Turns out, the Nasdaq 100 and S&P 500 are night owls. Most of their gains last year didn’t happen when traders were shouting on the NYSE trading floor — they happened in the quiet after-hours trading sessions.

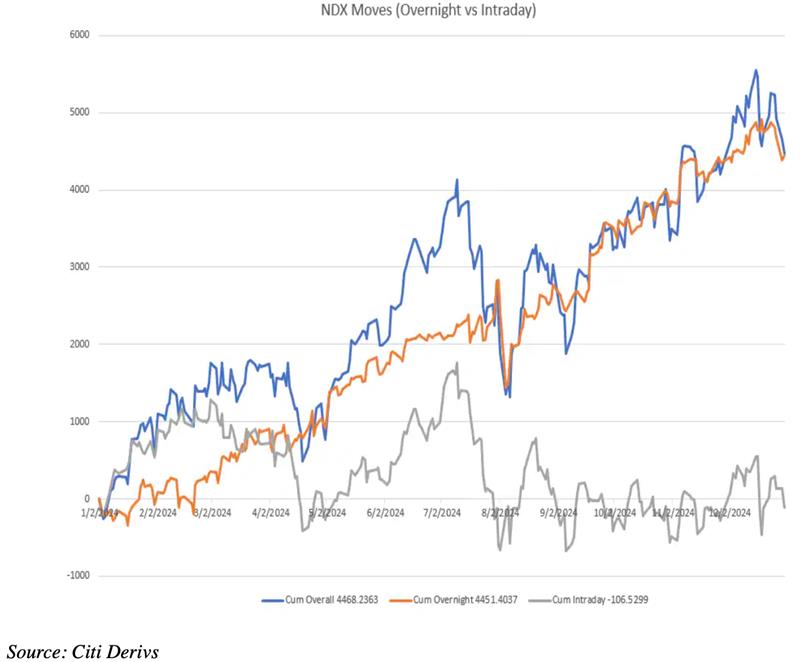

In 2024, the Nasdaq 100 climbed 25%, but every penny of that happened overnight, according to Citigroup trader Joseph Anastasio.

Here’s a chart to watch from Anastasio:

When the clock strikes 4pm in New York and the stock market officially calls it a day, is when the real fun rolls in. Why does the market moonlight, you ask?

- News doesn’t sleep. Earnings reports, product launches, and surprise announcements drop after the closing bell. These trigger immediate reactions in after-hours trading, where electronic systems take the wheel.

- Global markets matter. While New York sleeps, Tokyo and Shanghai are buzzing. Overnight trading reflects global moves, and the ripple effect often sets the stage for US markets.

- The algorithm army. With fewer human traders at night, algorithms dominate. These high-speed programs, often run by hedge funds, thrive in quieter markets, exploiting tiny price changes and creating outsized gains.

Read more: Wall Street’s biggest banks are betting big for 2025. Should you?

Should we go 24/7?

Some people are starting to wonder: why not keep the stock market open 24/7 to match our always-on world. If most of the action is happening outside regular hours, why limit the market to a measly six-and-a-half-hour workday?

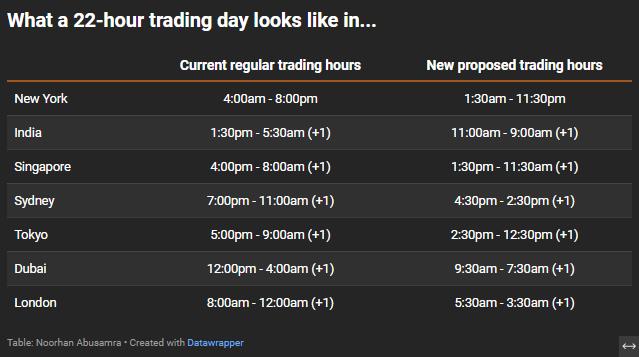

The NYSE is even toying with extending US market trading window from 1:30am to 11:30pm Eastern Time, giving traders in Dubai, Mumbai, and London a shot at daytime action.

Right now, Wall Street’s awake for 16 hours between 4am to 8pm, but Tokyo’s hitting happy hour, and Sydney’s fast asleep.

Read more: Magnificent who? The S&P 493 are going to be 2025’s big stars

But not everyone’s sold. Critics warn that 24/7 trading could amp up volatility and make it harder for investors to catch their breath.

But look: if the Nasdaq 100 had only traded during regular hours last year, it would’ve posted a loss. Instead, after-hours sessions carried the index, proving the overnight shift isn’t just a filler anymore — it’s the market’s secret weapon.

Maybe it really is time to reconsider how we think about the stock market’s workday.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com