The president-elect has dusted off his favorite economic weapon and fired the first salvo.

In Trump 2.0, tariffs aren’t just one policy — they’re a main act. And friends and neighbors won’t be spared.

Trump has already said he plans to increase tariffs on imports from China by 10% on Day 1 in the White House. But he’s also threatening to slap a 25% tax on imports from Canada and Mexico. That’s sent the Mexican peso, the Canadian dollar and the yuan reeling.

Just like 2018-19, we’re back in Trump Tariff Threat or TTT mode. Markets are responding exactly how you’d expect: dollar up, US stocks up, and the rest of the world sulking in a sea of red.

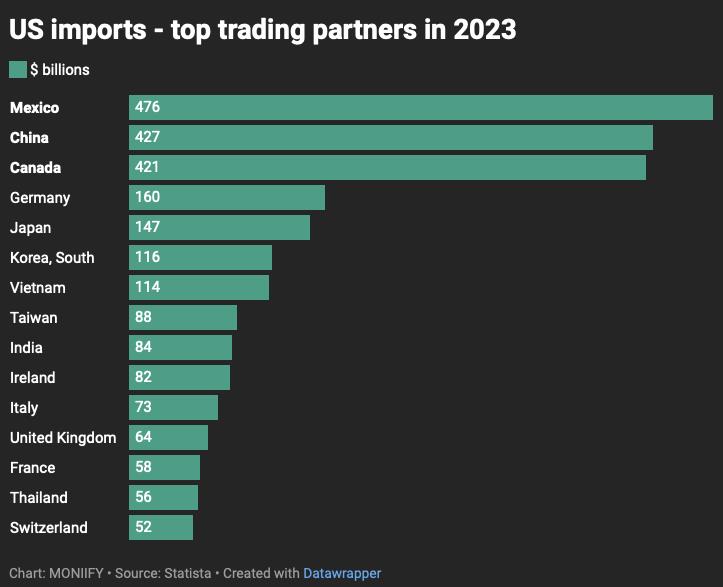

Going by the list below, Germany and Japan must be sweating now, because Trump’s already picked the US’ top three trading partners for his first salvo.

“I think it’s the waiting that is really the problem,” says Richard Privorotsky, a partner at Goldman Sachs.

Japanese stocks were down more than 1% on Tuesday, while German blue-chips slipped 0.4%

Whatever you think of Trump, the more this happens, the more investors are likely to switch to US stocks, adding to what’s been a one-way street for years now. The result? The US attracts even more foreign capital, feeding its already bloated asset bubble.

The US’ net international investment position –– basically foreign ownership of American assets –– has ballooned to a staggering $22.5 trillion, nearly double the level when Trump’s first tariff crusade began in 2018, according to US Bureau of Economic Analysis.

What’s the play?

- Be wary of the euro: the US imports a lot from Europe’s manufacturing powerhouse, Germany. So if it does turn out to be next on Trump’s list, the single currency could suffer.

- You might also want to stay away from European car stocks (VW, BMW, Renault) for now, along with Europe’s luxury goods makers (LVMH, Gucci-owner Kering). Same reason as above.

- Japan and China are a no-no too. BofA sees the yuan weakening to 7.60 against the dollar.

In a nutshell, it may be US stocks or nothing in the Trump era.

ChatGPT corner