Every big bank strategist has their pom-poms out for 2025, calling a win for the S&P 500.

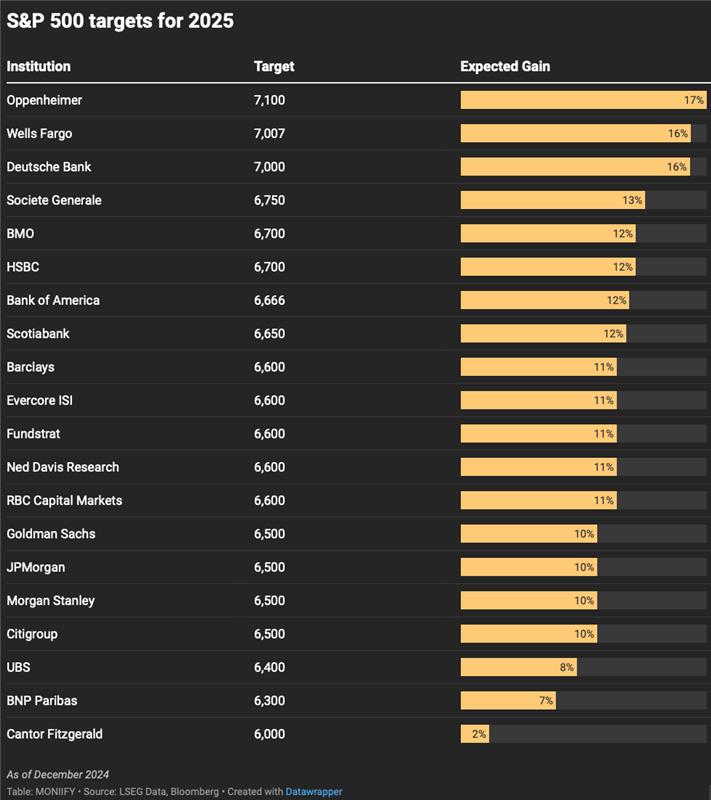

Oppenheimer is shooting for the moon with a 7,100 target (+21%), the highest on the street. Deutsche Bank, Wells Fargo and Yardeni Research aren’t far behind, all three of them boldly calling for 7,000.

Everyone’s betting on a feel-good market. But before you pop the champagne, let’s not forget: these folks don’t exactly have a spotless record.

These are the same pros who missed the post-COVID bounce and underestimated tech’s rocket ship-like rise. So, while their forecasts look spicy, the question is: what could go wrong this time?

Read more: Magnificent who? The S&P 493 are going to be 2025’s big stars

Read the fine print

No rocket science this. Trump’s trade wars could stoke inflation, forcing the Fed’s hand on rate hikes. That scenario topped Bank of America’s latest fund managers’ survey as 2025’s ultimate party pooper.

The same survey found that cash levels at fund managers fell to 3.9% of their assets, the lowest level since 2021. Global stocks have fallen 2.4% on average over the last 11 times when cash levels dipped below 4%.

The market’s already feeling it. Stocks skipped the usual Santa rally and started the new year in a dullish funk.

Not so hot

Now, not all the big boys are this bullish. UBS and BNP Paribas are playing it cooler, with targets of 6,400 and 6,300, respectively. Cantor Fitzgerald is the most cautious at 6,000, though even that’s an uptick from today.

Firms like Goldman Sachs, JPMorgan, and Morgan Stanley are eyeing a middle ground at 6,500 — balanced bullish, but not bonkers bullish.

Goldman’s Jan Hatzius warns that Trump’s rumored 10-20% universal tariffs could hammer growth before any tax cuts provide relief.

Read more: Small investors ate and left no crumbs for Wall Street pros

He gives this trade war scenario a 40% chance, noting the White House may shy away from the political and economic fallout.

After flubbing 2022, 2023, and 2024 predictions, Wall Street’s pros don’t inspire blind trust. We know it’s not an easy job and we discussed it here, there are a lot of variables in play — trade policies, rate cuts, economic growth.

Whether the S&P flies or flops, brace yourself, the only sure thing is that 2025 will be another rollercoaster for the markets. Like every year post-Covid has been.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com