Their shopping carts are overflowing with stocks, but fund managers just can’t get enough. 🚀

Seasoned Wall Street pros see a rally in US stocks hitting new peaks next year, driven by small caps as Trump’s election victory injects new market momentum.

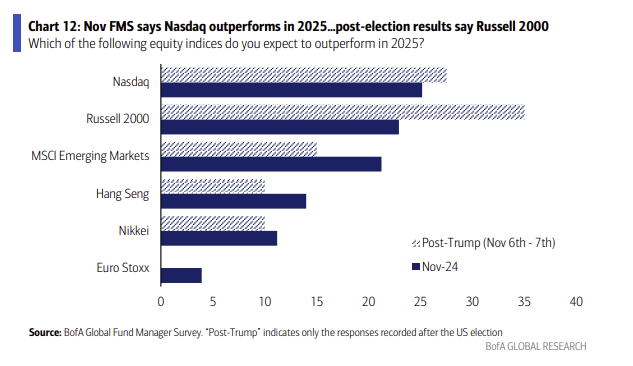

Bank of America surveyed fund managers overseeing a whopping $565 billion in assets and found that 35% see the Russell 2000 gauge of small caps taking pole position in 2025, followed by the Nasdaq 100 and emerging-markets stocks.

The US economy is also expected to keep cruising next year, with no real setbacks stalling a record-hitting spree in stocks.

China bounce

Hong Kong’s benchmark Hang Seng Index took fourth place in the BoFA survey, with 35% of fund managers saying they saw China’s potential growth acceleration as a major catalyst for next year. With targeted stimulus measures still in play, China’s prospects aren’t looking as bleak as some think.

Gold play

In terms of asset classes, US stocks are expected to be next year’s best performers, followed by global stocks and gold. The precious metal made a surprise comeback to the list after the US elections. It didn’t even make the top three earlier, which suggests something is bothering Wall Street. Could it be…

… Inflation?

While investors are more optimistic about global growth than they’ve been in over three years, this surge in confidence – combined with Trump’s anticipated tax cuts and tariffs – has also putt inflation back in the spotlight. With global inflation acceleration topping the list of risks in the survey, central banks could face a tough road ahead, especially Jerome Powell at the US Federal Reserve, who must face down Trump himself.