coffee, cocoa, orange juice and olive oil have all seen their prices spike to record highs in recent months, and they remain high.

Instruments to watch

Now if you want a less complicated way to console yourself than shorting these chocolate stocks while biting into ever pricier blocks of Lindt dark chocolate, you could take a look at the WisdomTree Cocoa (COCO) ETF.

A more indirect option would be Teucrium AiLA Long-Short Agriculture Strategy ETF (OAIA), which gives you agricultural commodity hedge fund-type exposure.

But heads up. Commodities are like the Wild West: volatile, unpredictable, and not for the faint-hearted. Do your research and tread carefully.

Read more: ETFs: The cheat code that could crash the markets

Graphics by Alia Chughtai. Edited by Thyagu Adinarayan and Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com