Elon Musk is Donald Trump’s newest wingman and the hype around their bromance is fueling Tesla shares like crazy: it’s like no brakes, no seatbelts and full throttle. 🚀

Here’s a crazy stat: After this month’s rally, Musk’s million-dollar election giveaway for voters works out at precisely 0.0003% of his wealth. He’s now the richest man on Earth with a net worth of $348 billion.

Reports that Trump may ease rules on fully self-driving cars pushed Tesla’s stock even higher. Wall Street’s biggest bulls are still shaking their heads at how fast it has zoomed back up to a $1 trillion market cap.

But we’ve seen this movie before. This plotline is straight out of 2021 – and it didn’t stick that time either.

What’s different with Trump 2.0? Nothing much. Trump seems to love Musk. Musk loves the spotlight. Investors are loving the hype. But there’s a lot more to think about here.

Easy tiger

Even if the Trump administration revisits self-driving car policies, Tesla still has major hurdles to clear.

The technology, testing and permits for commercialization are still major roadblocks, according to Morgan Stanley. Individual states and cities will still probably have the biggest say on final deployment, Adam Jonas, an analyst, says in a note to its clients.

The fanboys may be juiced, and will point to Tesla’s self-driving robotaxis, the Optimus robot and budget EVs as the future. But the lukewarm response and selloff after the “We, Robot” event last month suggests Wall Street doesn’t think these products are ready to bring in the big bucks yet.

Tesla’s long-promised $25,000 EVs have yet to see the light of day, but Musk is now saying that making cheap cars for human drivers is “pointless.” So it’s not really clear what is happening with that and when.

And the Trump effect might backfire too! Despite cozying up to Musk, the incoming president has hinted he’d consider slashing a $7,500 EV tax credit.

Pricey for no reason

- Tesla’s trading at a jaw-dropping 109 times its future earnings – a full 195% pricier than Nvidia and far above any other Magnificent Seven stock.

- Not to mention, its forward price-to-sales ratio is nearly 10x, which is a premium you just can’t unsee (or explain). Meanwhile, BYD, which sells more cars than Tesla, sits at a chill 1x price-to-sales.

Translation: Tesla’s sky-high valuation looks like it’s running on pure hope and hype. Trump or not, this stock’s got a lot to prove.

So pick or pass?

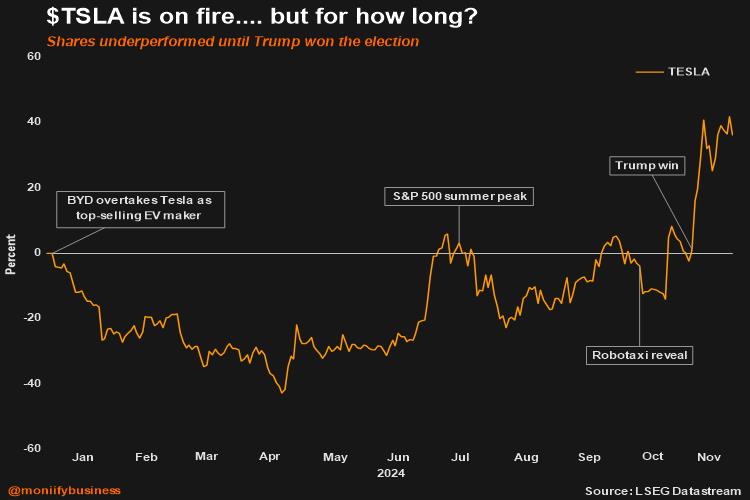

Before the Trump bump, the stock was having a lackluster year.

Even with its current rally, Tesla is only up a modest 29% this year – hardly the rocket-fueled gains investors were used to in its glory days.

Analysts are mostly leaning towards “hold” or “buy” ratings, but a notable 12 say “sell” and the consensus price target is pointing to a potential downside of more than 25% next year.

But…

Tesla bulls think this rally still has room to run. Take brokerage Wedbush Securities. It just upped its 12-month target from $300 to $400 a share, banking on Tesla’s AI and autonomous ventures hitting that elusive trillion-dollar mark.

It’s also betting on Trump’s win fast-tracking regulatory clearances for self-driving tech, putting Tesla’s big ambitions firmly in the fast lane.