While the Ambanis lit up the dance floor at the grand Bollywood-style wedding of son Anant, something strange happened in the stock market: Reliance Industries’ shares started losing their rhythm.

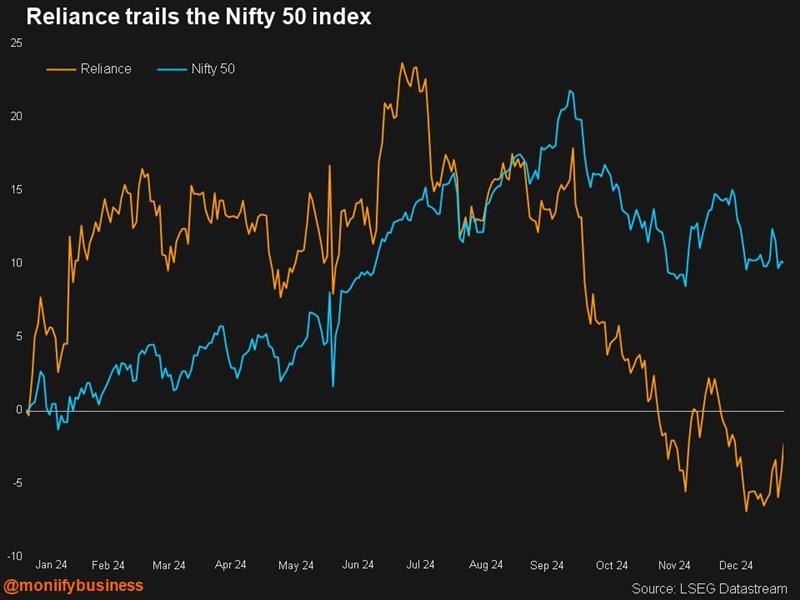

For the first time since 2015, RIL stopped dancing in step with India’s Nifty 50 index. The multinational conglomerate lagged — a rare misstep for the country’s corporate darling.

Two lukewarm quarters, stagnant earnings growth, and a drought in innovation turned 2024 into a grind for RIL, overshadowing what should’ve been a celebratory year. Just look at this chart:

MONIIFY reached out to RIL for comment on its underwhelming stock performance but had not received a response by the time of publishing.

Read more: #HotStox: India’s Maruti has its handbrake on

Bulls eye

But don’t count RIL out just yet. Analysts are rolling out the comeback predictions, with an average upside of 30% in 2025, according to LSEG data.

Jefferies is particularly bullish, forecasting a 36% rally and calling it the stock’s best value since the pandemic. Bernstein is not far behind, projecting a 22.5% gain. Of 37 analysts tracking the stock, 34 have a “buy” rating.

The stock trades at a forward price-to-earnings ratio of just 21 times, almost the same as the Nifty 50. For a company like RIL, India’s blue-eyed boy for decades, that’s bargain-bin pricing.

And let’s not forget the buzz around the upcoming IPOs of its telecoms and retail businesses. These spin-offs could inject fresh momentum, giving investors the “unlocking shareholder value” narrative they crave.

These are the kind of events that can propel stock prices to new heights.

Read more: #HotStox: Hyundai India hits red right out the gate

Trouble in paradise?

But a rally isn’t guaranteed. Rajat Sharma of Sana Securities thinks the stock will stumble again.

Despite its heavyweight status in the Nifty 50, the stock will underperform the broader market in 2025 as it has in the past five years, he tells MONIIFY. One clear reason: oil refining is a shrinking business with a limited future over the next decade, he says.

Reliance must back up the hype with real earnings growth and that will be a task.

Jio’s bold 25% tariff hike hasn’t exactly been a cash cow, losing customers instead of raking in revenue. Reliance Retail, which added 464 stores last year, is feeling the heat from Trent’s Zudio in the clothing game. Even Jio Finance, which debuted with flair, hasn’t delivered on its promise.

Read more: India’s Jio is eyeing a blockbuster IPO

There is also the family factor to consider. Mukesh Ambani is passing the torch to his kids, and how they navigate competition and steer the conglomerate’s diverse businesses will shape the next chapter of the RIL story.

One also cannot overlook ownership shifts: promoters and foreign investors have been trimming their stakes since 2022 — a red flag for market watchers.

Analysts are eyeing the next two or three quarters for signs of improvement. Jio’s tariff gamble needs to pay off, retail has to find its footing, and leadership needs to prove it can steer through increasing competition.

RIL’s track record as India’s go-to wealth creator hangs in the balance. Can it get its groove back, or is the music fading?

Edited by Ankush Chibber. If you have any tips, ideas or feedback, please get in touch: talk-to-us@moniify.com