It’s THAT time of the year again – when you’re almost guaranteed a win on Wall Street. (It’s also Christmas and NYE, but this might be bigger!)

Big $$$ are expected to flow into stocks. 🤑

More than $140 billion have gone into US stocks over the last four weeks — the largest monthly inflows on record — Scott Rubner, Goldman Sachs’s managing director for global markets, says in a note to investors.

(All funds that don’t cover US stocks have seen outflows of $8 billion over the same period.)

And guess what? History suggests there’s more to come:

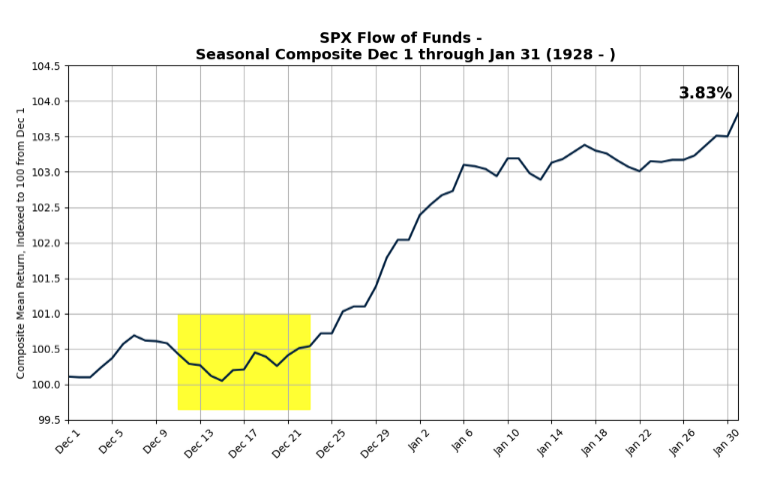

- Since 1928, the S&P 500’s median monthly return for December has been 2%.

- For December and January, the returns are even higher: 3.8%.

Plus, the “January effect” may be around the corner. That’s when the “largest capital in the world” gets pumped into US stocks in the first few weeks of the new year, Rubner says. “Cyber Monday deals keep getting extended and the US equity market rally is no different.”

Here’s what December and January could look like if this trend plays out again:

And if you needed another reason to celebrate, retail traders are back! Goldman’s in-house panic index is at new lows and activity from individual investors is picking up.

Year-end FOMO = $$$$. 🏃

But first…

It’s jobs day on Friday. Yay.🙄

All eyes are on whether November payrolls have snapped back after October’s hurricane and strike-hit flop of just 12K jobs added. The consensus from a Reuters poll is 200K jobs — more in line with September’s strong 223K showing.

Here’s why it matters: a weak report will solidify market expectations of a 25-basis point cut from the Federal Reserve on December 18. It’s currently priced in as a 70% chance, according to CME’s FedWatch Tool.

But a stronger-than-expected jobs report could raise more questions about the Fed’s freshly launched easing cycle, especially since inflation jitters have entered the chat thanks to Donald Trump’s tariffs and lower corporate tax policies anticipated next year.

Bank of America is forecasting an even heftier print of 240K jobs added, while Morgan Stanley is shooting for 270K — so a blowout number isn’t off the table. If the economy proves strong and cuts get shelved sooner than expected, brace yourself for volatility to stage a grand comeback.

ChatGPT corner