Get ready for some sleepless nights – the NYSE is planning to add six more hours to its daily grind, which means it’ll be open for business almost round-the-clock, five days a week.

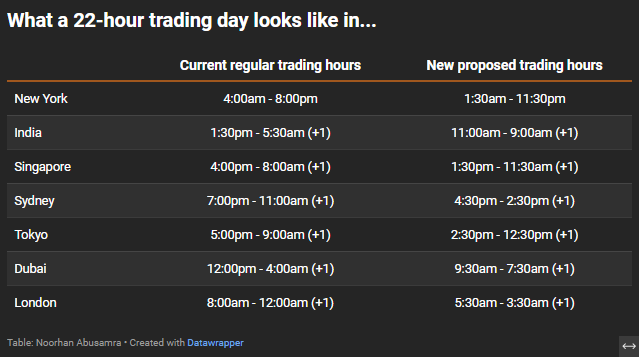

Right now, the US stock market’s operating hours (including pre and post-market) run from 4am to 8pm Eastern Time – 16 hours. That’s being extended to 1:30am to 11:30pm.

The goal? To give traders from Sydney and London to Dubai a fair shot at the action during their daytime, not just New York’s. Right now, it’s bedtime in Sydney and “beer o’clock” in Tokyo when Wall Street wakes up. This change could finally sync up the world’s trading clocks.

The trading would happen round-the-clock on NYSE’s Arca exchange, an electronic platform with virtually all US-listed stocks, ETFs and closed-end funds available. This idea, still subject to regulatory approval, could make trading feel more like binge watching.

The US market is already the most accessible in the world, and stretching trading hours will likely attract more $$$. More time to shop the stock market means more opportunities for traders to dive in, and the allure of 22/5 could pull in a whole new wave of investors who just can’t live with the FOMO.

Is this new?

Not really. Back in May 2023, Robinhood rolled out its 24-hour trading feature for hundreds of stocks. Since then, more than $10 billion has changed hands in overnight sessions (and the data takes us only to March), showing just how strong the demand for round-the-clock trading is.

Overnight trading also exists on platforms like Interactive Brokers, where people can buy and sell US stocks 24 hours a day, five days a week.

So, you must be thinking: what’s the big deal, right? The answer: liquidity.

These 24-hour trading features became popular during the pandemic when people were stuck at home with extra cash and a taste for the stock market. But even so, it’s far from the norm. Trading volumes during these hours are still much lower than regular trading sessions, meaning liquidity is thinner. That can make it harder to get the best deal on a stock or ETF, since there aren’t as many bidders in the mix.

But if a 22-hour trading day becomes the standard, it changes everything. The stock shop will be open to more than just a few overnight bidders. With an extended window, more money will be flowing in and out, leading to higher liquidity. It’ll also mean traders might need to stay tuned for longer, as those late-night market moves could end up impacting their portfolios.

In fact, Wall Street will barely catch a break – just two hours for any maintenance or fixes. The rest of the day? Sleep is for the weak.

Game over for ROW

As the chart shows, the S&P 500 has beat all major indices in Europe and Asia this year.

The NYSE is already the world’s largest exchange by monthly trading volume, thanks to its easy access and simple exit strategies for investors. For those outside the US, the only real barrier has been the trading window.

But even with limited hours, Wall Street’s trading volumes dwarf those of other markets, and the depth and liquidity of the US market make it a magnet for global capital. Extending the trading day gives investors yet another BIG reason to pour money into US stocks, which offer steady and respectable returns compared to riskier markets with less transparency and clarity.