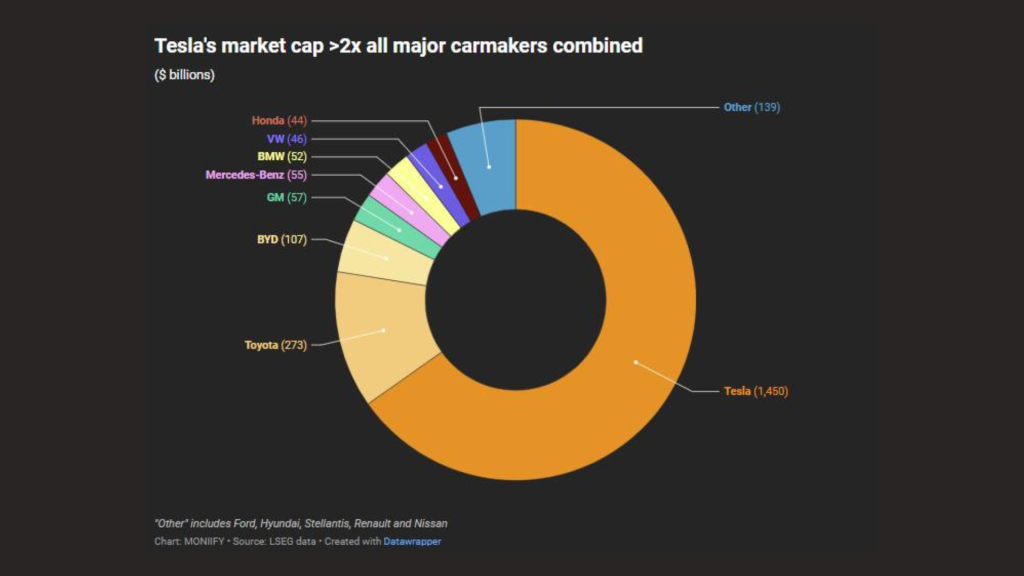

Tesla’s stock has gone so ballistic that its market cap is now nearly twice as much as all of the world’s biggest carmakers COMBINED.

That includes heavyweights like Toyota, Volkswagen and BYD – and every single one of these companies sells more cars than Tesla, btw.

Let that sink in: twice as much for fewer cars!

Sure, Tesla’s got the Optimus robot serving coffee, a Cybercab that’s not on the roads yet and the promise of cheaper EVs. But even if we count every futuristic gadget Elon’s dreamed up, it is starting to look less like a car company and more like a sci-fi screenplay that somehow got listed on the Nasdaq 100.

Tesla wouldn’t talk to us about its stock’s meteoric rise, but the data speaks for itself: the stock trades at 141 times earnings, the fourth-most expensive stock on the S&P 500.

Read more: #Snapshot: Don’t mess with Elon

If you buy it, you’re paying 141x the price for next year’s earnings. That screams expensive all the way… to Mars. FYI, S&P 500 is trading at 22x.

Plus, analysts expect Tesla shares to slump by more than 30% from current levels, according to LSEG data.

But if you’re a Musk fan, here’s what’s going your way. He’s Donald Trump’s pal and their bromance can keep anything going: Bitcoin, memecoins, $TSLA, US stocks… you name it.

In short: if you’re betting on their relationship to continue to blossom, then the rally might still have legs. BUT if you’re counting cars and reading financial statements, there are probably better places to park your money.