Saudi Arabia is running circles around the UAE in the Gulf IPO game.

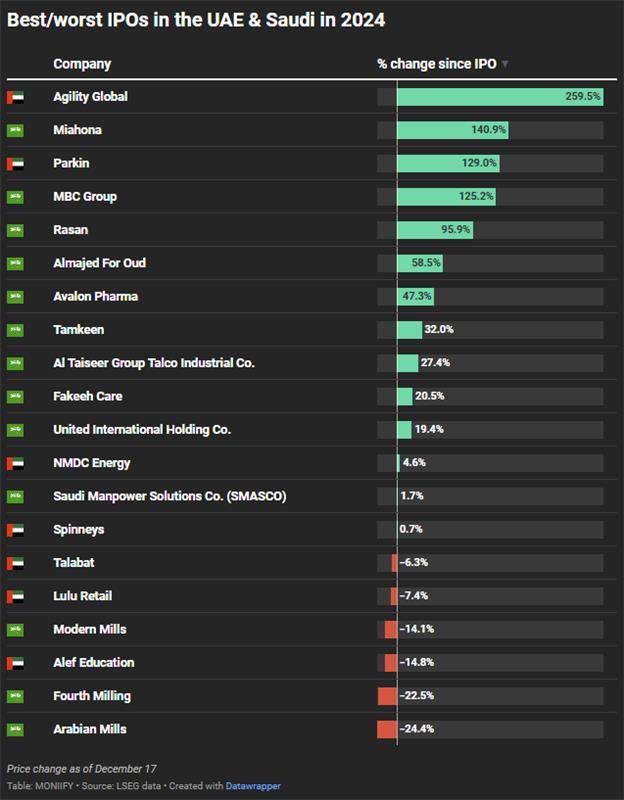

Riyadh’s listings aren’t just in the green — they’re crushing it. Take Miahona, the Saudi water and wastewater firm, which has gained 140% since its June debut.

Meanwhile, the UAE’s IPO scene is looking like a snooze-fest, with most listings flat or losing steam. Sure, there are outliers like Agility Global, a subsidiary of Kuwait’s Agility Public Warehousing Company, which skyrocketed 260% after its May debut. But again, strip away that opening day pop, and the stock’s down 16%. Ouch.

Saudi Arabia’s 2025 pipeline looks promising: Tabby, the buy-now-pay-later unicorn and tech firm Ejada could go public in Riyadh, according to media reports.

Over in the UAE, Dubai party hotel operator FIVE, Etihad Airways and IT services firm Alpha Data are most likely next on deck.

But the UAE continues to see a string of high-profile flops. Lulu Retail and Talabat didn’t even make it into the dreaded first-day-pop-then-fizzle trap. While the former was flat, the latter just straight up nosedived on Day 1.

Why does this keep happening? MONIIFY spills the tea.