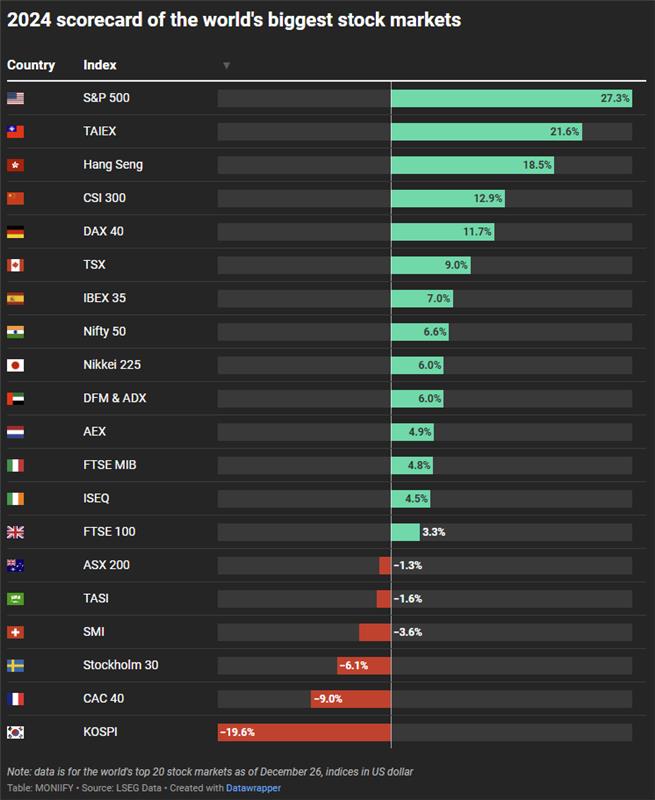

The US is flexing at the top of the global markets’ leaderboard, leaving Europe to fumble through mediocrity.

The S&P 500 is sitting pretty at the top, up 27% since January — riding high on the AI hype and Donald Trump-fueled optimism. It’s also a solid comeback for US stocks, considering they were outshined by Japan in 2023.

Let’s be real, though. The Magnificent Seven single-handedly carried the US markets. Without them, the S&P 500 Equal Weight Index is up just 12.7%… trailing China!

Losin’ its groove

But Europe’s stock markets are like that party where the DJ won’t change the track –– flat, uninspired, and losing the crowd.

Out of the 20 biggest stock markets globally, only six are in the red this year. Care to guess where half of them are? Europe.

France’s CAC 40 was the worst performer, down 9%, with Switzerland and Sweden not far behind. Only South Korea did worse globally and it’s in the middle of a political meltdown. What’s Europe’s excuse?

Europe is just stuck in a meh loop of near-zero growth, sticky inflation, and high rates. And it might get worse with the imminent arrival of Trump in the White House.

His “tariff everything” agenda could hand Europe another “L” in 2025.

Bank of America’s December fund manager survey says it as it is: 25% of investors were underweight on Europe, marking a two-year high, while 36% were net overweight on US equities — the highest share on record.

Read more: Wall Street’s 2024 faceplant: The year all its predictions got smoked

Challengers or also-rans?

Taiwan rode shotgun on the tech hype train. Thanks to Taiwan Semiconductor Manufacturing Company and Apple supplier Foxconn, both of whom were up 70% to 80% in 2024, the Taiex went off on a rally.

Saudi Arabia, despite all the positive vibes, didn’t see its stock market leave 2024 unscathed. The Tadawul All Share Index slumped into the red zone, thanks to Saudi Aramco, the world’s largest oil exporter, dropping 15%.

With a $1.8 trillion market cap, Aramco accounts for 60% of the entire Saudi stock market. And so, when oil prices went down by more than 4% this year on fears of oversupply and sluggish demand, it was all over for the index.

India’s Nifty 50 gained 6.6% in dollar terms, despite slowing earnings in the back half of the year. UAE markets (the Dubai and Abu Dhabi indices combined) also eked out a 6% gain. Not bad for still-developing, illiquid markets.

After hitting a 33-year high, Japanese stocks lost steam but still managed to end the year slightly up. For dollar-based investors, though, the story was less rosy, with returns dampened by a 10% slide in the yen against the greenback.

Fair to say that Japan, India, and the UAE held steady in the middle — not breaking records but not tanking either.

But 2024’s story is wrapping up, and the stage is being set for 2025’s winners. ETFs are already buzzing with potential, and we’ve got the shortlist ready for your radar.

Edited by Ankush Chibber and Thyagu Adinarayan. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com