The TV’s flashing headlines of yet another record low for the rupee against the dollar, and your distant Indian uncle is declaring doomsday for the country. But let’s not hit the panic button just yet — there’s more to the story than meets the eye.

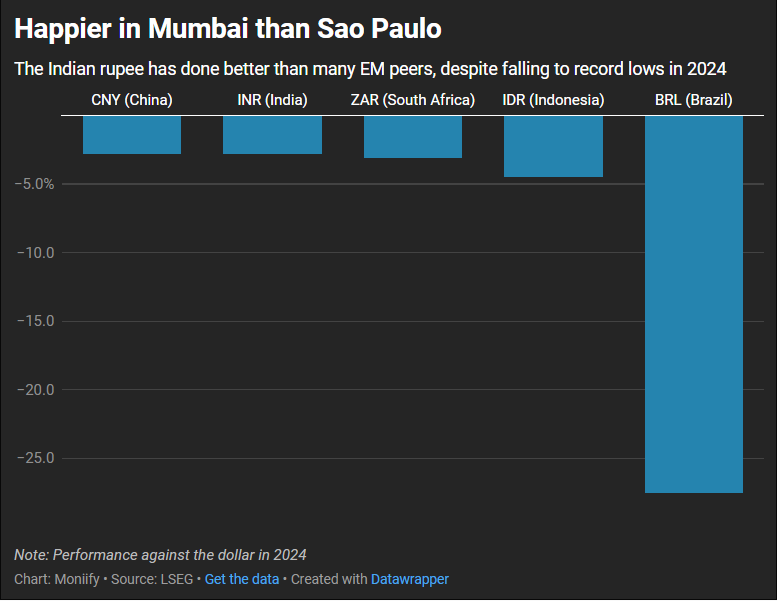

Sure, the rupee had a December to forget, with the currency notching fresh lows after trading almost steady for most of the year. But with Donald Trump itching to pull the tariff trigger, the Chinese yuan and the Mexican peso are sweating it considerably more than India right now.

India’s still not likely to get away scot-free though. Any headaches for the yuan are going to be India’s problem too, because the central bank is expected to intervene by selling dollars to make sure the rupee doesn’t get too strong relative to China’s currency, potentially hurting exports.

Read more: The Dalal Street deceleration is real. What’s next for Indian stocks?

That could push Indian rupee to 86 a dollar sooner rather than later.

Amit Pabari, managing director at CR Forex, says there’s no “significant reason” for prolonged depreciation of the currency. He called the ongoing drop as “temporary pressure.”

Meanwhile, Goldman analyst Kamakshya Trivedi sees INR as the best play in the medium term, and thinks it will outperform other emerging market currencies in periods of dollar strength.

Why does it matter

But while we’ve hopefully said enough to put a stop to that distant uncle’s freakout – this is all still likely to impact the lives of ordinary Indians.

Got plans to travel internationally? Or study overseas? Thinking of investing in physical gold?

All of that is going to get pricier.

Of course, the flipside is if you’ve got plenty of dollars to your name, it might be a good idea to hold on to them a bit longer. And if you’re an NRI, the $$$ you send to India might be worth 2.8% more than usual (that’s how much rupee fell against the USD in 2024).

Read more: India’s 2025 stocks outlook is giving déjà vu

Indians have a $250,000 cap on how much of their wealth they can keep outside the country without any special permission. So if you haven’t used that at all yet, or if there’s room to add to your holdings of, say, US stocks with a broker offshore, that’s one option.

After all, US stocks are outperforming the world by a huge margin.

Inside India?

There are India-listed companies that make most of their bank outside the country, who get a nice boost when the rupee is hurting (think TCS, Infosys or drugmakers like Sun Pharma or Aurobindo, who have a lot of customers in the US).

Those $$$ come back to them as sweeter Indian rupees.

And for investors from outside India? More Indian stocks per dollar.

Now – back to that uncle. Fair to say, his concerns aren’t totally unfounded.

Read more: As India’s world-beating growth falters, winners are scarce

Bank of America strategist Abhay Gupta says domestic risks from a deeper growth slowdown need to be watched more closely. Yes, that shocking GDP growth number in the second quarter is a reminder not to be complacent.

Plus, with lofty stock valuations and the massive wild card that’s the incoming Trump administration, it’s easy to see why foreign flows might not be rushing back after a $12 billion exodus in the final quarter of last year.

Which is all good reason to act with a little caution as you step back into the market as 2025 kicks off.

Edited by Thyagu Adinarayan and Tim Hume. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com