With Donald Trump’s presidency just three weeks away, it’s time to buckle up if you care about the planet — or have cash in green tech. His first term shredded climate policies, and the sequel looks even messier.

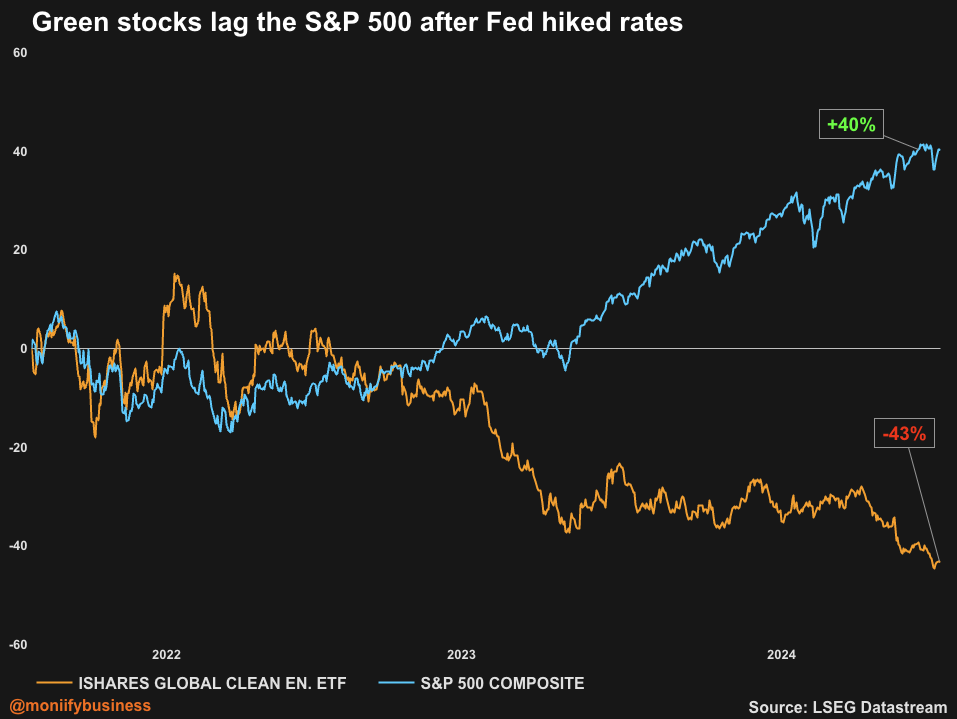

Before we even wade into Trump’s climate politics, let’s take a look at the sorry state climate investing is already in.

Despite massive clean energy incentives, green stocks have tanked by almost 50% since 2009. Global stocks in the same period? They’ve tripled.

On the clock

If Trump’s climate agenda had a catchphrase, it’d probably be, “Drill, baby, drill!”

He’s promised to axe the Inflation Reduction Act (IRA), which gave record tax breaks for US green investments, and give oil and gas projects the green light — faster than you can say “renewables.”

Even if the IRA survives intact, life is about to get harder for green investors.

Trump’s been itching to slap massive tariffs on China. Cue higher inflation and the Fed taking its sweet time cutting borrowing costs. Say goodbye to cheap loans for wind farms, solar panels, and other big-ticket green projects already struggling to get buy-in.

“Trump’s policies are likely to be more inflationary,” Alex Monk, portfolio manager of global resource equities at Schroders, tells MONIIFY. That means project delays, fewer investments, and slower adoption of EVs, rooftop solar, and heat pumps.

In short, green projects are facing the steepest climb.

Read more: A Trump win is bad news for these stocks

A policy wrecking ball

Trump’s not stopping at the IRA. He will gut what he can. He’s vowed to scrap offshore wind projects with an executive order the moment he’s back in the Oval Office.

There’s even chatter about pulling the US out of the UN Framework Convention on Climate Change. Remember when Trump dipped on the Paris Agreement or Bush bailed on the Kyoto Protocol? Déjà vu.

As with everything climate related, the implications go far beyond national borders.

If Trump taxes China’s solar cells, EV batteries, and other green exports, Beijing won’t sit idle. “If exports to the US get harder, China could redirect to other markets,” says Roshan Raj, partner at Redseer.

That could boost China’s global share in alternative energy, even as the US backpedals.

Read more: Biden’s red tape is out, all aboard the Trump deal train

End game?

However, let’s not get it twisted. Climate change is still, resolutely, a thing. Natural disasters are on the rise, as no American will need reminding.

Yet under a Trump presidency, US emissions could pump out another four billion tons of greenhouse gases, with climate damages soaring over $900 billion, according to one analysis.

It’s a tough pill for green investors to swallow, but Trump’s second act might be the ultimate stress test for climate policy and clean energy. It might not kill green investing outright, but it will definitely make it harder.

That being said, if the sector can weather this storm, it’ll prove it can thrive even in the harshest political climates.

For now, the message is clear for green investors: keep your expectations low and your timeline long — because the road ahead looks anything but smooth.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com