When you can get nearly 5% risk-free, chasing pricey stocks feels like trying too hard.

Last week’s $143 billion influx into money market funds, the most since 2020, proves it fair and square. These funds basically hoard short-term Treasury bills — getting paid while your cash sits there doing diddly squat.

US stocks slumped on Friday after a red-hot jobs report dropped. Yep, good news spooked the markets again. The awesome jobs data means the Federal Reserve’s expected to cut rates just once this year instead of the four cuts everyone was fantasizing about. Cue the chaos.

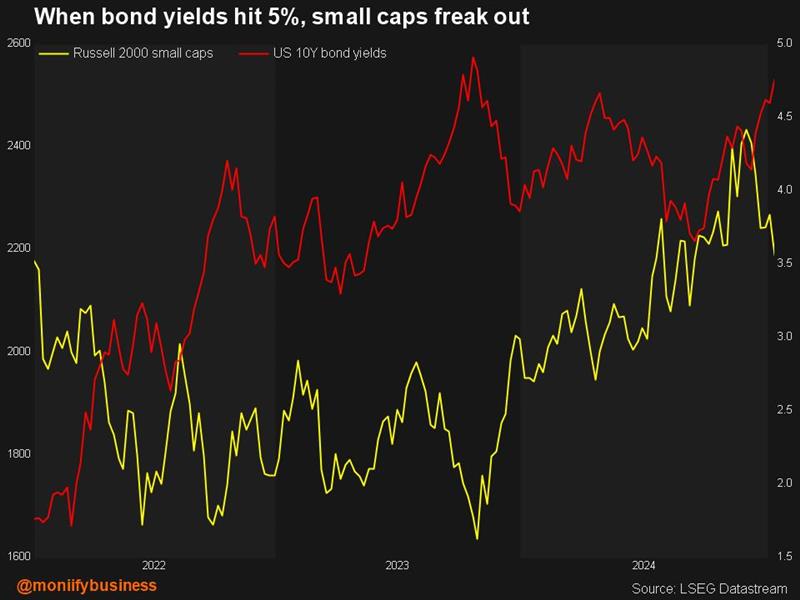

With Treasury yields inching toward 5%, borrowing costs are climbing across the board — from mortgages to credit cards.

High yields are the stock market’s grumpy uncle, and right now, it’s more sell the rally than buy the dip, Keith Temperton, sales trader at Forte Securities, tells MONIIFY.

Read more: Markets are serving chaos, and we’re just here for the plot twists 🎢🌊

Small caps hit hard

Small caps, the market’s underdog stocks, are getting crushed. These companies rely on borrowing to grow, and higher rates are their kryptonite.

The Russell 2000 has lost its “Trump bump” and now trades 3% below pre-election levels. The S&P 500 is barely positive, while the Nasdaq 100 is up a minor 3%.

It’s not all doom and gloom, though. Every market dip is like a season-ending sale at your favorite store: exciting, but not everything’s worth grabbing.

The playbook

So, how do you navigate this market? It depends on your risk appetite.

- Zero-tolerance? Just pump your money into money market funds such as Vanguard Federal Money Market Fund (VMFXX) and Fidelity Money Market Fund (SPRXX). No drama. Just steady returns.

- Feeling a bit bold? Focus on the Magnificent Seven — Apple, Google, Microsoft, etc, but minus Tesla. These giants are swimming in cash and can shrug off higher rates.

- Risk junkie? Short small caps, bet on Wall Street’s fear gauge (VIX), or try leveraged funds tracking big tech.

Read more: The night shift is the stock market’s secret weapon

Reality check

And then there are banks. While higher rates spook most sectors, banks are cashing in on pricier loans. Quietly thriving, they’re the underrated MVPs in this chaos.

There’s nothing to dislike in this market: the economy’s solid, earnings are up, and valuations are only slightly bloated. But don’t get too comfy. High rates have a history of breaking things — remember the US regional bank crisis of 2023?

It’s all about finding the sweet spot between risk and reward. Or just let your money chill in Treasuries and call it a day.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com