When Jensen Huang speaks, the market listens. And sometimes panics.

The Nvidia boss, hailed by some as the “God of AI”, casually dropped a truth bomb at an analyst meeting and quantum stocks fell off a cliff.

What did Huang say? Useful quantum computers are likely 20 years away. Maybe 15 if you’re optimistic, 30 if you’re not.

Simply put, Huang said that quantum’s golden era isn’t knocking on the door just yet.

The fallout was instant. Quantum Computing, D-Wave Quantum, Rigetti, and IonQ stocks tanked stateside. In China, QuantumCTek and Accelink followed suit.

Even Alphabet, Google’s parent, felt the tremor, albeit with a minor dip.

Read more: Is Nvidia switching to the slow lane?

Wild ride meets wall

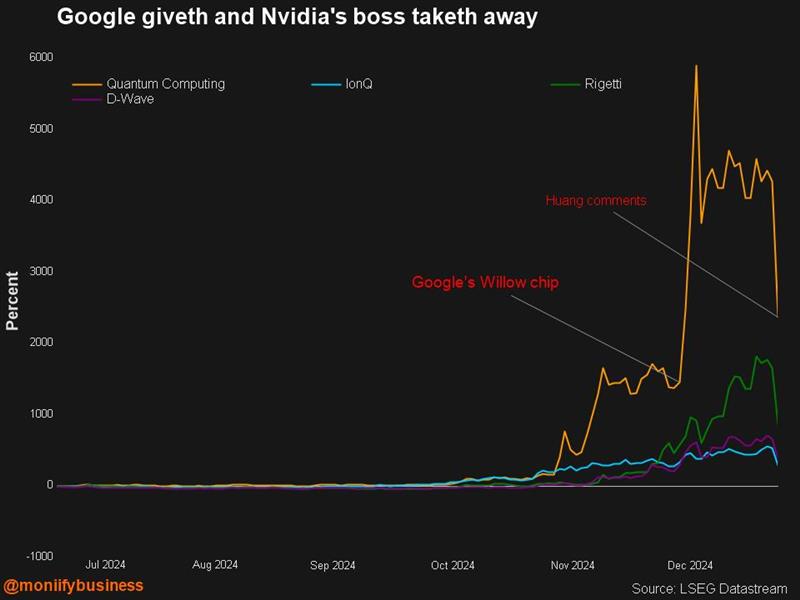

These stocks had been on a speculative bender, fueled by Google’s unveiling of Willow — a quantum chip capable of solving calculations in minutes that would take a supercomputer 10 septillion years. Yes, that’s 24 zeros.

Quantum Computing shares (yes, the name says it all) at the peak of the boom gained almost 6,000% in three months, while Rigetti stock was up some 1,000%.

The former even took advantage of its bloated stock price, raising $100 million in a cash call just before the crash.

Morgan Stanley’s trading desk flagged the unsustainable rally in late December, saying that the quantum frenzy made it “nervous.”

This chart would make anyone nervous + gives you fartcoin vibes:

How Swiftie are you?

The bigger story here is Huang’s influence. His clout now clearly goes beyond Nvidia.

His words ripple through sectors he merely glances at, from AI to quantum to broader tech. When Mark Zuckerberg calls him the “Taylor Swift of tech,” it’s not hyperbole. The man can move markets with a sentence.

Quantum’s sugar rush was always fragile, but Huang’s reality check hit like a cold, even frigid, shower. That being said, not everyone agrees with his timeline.

D-Wave CEO Alan Baratz is one of them. He clapped back on CNBC, claiming that quantum is here and now.

Read more: Nvidia who? The two stocks that matter more

While Baratz acknowledged that one approach to quantum computing, gate-based, may be decades away, another technique is ready today.

Still, even if quantum is ready, are these companies? Many are making losses quarter after quarter. A 1,000% surge in loss-making stocks is less innovation, and more fartcoin.

Huang has now popped the quantum bubble, and the market has spoken and it’s sounding a lot like: “Cool story bro, but let’s see some receipts.”

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com