Feeling bad about bad breadth? Don’t panic! History shows stocks still win. Most of the time.

Needless to say, we are not talking about the S&P’s oral hygiene. Simply put, the Magnificent Seven are doing all the heavy lifting right now.

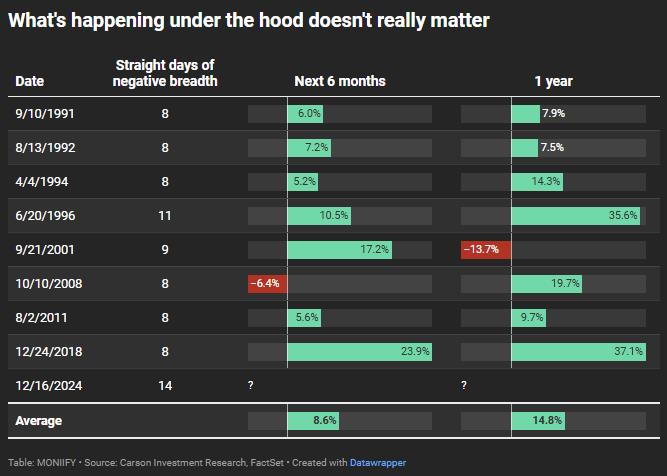

December’s record-setting run has seen 14 straight days of more losers than winners, the longest such streak since 1990. After similar stretches, the S&P 500 posted average gains of 3% in one month, 4.8% in three months, and a whopping 14.8% in a year, according to Carson Investment Research.

Michael Wilson, a Morgan Stanley equity strategist, agrees: “Breadth may not matter as much as it has in the past for high-quality indices with the greatest price momentum.”

In the long run, markets always circle back to fundamentals, and they look solid for 2025.

Read more: Five wildest things that happened in 2024

Good year coming?

S&P 500 earnings are expected to grow nearly 15% year on year, well above the 10-year average of 8%, according to FactSet data.

Even better? While tech is still expected to lead growth for 2025, earnings outside the Mag 7 are set to shine too — 21% growth for the Mag 7 and 13% for the other 493. That’s a major rebound from this year’s 4% growth for the broader index.

All 11 sectors are forecast to see earnings growth, with six expected to clock double-digit gains. Think IT, healthcare, industrials, materials, communication services, and consumer discretionary. Even financials and utilities are looking at respectable 9% growth, according to FactSet.

Even the world’s biggest banks see respectable gains for the S&P 500: their average 2025 price target points to a 12% increase.

All that looks rosy, but let’s not forget the risks too.

Read more: Bears are crashing the Christmas party

Inflation is back on the rise, which means interest rates are back into the spotlight. The Fed’s already hinted at fewer rate cuts next year, which means rates could stay higher for longer — a headwind for stock returns.

Hear us out before you head off for Xmas: Bad breadth may make for flashy headlines, but history shows the markets keep climbing.

Just keep an eye on how much more that Xmas shopping is costing this year. Yes, we are talking inflation.

Edited by Azar Zaidi and Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com