If Nvidia crushed 2024, Dixon Technologies just one-upped it. This Indian electronics manufacturer didn’t just match the chipmaker’s epic AI-fueled run — it beat it.

Dixon’s stock has shot up 179% in the past year, edging out Nvidia’s 173% return, thanks to India’s billion-dollar push to develop and eventually dominate electronics manufacturing.

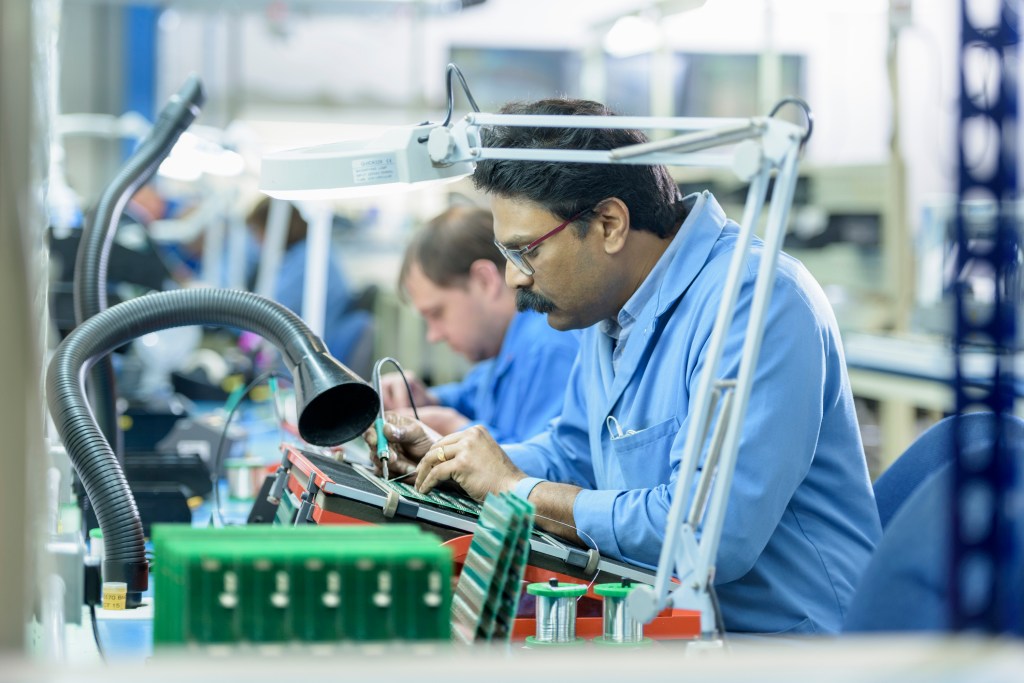

Dixon is riding high on the “Make in India” scheme, which you can safely say is not a slogan anymore. The company already assembles phones, TVs, and appliances for Samsung, Xiaomi, Vivo, and Dell. Starting 2025, it will add Google Pixel phones to that lineup.

The government scheme subsidizes manufacturers based on output and capital spending, and has turned players like Dixon into one of the faces of India’s manufacturing ambitions.

In 2022, it became the first producer of mobile phones to get approval under the scheme for electronics manufacturing, securing approximately $6.5 million for meeting the scheme’s investment and production targets.

MONIIFY has reached out to Dixon to see if there have been other disbursements to the company under the scheme.

Read more: India’s 2025 stocks outlook is giving déjà vu

It’s in the numbers

Dixon’s financials have been impressive. Profits have soared 500% over the past five years, with a healthy 24.7% return on equity and a manageable debt-to-equity ratio of 0.36.

With global demand for consumer electronics surging — especially as AI integrates into everyday tech like mobile phones — Dixon could have plenty of upside left.

India’s mobile phone exports jumped from $200 million in 2014 to $14.5 billion in 2024. By next year, India is expected to export a third of its $50 billion mobile phone production, according to India Cellular and Electronics Association.

The company currently accounts for only 53 million of India’s 417 million mobile phone manufacturing capacity. Translation: there’s a lot of room left for it to run.

Read more: Why cocoa tasted even sweeter than Nvidia in 2024

And it wants to. The company plans to invest approximately $46.7 million in capital expenditure in the two financial years ending in March 2026.

Dixon also recently signed a binding term sheet with Chinese smartphone manufacturer Vivo for a JV in India, which prompted brokerage Anand Rathi to raise price targets, citing significant revenue visibility for its mobile segment.

A high-risk play

But not everything’s sunny in Dixon land. More than 80% of its revenue comes from mobile and electronics –– a very cyclical part of the market, which means a global economic slowdown could just kill demand and kneecap its growth.

Dixon already trades at 103 times forward earnings. There’s zero room for a slip-up.

Analysts are also already hedging their bets. A third of the 25 analysts covering Dixon recommend a “sell,” with average price targets predicting a 20% drop from current levels, LSEG data shows.

Read more: #HotStox: Nvidia fan? India’s TCS could be a worthy AI bet

And then there’s President-elect Donald Trump. His tariff-happy agenda could throw a wrench in India’s manufacturing ambitions.

Still, with India’s government pouring another $3 billion reportedly into electronics manufacturing, Dixon has become the ultimate high-risk, high-reward play.

Pricey? Sure. But Nvidia-like gains come with Nvidia-level risks.

Edited by Ankush Chibber and Thyagu Adinarayan. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com