What recession? The bulls are back, and they’re splurging like it’s Black Friday (harsh truth: it’s not).

US stocks closed Monday at an all-time high for the 46th time, and valuations are well above long-term average levels. But that hasn’t stopped Wall Street from buying.

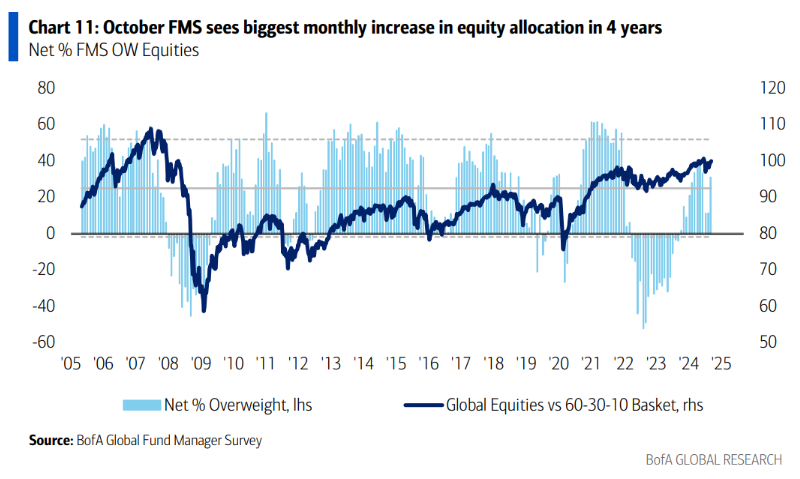

A Bank of America survey shows fund managers boosted their stock positions by the most in four years. The poll, which surveyed managers overseeing $650 billion in assets, shows that a net 31% of these investors bought stocks last month, up from just 11% in September.

The dreaded R-word is quickly fading into the background, with recession worries falling to third place in the list of potential market risks. Geopolitics is a top concern.

Even the data backs it up: employment is strong, growth is steady, and Goldman Sachs now puts the chance of a recession in the next year at just 15%.

The ‘but’

Investors dumped some of their bonds, cash and safety bets, and bought into emerging market assets, energy and tech stocks. Materials, bonds and staples were the least loved business sectors in these portfolios.

The bottom line: investors are feeling less pressure to shield themselves from a “bad” economy and are shifting towards cyclicals – assets that rise and fall with the economic tide.

Here’s a little something to keep in mind: the rush might also mean the bulls are charging too fast.

Cash levels among fund managers are down to just 3.9%, the lowest since early 2021. That sets off a “contrarian sell signal,” according to BofA.

Basically, this is a situation where extreme bullishness suggests a market pullback is around the corner. These signals have triggered mini declines in the past – about 2% losses in a month – so keep your guard up.