If we’d told you a year ago that 2024 would see Donald Trump headed back to the White House, a single tech stock break records for both the biggest single-day rise AND fall, and Bitcoin break $100k…? Safe to say, you’d probably be skeptical.

Yet… here we are! Here’s MONIIFY’s recap of the most memorable moments of the rollercoaster that was 2024.

The Trump trade

Just weeks before Trump claimed the US election, polls still had Kamala Harris in front. Then, in true Trump fashion, he turned it all around — setting off a Trump trade on steroids!

Tesla, where Trump’s new BFF Elon Musk reigns, saw explosive gains, surging nearly 80% since election day. Oh, and Musk? He even scored a spot on Trump’s new Department of Government Efficiency, or DOGE. That bromance really is something, and we wrote all about it here.

The Trump effect didn’t stop there, boosting financial stocks like banks and brokerages. But there was one other part of the markets where the impact was CRAZY. You know where we’re going with this…

Bitcoin @ 100K!

On December 5, the world’s largest cryptocurrency hit the magic $100K mark, setting the crypto world on fire. Sure, it’s dipped below $95K since, but that’s beside the point.

Crossing this milestone signaled the start of a new bullish cycle, according to analysts, with even Wall Street’s big names now treating Bitcoin as a major player in markets for 2025.

Trump’s election win, and his subsequent move to appoint pro-crypto Paul Atkins as SEC chair, catapulted Bitcoin past a $2 trillion market cap at that point.

And it wasn’t just Bitcoin. Plenty of others, from Ether to Dogecoin, rode the wave. Even MicroStrategy, the company borrowing billions to hoard Bitcoin, saw its stock rocket more than 370% this year.

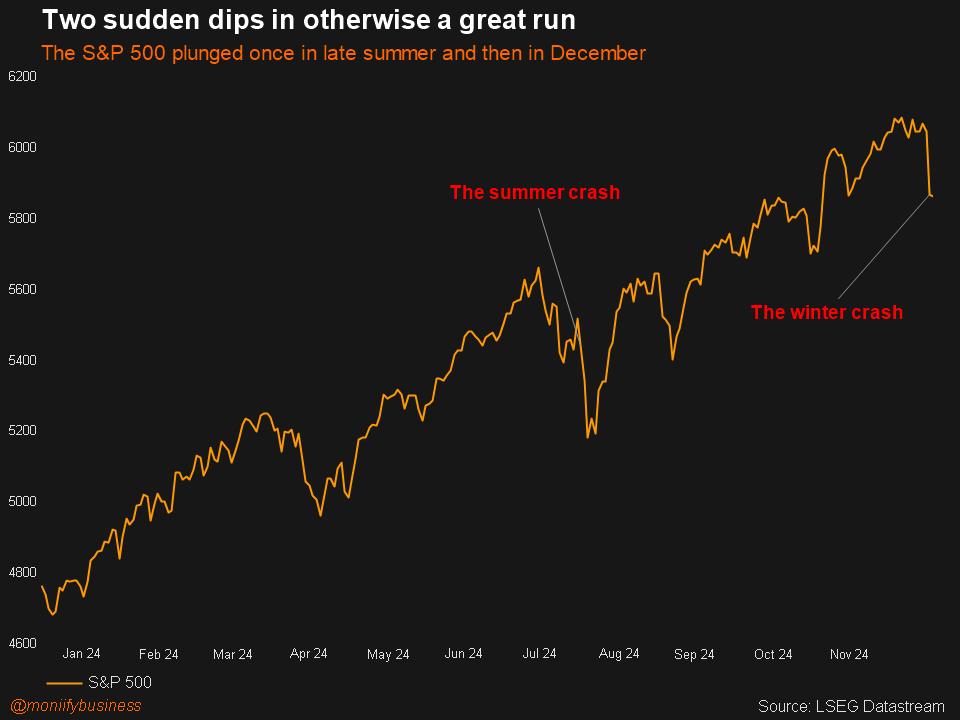

US market freakouts

Two crazy days this year saw the markets in full-blown panic mode, with volatility shooting through the roof.

August 5 was a Monday crash that sent the S&P 500 and Nasdaq 100 tumbling around 5%, sparking flashbacks to 1987’s “Black Monday”. It was fueled by fears of a recession, triggered by a weak US jobs report and an unwinding yen carry trade that rattled global markets.

Then, just when the markets had recovered from August’s chaos, December 18 delivered another shocker. US stocks took their biggest hit since that dark day in August after the Federal Reserve signaled fewer rate cuts in 2025. This confirmed fears that Trump’s low-tax, high-tariff policies could reignite inflation, forcing the Fed to step off the rate-cutting gas.

On both days, the VIX index — Wall Street’s “fear” gauge — went wild, spiking 60%-70%, marking two of the most volatile moments for markets in years.

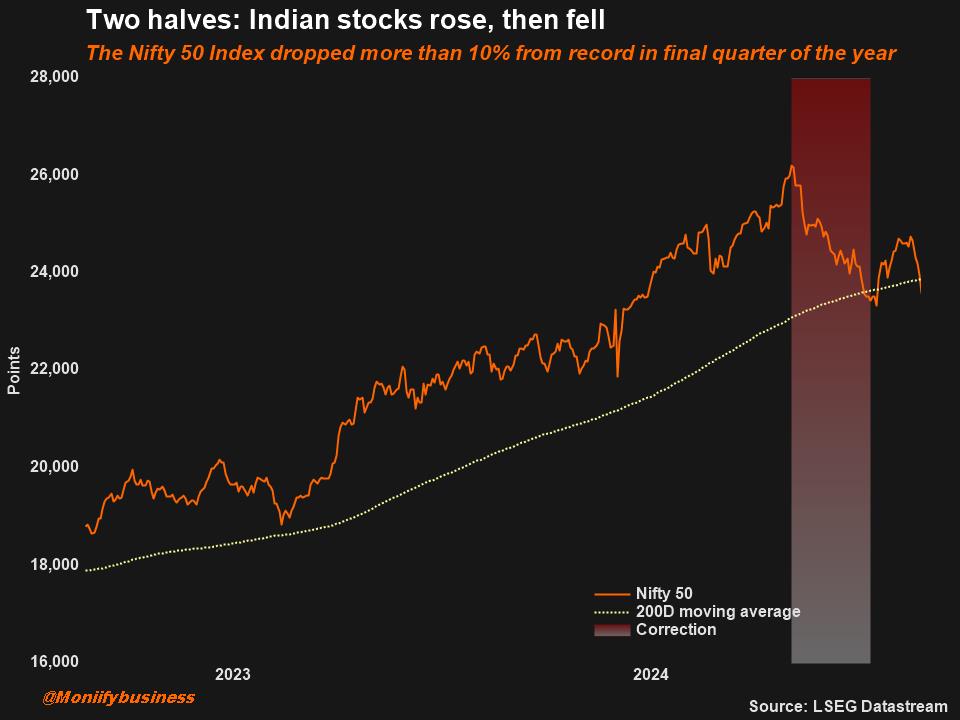

Indian drama

Meanwhile, the markets in India had their own share of excitement.

Indian stocks had their first decline since March 2023… because foreign investors are always thirsty for a Chinese market comeback.

The rotation out was real after the Nifty 50 peaked in September, riding high on the back of Modi’s third straight election win in June.

The Nifty 50 hasn’t gotten its groove back, still sulking around the lows it hit a month ago.

Yet that didn’t stop 2024 from being a record year for capital raising by Indian companies. That included 337 IPOS this year — the most anywhere — but also rights issues (which go to existing shareholders) and qualified institutional placements (direct to the big boys).

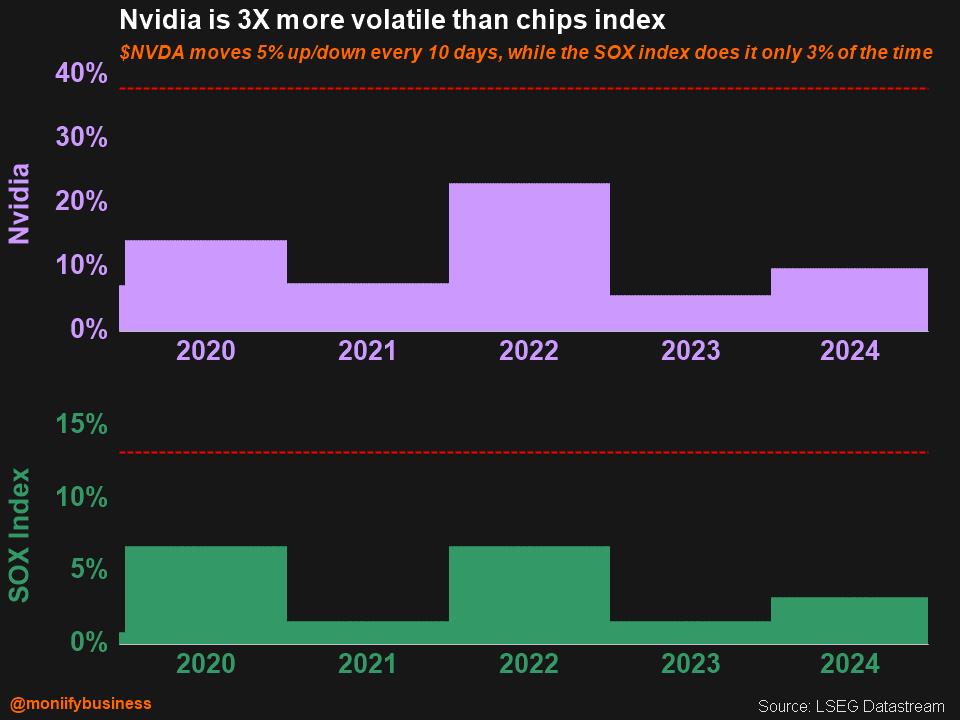

Nvidia’s wild ride

Of course, no recap of 2024 would be complete without the crazy journey of Nvidia.

The AI giant made history this year — not once, but twice. On September 3, the stock saw a jaw-dropping $279 billion wiped off its value, the biggest one-day market cap drop for a US stock EVER. The stock fell 9.5% on the back of weak economic data, and a disappointing quarterly revenue forecast.

But just two months earlier, Nvidia had smashed records in the opposite direction. In July, it added $329 billion to its market cap with a 12.8% gain in one day, the biggest single-day value increase in stock market history.

Even with these wild swings, Nvidia is still up more than 170% since January, but the ride sure wasn’t for the faint-hearted. These days? The stock’s been cruising in the slow lane, down more than 5% since MONIIFY flagged it in its recent coverage.

After a year like this one, the only question is: exactly how crazy do things get from here? Watch this space.