A single tweet from @HindenburgRes was enough to send CEOs scrambling, sweating bullets, wondering, “Are we next?”

Founded by Nate Anderson at a time when short sellers were nearing extinction in an unstoppable bull run, Hindenburg Research broke out of nowhere, reshaped the market, and has now, quietly, called it a day.

Anderson has officially announced the shutdown of Hindenburg Research, the forensic financial outfit that began with Bollywood movie distributor Eros International in 2017 and ended with Carvana, a used car seller run by a father-son duo, in 2025.

In its eight-year run, Hindenburg targeted more than 50 companies, erasing billions in market value, according to our calculations, though a few escaped unscathed, and fewer still survived intact.

With a lean team of 11, Hindenburg dug deep, bet on stocks cratering, and detonated bombshell reports amplified by Anderson’s nearly 900,000 followers on X.

Their method was ruthless but effective, making Anderson one of the most influential figures in short-selling history. The median loss for stocks Hindenburg targeted? A jaw-dropping 71%.

Here are some of the hits that defined Hindenburg.

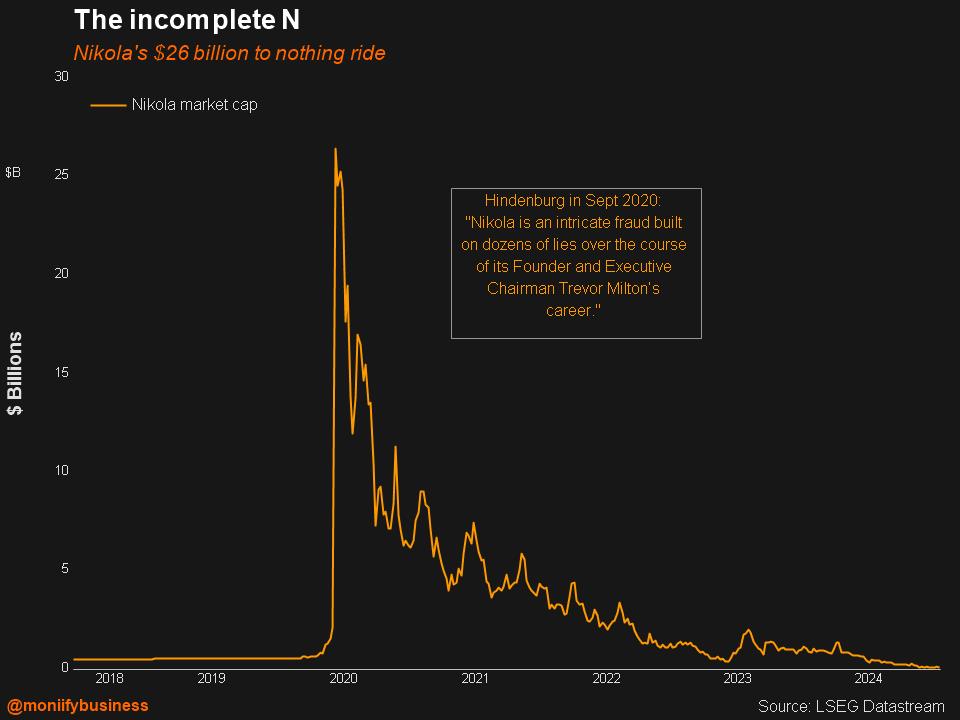

An electric reckoning

Hindenburg’s 2020 report on Nikola, labeling it “an ocean of lies,” was a watershed moment. Wall Street took note of the short attack and the attacker. The stock has plunged 99.5%, its market cap collapsing from $20 billion to just $100 million.

Similar takedowns followed with Lordstown Motors and Mullen Automotive. One filed for bankruptcy and the other’s barely limping along, leaving investors in tatters.

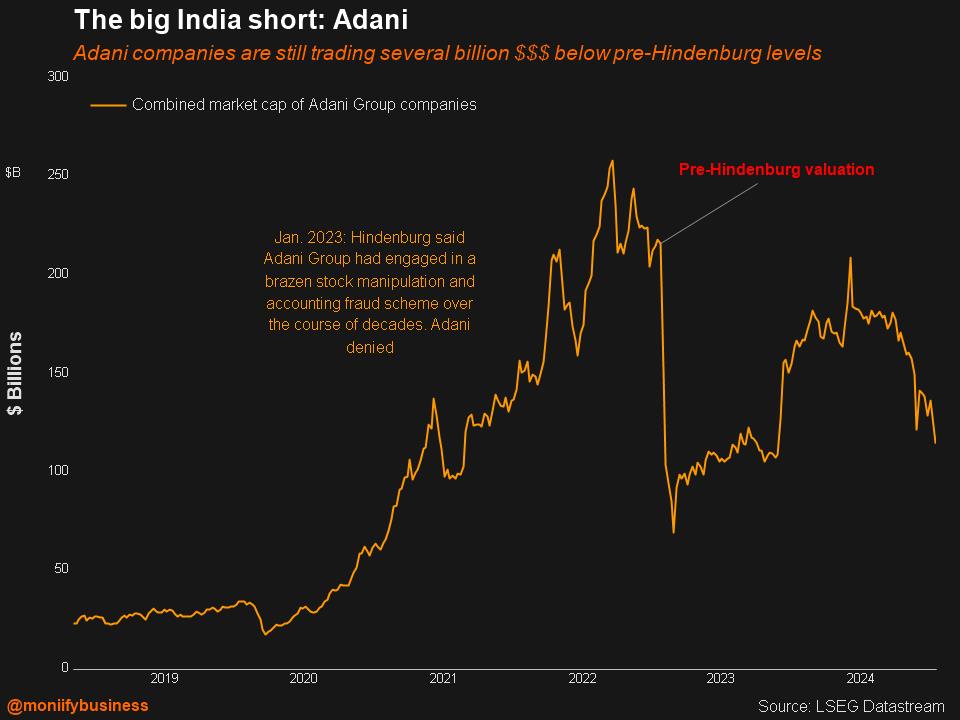

An Adani masterstroke

This attack cemented Hindenburg’s global reputation. In 2023, Anderson accused India’s Adani Group of perpetrating “the largest con in corporate history.”

The fallout wiped over $100 billion off Adani’s market value and rattled markets across Asia. The episode remains one of the boldest short attacks in recent history. Just look at this chart here:

Hindenburg’s closure has got Adani a breather, with stocks soaring in Mumbai.

Better than reality

The short-seller rarely missed. If the firm predicted a 70% downside, you could count on 90%. SmileDirectClub? Predicted an 85% drop; it hit 100%. NexTech Solutions and Pershing Gold were labeled “worthless” and ended up just that.

The impact extended beyond stock prices — Hindenburg’s reports often led to arrests and criminal proceedings, shaking entire corporate empires.

Nearly 100 individuals, from billionaires to oligarchs, faced charges stemming from their investigations.

In Anderson’s words: “And boy did we have an impact, eventually — more than I imagined was possible at the outset.”

Hindenburg shutdown

In a farewell note, where he mentioned that no single issue was behind the decision to wind up the business, Anderson said: “We shook some empires that we felt needed shaking.”

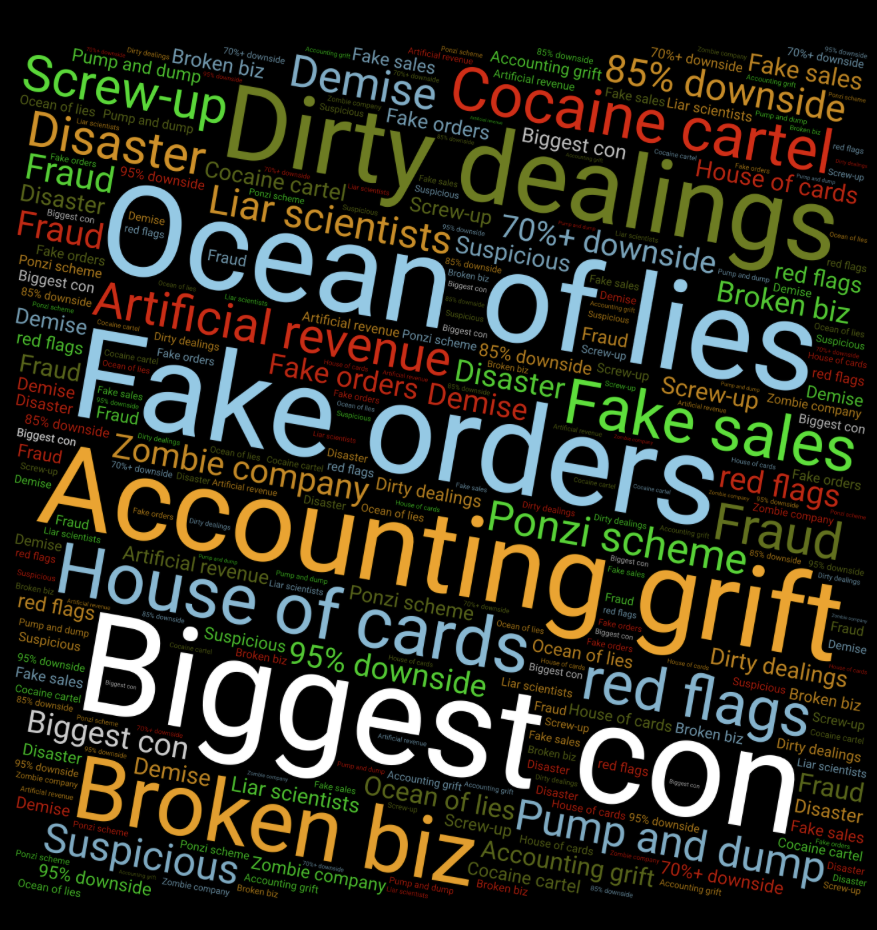

Shake up things, they did. Hindenburg’s reports paired evidence with punchy titles like “Screw-up,” “Dirty dealings,” and “Cocaine cartel.” Each headline sharpened the blow, turning financial fraud into gripping narratives.

Here’s a nice little word cloud on all the punchy headlines Hindenburg used:

Hindenburg’s impact was seismic, reshaping markets, dethroning titans, and redefining the role of short sellers in a world that often resented them. It leaves behind a legacy as polarizing as it is unforgettable.

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com