Been wondering why the S&P 500’s barely scraping a 3% gain this year, even after those massive rallies in all things AI? Turns out Apple is the culprit.

The iPhone giant is the only Magnificent Seven stock in the red, and not by just a little bit. We’re talking deep, almost 11% red. And it’s only January!

In just three weeks, Apple’s market cap has shrunk by $420 billion (let that sink in).

This kind of free fall isn’t business as usual for Apple. Something’s seriously off, and it’s got people asking: what’s going wrong in Cupertino?

Read more: #HotStox: No Trump bump for Apple

Low battery

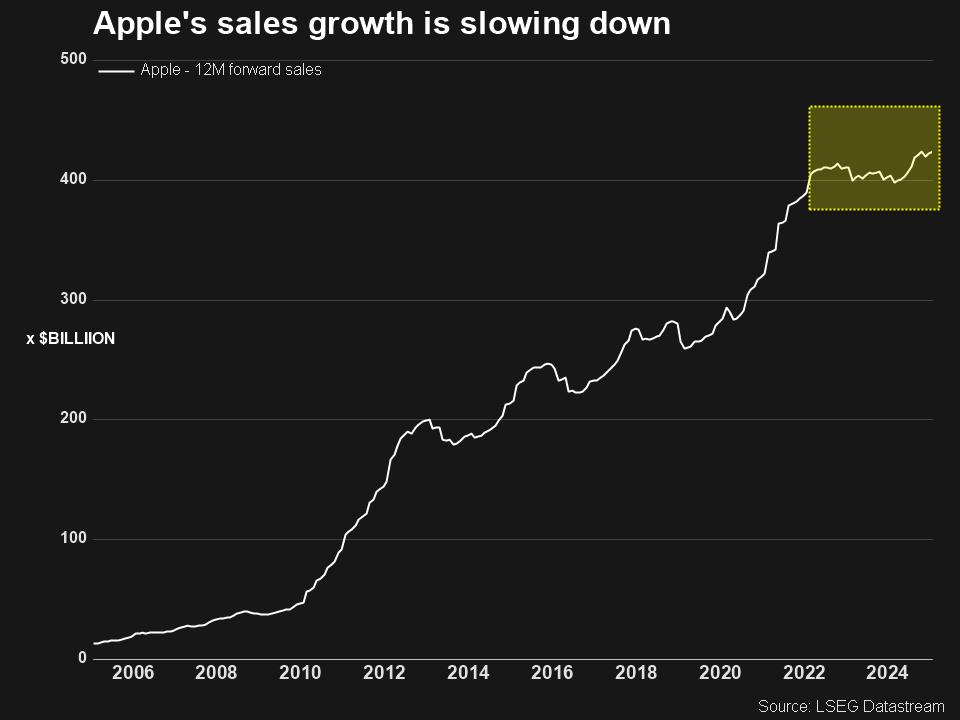

Apple’s still growing, but not really like it used to. At its core (pardon the pun), it’s an iPhone company, with those devices making up the lion’s share of its revenue. And that’s exactly where it’s starting to hurt: sales have been slowing since 2022.

US brokers Jefferies and Loop Capital cut their rating on the stock this week, citing sloppy demand for iPhones. Jefferies also reduced its outlook for iPhone 17 and 18, and expects Apple to miss its revenue growth guidance of 5% for its first quarter, due on 30 January.

Apple’s slipping market share in China, the world’s biggest smartphone market, is to blame. That’s not exactly breaking news, but the problem is that the company hasn’t been able to really fix this.

Plus, coming into the new year, the valuation was sky high: 32.5x forward earnings. That’s flirting with the whopping 34x multiple Apple hit way back in 2008, when the first iPhone launched. The difference this time is that there’s no groundbreaking innovation to back up that sky-high price tag.

Not even the iPhone 16 could justify the hype. And as for the much-touted Apple Intelligence features Tim Cook hyped up in September, the world doesn’t seem all that impressed… at least not yet.

Read more: China’s Oppo is teaching Apple and Google a lesson about Indonesia

The rot is spreading

Apple’s biggest manufacturers Foxconn and Pegatron are feeling the heat too, with Pegatron down more than 19% from its June peak, and Foxconn down just as much from its November peak. Lens suppliers Largan and Genius have also seen their stocks under pressure over the past six months.

At least Warren Buffett dodged the worst of this: he’s been trimming Berkshire Hathaway’s Apple stake, once its largest stock holding, since late 2023, cutting it by more than 65% as of September.

Even after the latest drop, Apple’s stock still looks relatively expensive compared to some faster-growing Big Tech peers like Meta and Alphabet, with its forward price-to-earnings ratio still at 29.2x.

Read more: Indonesia’s cool with Apple’s $1 billion investment (sort of)

But still… it’s freaking Apple!

Some Wall Street pros think things aren’t that bad for the stock that’s dominated world stock markets for most of the last decade.

Morgan Stanley analysts are overweight on Apple, and bullish on Apple Intelligence accelerating iPhone replacement cycles starting in fiscal year 2026 (that’s end-September). They’re seeing the current year as “a bit of a calm before the storm.”

The bank has a 12-month price target of $273, nearly a 22% increase from current levels.

Meanwhile, Bank of America, while naming potential trade conflicts and tariffs among several risks facing the stock in a December report, still rates it a “buy,” with a price target of $256 for the next 12 months.

MS analysts aren’t too worried about the risk of China tariff retaliation, since Apple has a “productive relationship” with President Donald Trump that could earn it exclusions on products like iPhone, Mac and iPad like the first round of China tariffs in 2018.

Will iPhone 17 this September be the wildcard?

Edited by Thyagu Adinarayan and Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com