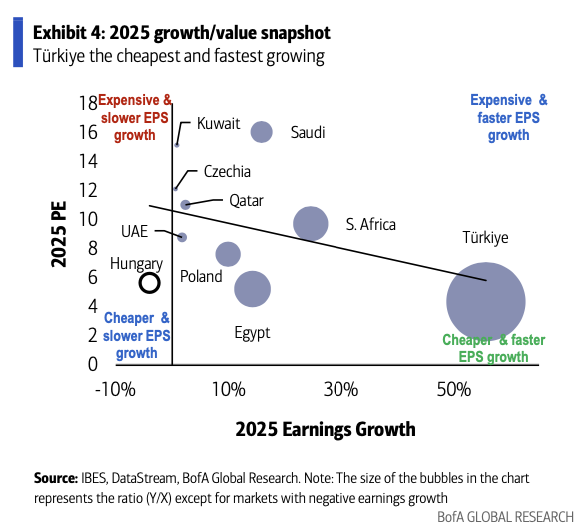

Saudi Arabia stands out as one of the priciest stock markets, according to an analysis by Bank of America.

With a 2025 price-to-earnings ratio of more than 16 times, it falls in the “expensive and slower earnings growth” zone.

Translation: investors are paying a premium for these stocks when earnings growth is slowing down. And all this even as the main stock index has been flat this year – aka it has done nothing!

Right behind Saudi on the pricey scale are Kuwait, Qatar and the UAE.

On the opposite end, Egypt and Turkey present the cheapest options. Egypt is stuck in the “cheaper and slower earnings growth” category, making it less appealing than Turkey, which occupies a sweet spot: it’s the least expensive market with the highest expected earnings growth.

So … you might want to ask yourself if Saudi is worth the hefty price tag when faster growing and cheaper options are on the table.