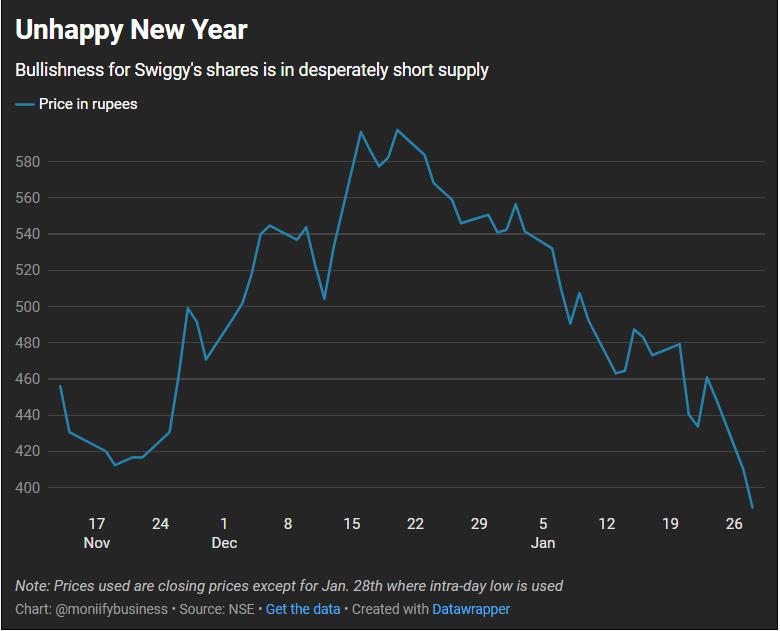

Swiggy is floundering after one of India’s biggest internet IPOs in years.

Its shares tumbled nearly 9% during Monday’s DeepSeek-triggered global equity sell-off, briefly dipping below its November IPO price of 390 rupees on Tuesday. Zomato wasn’t spared either, sliding 4.4% at the start of the week, and only partially making up losses on Tuesday.

And it is all down to valuations. New-age internet companies with high valuations usually face heavier selling pressure in downturns, says Kranthi Bathini, director of equity strategy at WealthMills Securities.

Both Swiggy and Zomato have price-to-sales ratios higher than Indian peers, and are banking on India’s rapid food-delivery growth.

But food delivery is already yesterday’s battle. The fight now is for quick commerce — groceries… electronics… whatever you want delivered in 10 to 15 minutes — and it’s a brutal game of razor-thin margins.

Read more: Swiggy goes on valuation diet for market debut

Zomato and Swiggy dominate India’s $44 billion food-delivery market, but the quick-commerce race has been turbocharged by Zepto, an unlisted upstart siphoning both market share and a lot of VC money.

Zepto is fast becoming India’s benchmark in the quick-commerce business, having raised more than $1.9 billion since its launch and $1.3 billion in 2024 alone. It doubled its dark store count in 2024, operating over 250 of these across more than 35 cities. As of August 2024, Zepto was valued at over $5 billion.

Read more: Domino’s India operator is slicing up the competition

Zomato’s quarterly report last week hinted at how messy things could get: its quick-commerce unit, Blinkit, reported $11.9 million in losses and plans to double its store count this year instead of next.

Meanwhile, Swiggy is grappling with its own strategy shift. It’s pivoting to a multi-app approach to take on Zomato’s ecosystem of standalone apps for 10-minute food and grocery deliveries.

Elara Capital analyst Karan Taurani still rates Zomato a “buy,” with a target price of 300 rupees, despite the fierce competition. Swiggy is dicier. Perhaps wait for the December quarter earnings before making any moves.

Quick commerce might be the next big thing, but Swiggy’s post-IPO struggle shows just how brutal the market can be.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com