Welcome to the stock market’s favorite season — the year-end has been delivering gains for nearly a century. Seriously, a century.

Known as the Santa Rally, this stretch from mid-December through early January has historically been a goldmine for investors.

Lots of $$$ have already been flowing into US stocks — $186 billion over the last nine weeks to be exact, the largest inflow on record, according to a senior Goldman Sachs trader, Scott Rubner. And we’re not done yet.

The stats don’t lie

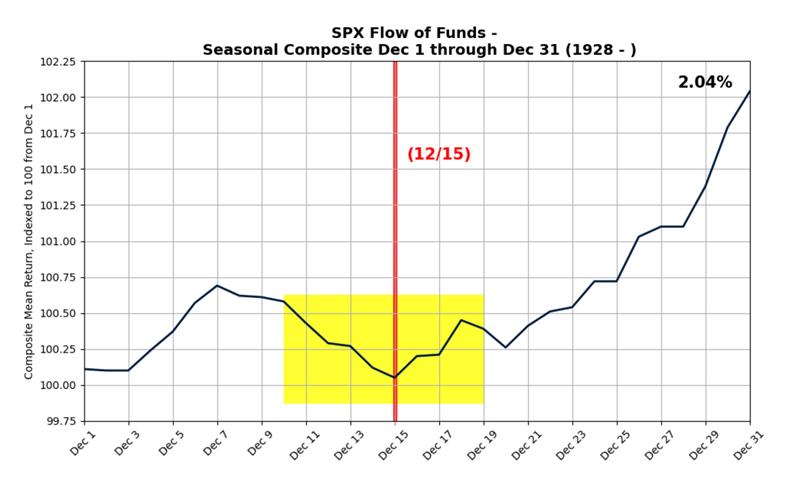

- The second half of December is the third best two-week period of the year since 1928. The first half of January is the best two-week period of the year since 1929.

- Add in the “January effect,” when the massive amounts of capital get pumped into US stocks in the first few weeks of the new year.

Rubner puts it mildly: “The bar for being bearish right now remains high.”

Here’s Goldman’s chart to show what the rest of December could look like if historical seasonality plays out. Yellow is where we are 📍:

Bad breadth

The party does not last forever though. So don’t just toss the greenbacks on the trading floor and go MIA. Markets could overshoot in the second half of January, setting the stage for a post-hype pullback.

Rubner thinks the risk of that happening “remains high.”

Steve Sosnick, chief strategist at Interactive Brokers, warns investors against bad breadth –– basically when only a handful of heavyweight stocks drive the entire market.

“Santa can arrive, whether with a sleigh or via interest rate cuts,” says Sosnick, but do not count on a balanced, diversified ride.

Investing in the S&P 500 is basically betting on the Magnificent 7 tech giants, making it a risky play if the sentiment sours.

If short-term trades stress you out, consider longer-term moves:

- Banks and brokerages: With deregulation under Donald Trump, stocks like JPMorgan, Bank of America, and Robinhood could see gains.

- Small businesses: Trump’s ‘America First’ agenda might mean potential gains for small businesses. The AIRR ETF (First Trust RBA American Industrial Renaissance ETF) is a known and solid choice for those tracking this space.

Oh, and Trump ringing the NYSE opening bell on Thursday? If you are into omens, he said that the American investor is in for “some very good days head.”

(He said that to CNBC’s Jim Cramer, tho. 😏 )